Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A developer is considering developing a Class A office building. The developer's preliminary estimate of value is $2-million. Initial discussions with lenders indicate that

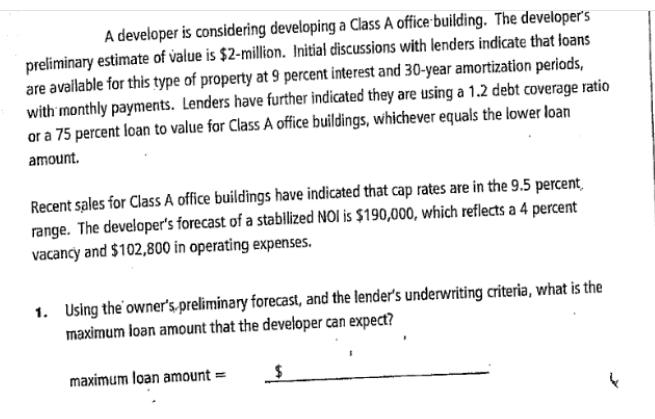

A developer is considering developing a Class A office building. The developer's preliminary estimate of value is $2-million. Initial discussions with lenders indicate that loans are available for this type of property at 9 percent interest and 30-year amortization periods, with monthly payments. Lenders have further indicated they are using a 1.2 debt coverage ratio or a 75 percent loan to value for Class A office buildings, whichever equals the lower loan amount. Recent sales for Class A office buildings have indicated that cap rates are in the 9.5 percent, range. The developer's forecast of a stabilized NOI is $190,000, which reflects a 4 percent vacancy and $102,800 in operating expenses. 1. Using the owner's preliminary forecast, and the lender's underwriting criteria, what is the maximum loan amount that the developer can expect? maximum loan amount =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The maximum loan amount can be determined based on the l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started