Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Diamond is looking at ways that it may improve its liquidity. One option is to sell some of its trade receivables to a debt

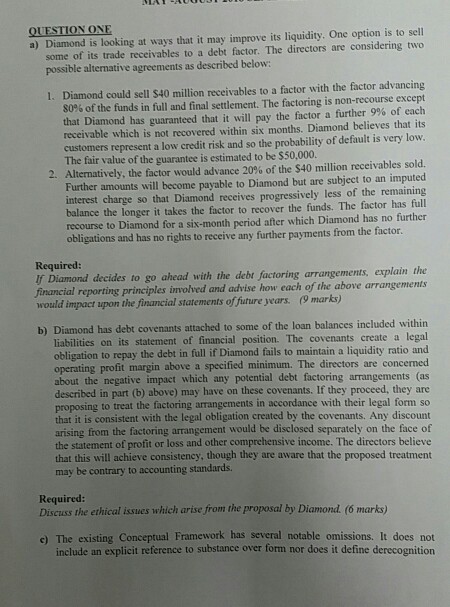

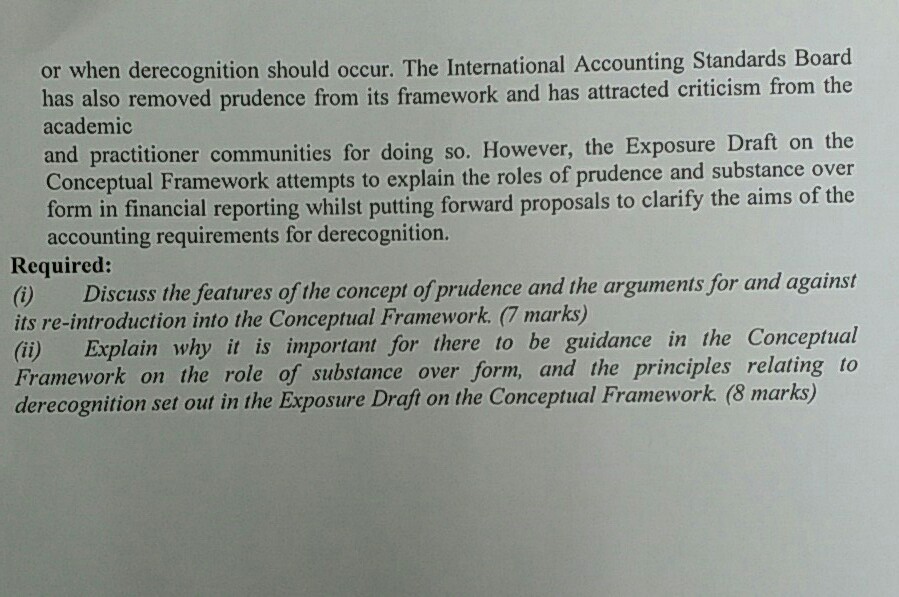

a) Diamond is looking at ways that it may improve its liquidity. One option is to sell some of its trade receivables to a debt factor. The directors are considering two possible alternative agreements as described below: Diamond could sell $40 million receivables to a factor with the factor advancing 80% of the funds in full and final settlement. The factoring is non-recourse except that Diamond has guaranteed that it will pay the factor a further 9% of each receivable which is not recovered within six months. Diamond believes that its customers represent a low credit risk and so the probability of default is very low I. The fair value of the guarantee i Al s estimated to be $50,000 ternatively, the factor would advance 20% of the $40 million receivables sold. Further amounts will become payable to Diamond but are subject to an imputed interest charge so that Diamond receives progressively less of the remaining balance the longer it takes the factor to recover the funds. The factor has full recourse to Diamond for a six-month period after which Diamond has no further 2. obligations and has no rights to receive any further payments from the factor Required if Diamond decides to go ahead with the debt factoring arrangements, explain the financial reporting principles involved and advise how each of the above arrangements would impact upon the financial statements of future years 9 marks b) Diamond has debt covenants attached to some of the loan balances included within nants create a legal obligation to repay the debt in full if Diamond fails to maintain a liquidity ratio and operating profit margin above a specified minimum. The directors are concerned about the negative impact which any potential debt factoring arrangements (as described in part (b) above) may have on these covenants. If they proceed, they are to treat the factoring arrangements in accordance with their legal form so that it is consistent with the legal obligation created by the covenants. Any discount arising from the factoring arrangement would be disclosed separately on the face of the statement of profit or loss and other comprehensive income. The directors believe that this will achieve consistency, though they are aware that the proposed treatment liabilities on its statement of financial position. The cove proposing may be contrary to accounting stand ards. Required: Diseuss the ethical issues which arise from the proposal by Diamond. (6 marks) The existing Conceptual Framework has several notable omissions. It does not include an explicit reference to substance over form nor does it define derecognition

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started