Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A developer promotes an apartment project that is under construction and expected to be finished in 2 years at the selling price of $20,000,000 each

A developer promotes an apartment project that is under construction and expected to be finished in 2 years at the selling price of $20,000,000 each unit.

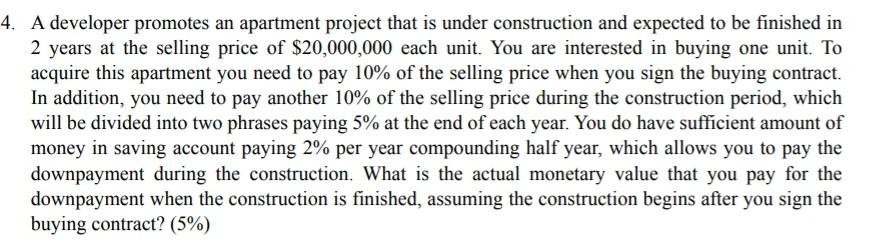

4. A developer promotes an apartment project that is under construction and expected to be finished in 2 years at the selling price of $20,000,000 each unit. You are interested in buying one unit. To acquire this apartment you need to pay 10% of the selling price when you sign the buying contract. In addition, you need to pay another 10% of the selling price during the construction period, which will be divided into two phrases paying 5% at the end of each year. You do have sufficient amount of money in saving account paying 2% per year compounding half year, which allows you to pay the downpayment during the construction. What is the actual monetary value that you pay for the downpayment when the construction is finished, assuming the construction begins after you sign the buying contract? (5%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started