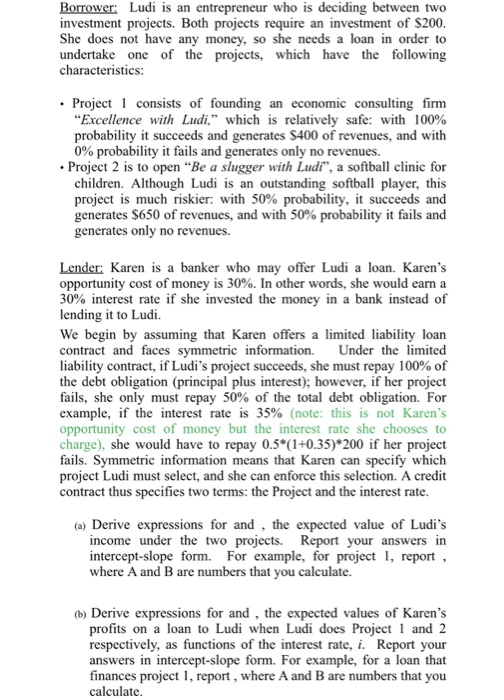

Borrower: Ludi is an entrepreneur who is deciding between two investment projects. Both projects require an investment of S200 she needs a loan in order to undertake one of the projects, which have the following She does not have any money, so characteristics: . Project consists of founding an economic consulting firm "Excellence with Ludi," which is relatively safe: with 100% probability it succeeds and generates $400 of revenues, and with 0% probability it fails and generates only no revenu es. Project 2 is to open "Be a slugger with Ludi", a softball clinic for children. Although Ludi is an outstanding softball player, this project is much riskier: with 50% probability, it succeeds and generates $650 of revenues, and with 50% probability it fails and generates only no revenues. Lender: Karen is a banker who may offer Ludi a loan. Karen's opportunity cost of money is 30%. In other words, she would earn a money in a bank instead of 30% interest rate if she invested the lending it to Ludi. We begin by assuming that Karen offers a limited liability loan faces symmetric information. Under the limited liability contract, if Ludi's project succeeds, she must repay 100% of the debt obligation (principal plus interest); however, if her project fails, she only must repay 50% of the total debt obligation. For example, if the interest rate is 35% (note: this is not Karen's opportunity cost of money but the interest rate she chooses to charge), she would have to repay 0.5 (1+0.35) 200 if her project fails. Symmetric information means that Karen can specify which project Ludi must select, and she can enforce this selection. A credit contract and contract thus specifies two terms: the Project and the interest rate. (a) Derive expressions for and , the expected value of Ludi's income under the two projects. Report your answers in intercept-slope form. For example, for project 1, report where A and B are numbers that you calculate (b) Derive expressions for and, the expected values of Karen's profits on a loan to Ludi when Ludi does Project and 2 respectively, as functions of the interest rate, i. Report your answers in intercept-slope form. For example, for a loan that finances project 1, report, where A and B are numbers that you calculate