Question

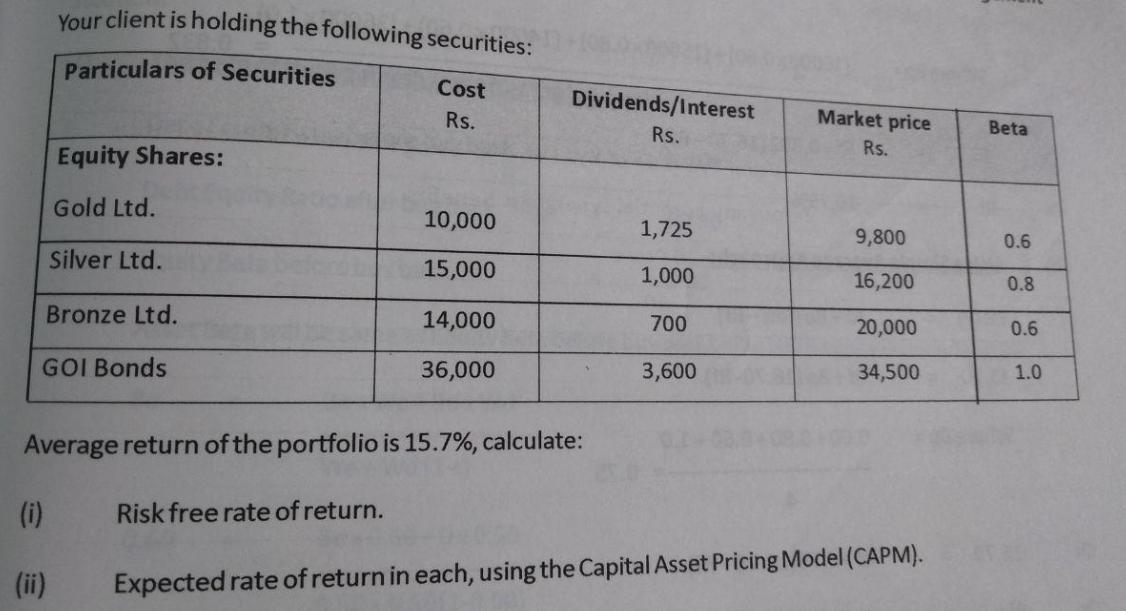

Your client is holding the following securities: Particulars of Securities Equity Shares: Gold Ltd. Silver Ltd. Bronze Ltd. (i) GOI Bonds Cost Rs. 10,000

Your client is holding the following securities: Particulars of Securities Equity Shares: Gold Ltd. Silver Ltd. Bronze Ltd. (i) GOI Bonds Cost Rs. 10,000 15,000 14,000 36,000 Dividends/Interest Rs. Average return of the portfolio is 15.7%, calculate: Risk free rate of return. 1,725 1,000 700 3,600 Market price Rs. 9,800 16,200 20,000 34,500 Expected rate of return in each, using the Capital Asset Pricing Model (CAPM). Beta 0.6 0.8 0.6 1.0

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Work...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Statistics A Decision Making Approach

Authors: David F. Groebner, Patrick W. Shannon, Phillip C. Fry

9th Edition

013302184X, 978-0133021844

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App