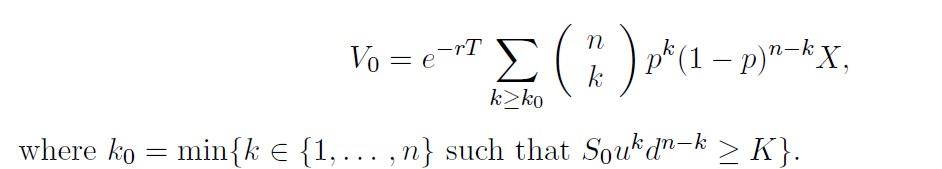

A digital option is one in which the payoff depends in a discontinuous way on the asset price. The simplest example is the cash-or-nothing option,

A digital option is one in which the payoff depends in a discontinuous way on the asset price. The simplest example is the cash-or-nothing option, in which the payoff to the holder at maturity T is X1{ST>K} where X is some prespecified cash sum. Suppose that an asset price evolves according to the binomial model in which, at each step, the asset price moves from its current value Sn to one of Snu and Snd. As usual, if T denotes the length of each time step, d < erT < u. Find the time zero price of the above option. You may leave your answer as a sum.

n Vo = e-rT *(1 p)-kX, k k>ko where ko = min{k {1,... ,n} such that Sou d"-k > K}.

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started