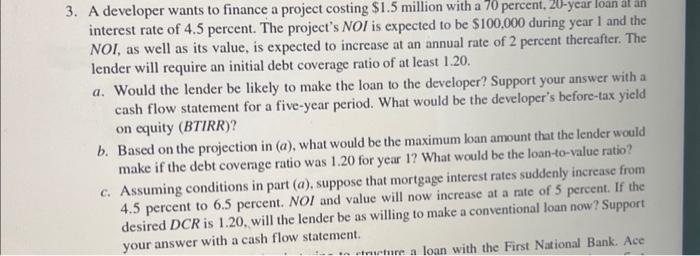

3. A developer wants to finance a project costing $1.5 million with a 70 percent, 20 -year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $100,000 during year I and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20 . a. Would the lender be likely to make the loan to the developer? Support your answer with a cash flow statement for a five-year period. What would be the developer's before-tax yield on equity (BTIRR) ? b. Based on the projection in (a), what would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1 ? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a mate of 5 percent. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? Support your answer with a cash flow statement. 3. A developer wants to finance a project costing $1.5 million with a 70 percent, 20 -year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $100,000 during year I and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20 . a. Would the lender be likely to make the loan to the developer? Support your answer with a cash flow statement for a five-year period. What would be the developer's before-tax yield on equity (BTIRR) ? b. Based on the projection in (a), what would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1 ? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a mate of 5 percent. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? Support your answer with a cash flow statement