Question: A developer wants to finance a project costing $1.70 million with a 70 percent, 20 -year loan at an interest rate of 4.5 percent. The

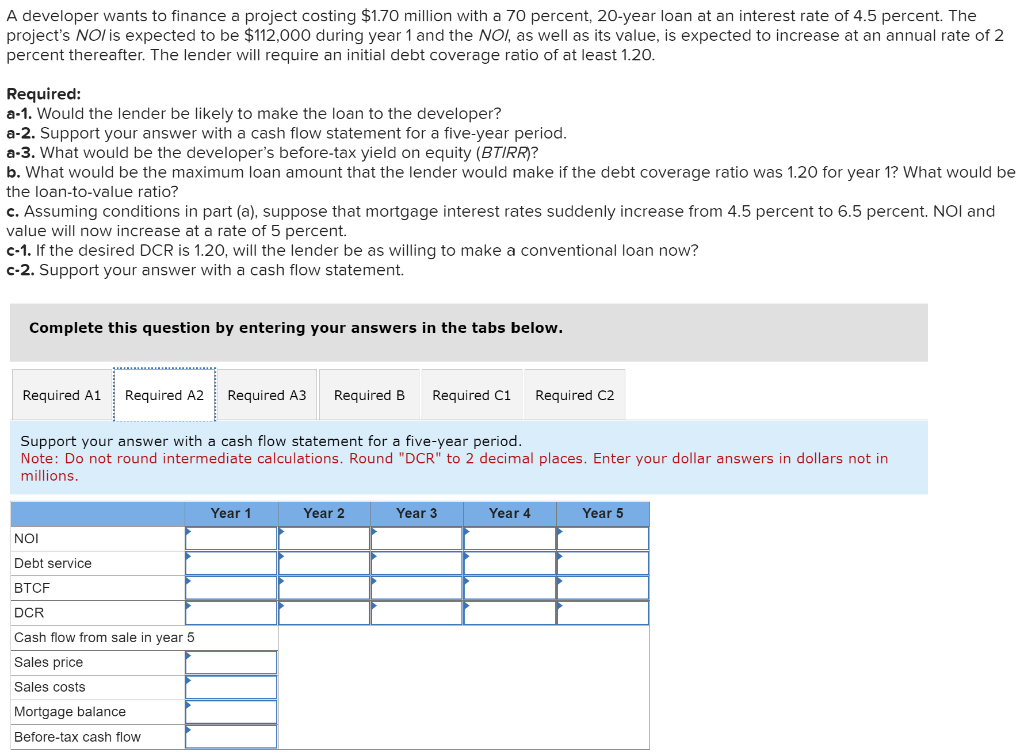

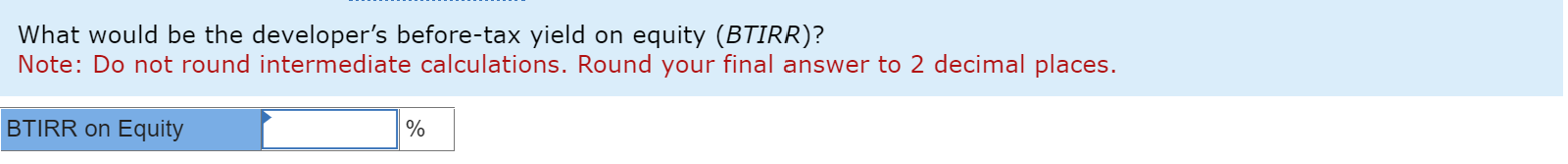

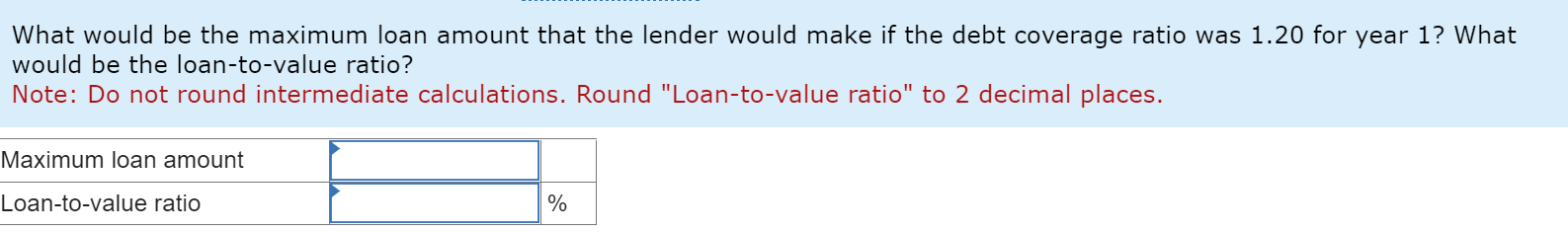

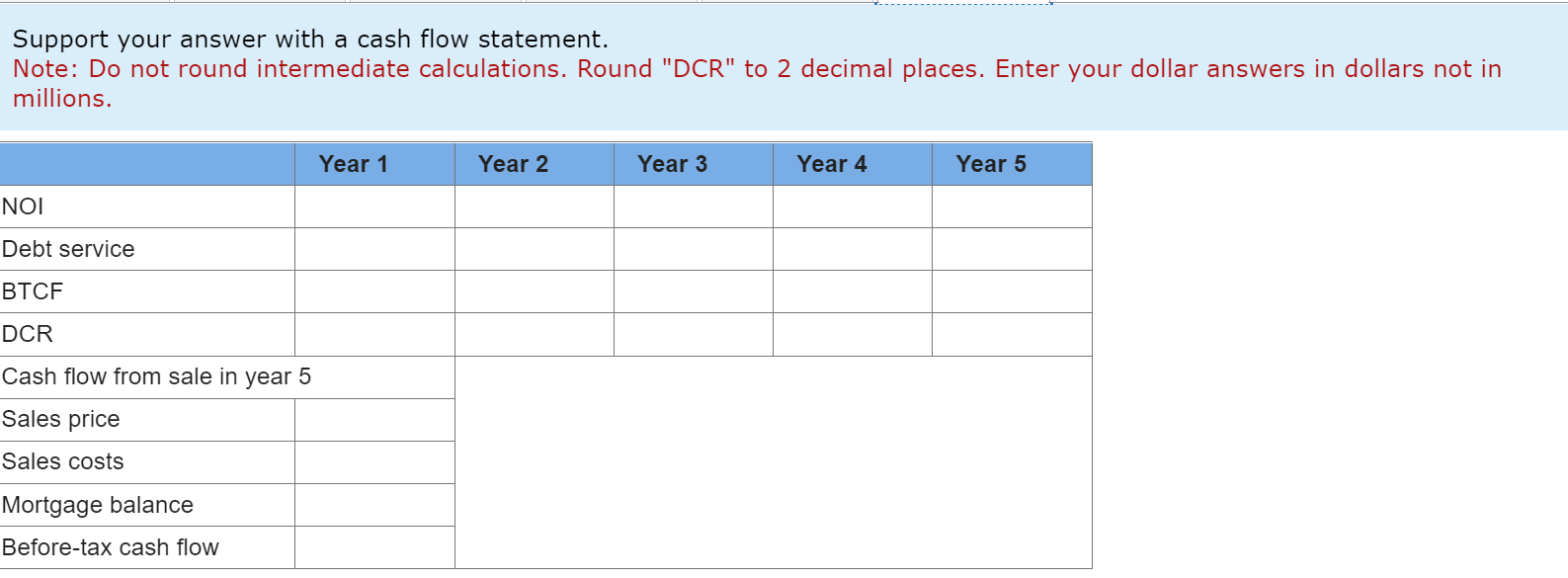

A developer wants to finance a project costing $1.70 million with a 70 percent, 20 -year loan at an interest rate of 4.5 percent. The percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR) ? the Ioan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement. Complete this question by entering your answers in the tabs below. Support your answer with a cash flow statement for a five-year period. Note: Do not round intermediate calculations. Round "DCR" to 2 decimal places. Enter your dollar answers in dollars not in millions. What would be the developer's before-tax yield on equity (BTIRR)? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1 ? What would be the loan-to-value ratio? Note: Do not round intermediate calculations. Round "Loan-to-value ratio" to 2 decimal places. Support your answer with a cash flow statement. Note: Do not round intermediate calculations. Round "DCR" to 2 decimal places. Enter your dollar answers in dollars not in millions. A developer wants to finance a project costing $1.70 million with a 70 percent, 20 -year loan at an interest rate of 4.5 percent. The percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR) ? the Ioan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement. Complete this question by entering your answers in the tabs below. Support your answer with a cash flow statement for a five-year period. Note: Do not round intermediate calculations. Round "DCR" to 2 decimal places. Enter your dollar answers in dollars not in millions. What would be the developer's before-tax yield on equity (BTIRR)? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1 ? What would be the loan-to-value ratio? Note: Do not round intermediate calculations. Round "Loan-to-value ratio" to 2 decimal places. Support your answer with a cash flow statement. Note: Do not round intermediate calculations. Round "DCR" to 2 decimal places. Enter your dollar answers in dollars not in millions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts