Question

a. Determine Winslet hotel's CMR. 0.6667 0.6687 0.6647 0.6657 b. Determine Winslet hotel's breakeven point in annual number of rooms sold. 360,000 500 6000 60,000

a. Determine Winslet hotel's CMR.

0.6667

0.6687

0.6647

0.6657

b. Determine Winslet hotel's breakeven point in annual number of rooms sold.

360,000

500

6000

60,000

c. Determine Winslet hotel's breakeven point in annual revenue amount.

30,000

90,000

360,000

60,000

d. If Kate, the owner of the Winslet hotel, want to earn an annual profit of 100,000 when there are no taxes. Determine the level of revenue to earn this profit using CMR.

509,954.50

509,974.50

509,934.50

509,964.50

e. If Kate, the owner of the Winslet hotel, want to earn an annual profit of 100,000 after tax, tax rate being 20%. Determine the income before taxes (Ib).

Group of answer choices

125,000

115,000

110,000

120,000

f. If Kate, the owner of the Winslet hotel, want to earn an annual profit of 100,000 after tax, tax rate being 20%. Determine the level of revenue to earn this after tax profit using CMR.

547,472.63

547,473.63

547,474.63

547,475.63

g. If revenues equal $400,000 (Annual), what is the Winslet Hotel's margin of safety in revenues?

40,000

60,000

20,000

360,000

h. If 600 rooms were sold during January, what was its 'Net Income' for January?

36,000

12,000

20,000

4,000

i. If variable cost increases by 10% and ADR by $4. What is the new CM?

42

44

40

46

j. What is the new 'Net Income' for January with increased VC and ADR?

38,400

13,200

6,200

5,200

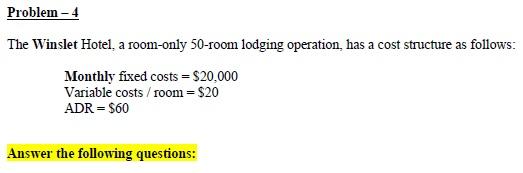

The Winslet Hotel, a room-only 50-room lodging operation, has a cost structure as follows: Monthly fixed costs =$20,000 Variable costs / room =$20 ADR=$60 Answer the following questionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started