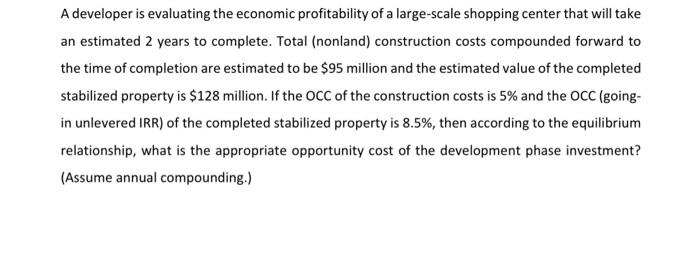

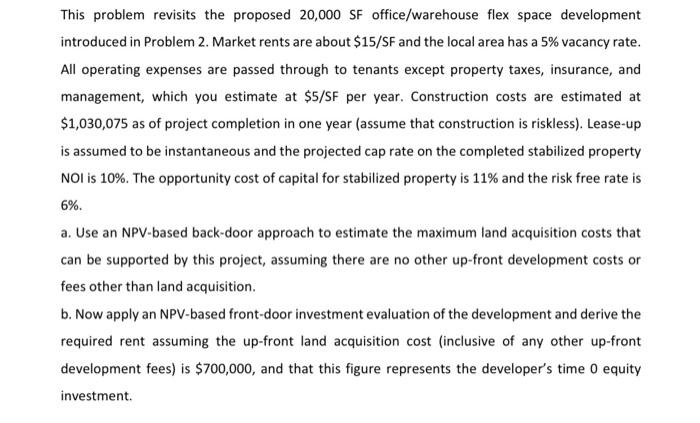

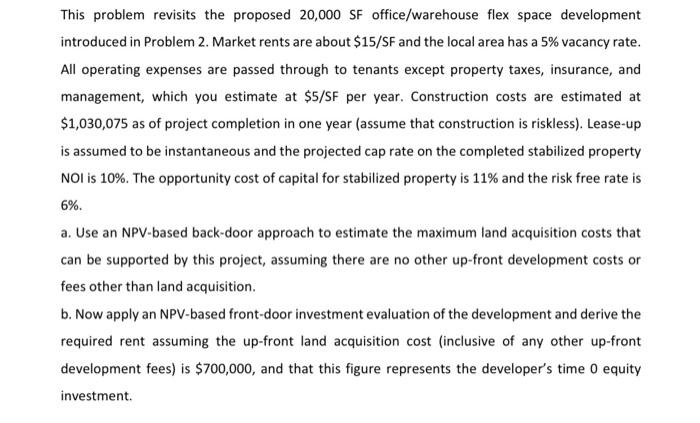

A developer is evaluating the economic profitability of a large-scale shopping center that will take an estimated 2 years to complete. Total (nonland) construction costs compounded forward to the time of completion are estimated to be $95 million and the estimated value of the completed stabilized property is $128 million. If the OCC of the construction costs is 5% and the OCC (going- in unlevered IRR) of the completed stabilized property is 8.5%, then according to the equilibrium relationship, what is the appropriate opportunity cost of the development phase investment? (Assume annual compounding.) This problem revisits the proposed 20,000 SF office/warehouse flex space development introduced in Problem 2. Market rents are about $15/SF and the local area has a 5% vacancy rate. All operating expenses are passed through to tenants except property taxes, insurance, and management, which you estimate at $5/SF per year. Construction costs are estimated at $1,030,075 as of project completion in one year (assume that construction is riskless). Lease-up is assumed to be instantaneous and the projected cap rate on the completed stabilized property NOI is 10%. The opportunity cost of capital for stabilized property is 11% and the risk free rate is 6%. a. Use an NPV-based back-door approach to estimate the maximum land acquisition costs that can be supported by this project, assuming there are no other up-front development costs or fees other than land acquisition. b. Now apply an NPV-based front door investment evaluation of the development and derive the required rent assuming the up-front land acquisition cost (inclusive of any other up-front development fees) is $700,000, and that this figure represents the developer's time 0 equity investment A developer is evaluating the economic profitability of a large-scale shopping center that will take an estimated 2 years to complete. Total (nonland) construction costs compounded forward to the time of completion are estimated to be $95 million and the estimated value of the completed stabilized property is $128 million. If the OCC of the construction costs is 5% and the OCC (going- in unlevered IRR) of the completed stabilized property is 8.5%, then according to the equilibrium relationship, what is the appropriate opportunity cost of the development phase investment? (Assume annual compounding.) This problem revisits the proposed 20,000 SF office/warehouse flex space development introduced in Problem 2. Market rents are about $15/SF and the local area has a 5% vacancy rate. All operating expenses are passed through to tenants except property taxes, insurance, and management, which you estimate at $5/SF per year. Construction costs are estimated at $1,030,075 as of project completion in one year (assume that construction is riskless). Lease-up is assumed to be instantaneous and the projected cap rate on the completed stabilized property NOI is 10%. The opportunity cost of capital for stabilized property is 11% and the risk free rate is 6%. a. Use an NPV-based back-door approach to estimate the maximum land acquisition costs that can be supported by this project, assuming there are no other up-front development costs or fees other than land acquisition. b. Now apply an NPV-based front door investment evaluation of the development and derive the required rent assuming the up-front land acquisition cost (inclusive of any other up-front development fees) is $700,000, and that this figure represents the developer's time 0 equity investment