I know how to perform consolidation for companies with a simple group structure, but Ive not learned how to perform consolidation for companies with a

I know how to perform consolidation for companies with a simple group structure, but I’ve not learned how to perform consolidation for companies with a complex group structure. I prepared these draft consolidated financial statements based on what I’ve learned about consolidation for a simple group structure.” Raynald commented, as he handed to you the financial statements he had prepared.

Raynald is an intern who had just joined the accounting department of Algo Company. You are his supervisor at Algo Company. A few days ago, you had assigned him to prepare the draft consolidated financial statements for the Algo group for the year ended 31 December 20x9.

“Could you let me know whether there are any errors in this set of draft consolidated financial statements and advise me on how I could correct the errors?” asked Raynald.

You have the following information about the Algo group:

On 1 January 20x8, Algo Company paid $560,000 to acquire 80% of the ordinary shares of Bossa Company. On that date, the book value and fair value of Bossa Company’s identifiable net assets were represented by share capital of $300,000 and retained profit of $300,000.

On 1 January 20x6, Bossa Company had paid $410,000 to acquire 70% of the ordinary shares of Caro Company. On that date, the book value and fair value of Caro Company’s identifiable net assets were represented by share capital of $200,000 and retained profit of $200,000. On 1 January 20x8, Caro Company had a share capital of $200,000 and retained profit of $350,000.

During 20x9, Bossa Company sold inventory to Caro Company at cost plus 50%. The total intercompany sales for 20x9 was S$180,000. As at 31 December 20x9, the inventory had not been resold to external parties.

All dividends were declared out of 20x9 profits, and had been duly paid and received.

Algo Company, Bossa Company, and Caro Company adopt the Singapore Financial Reporting Standards (International) (SFRS(I)). All the relevant SFRS(I) that were issued by the Accounting Standards Council as at 1 January 2021 are assumed to have been effective on 1 January 20x6. All the companies present annual financial statements with 31 December financial year-ends.

The group policy was to measure inventory using the first-in, first-out method and measure non-controlling interests at the acquisition date based on their proportionate share of the acquisition-date fair value of the identifiable net assets of the subsidiaries acquired.

Ignore the deferred tax effects, if any, arising from consolidation.

Assume that a direct shareholding interest of more than 50% gives rise to control, and a direct shareholding interest of 20% or more but less than 50% gives rise to significant influence.

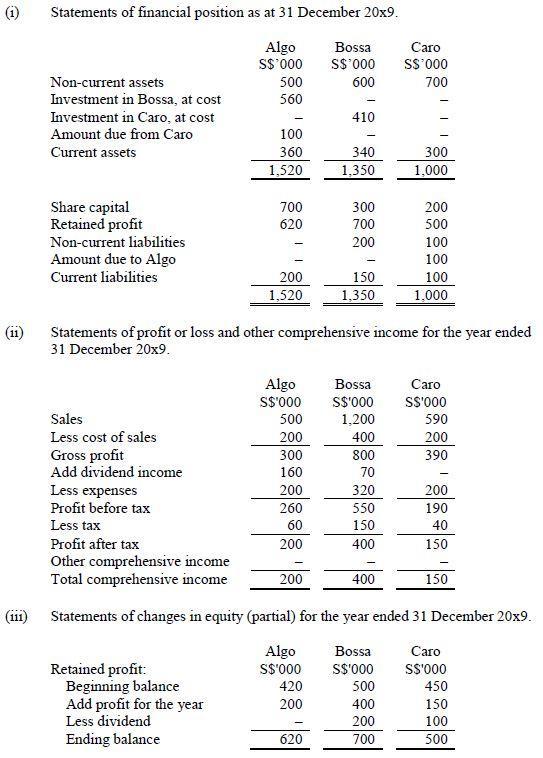

The individual statements of financial position as at 31 December 20x9, individual statements of profit or loss and other comprehensive income for the year ended 31 December 20x9, and individual statements of changes in equity (partial) for the year ended 31 December 20x9 of Algo Company, Bossa Company, and Caro Company are provided here.

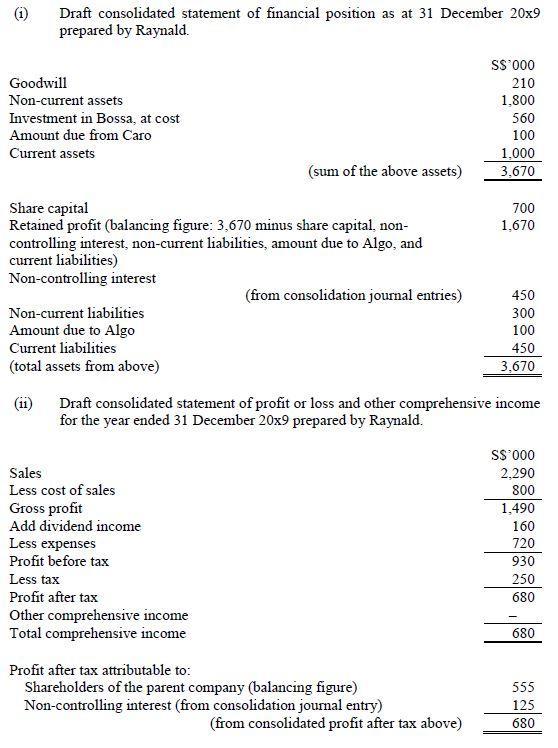

Shown below is the draft consolidated statement of financial position as at 31 December 20x9 and the draft consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20x9 prepared by Raynald.

The words in brackets in the draft consolidated financial statements are the notes that Raynald had included in the draft consolidated financial statements to explain how he computed some of the financial statement items and some of the subtotals.

Required:

(a) Write an e-mail to Raynald regarding the errors in the draft consolidated financial statements that he had prepared. For each error identified, discuss why it is an error and how it can be corrected.

(b) Construct for the Algo group the consolidated statement of financial position as at 31 December 20x9 and the consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20x9. Show your workings for:

(1) Retained profit in the consolidated statement of financial position;

(2) Non-controlling interest in the consolidated statement of financial position;

(3) Profit after tax attributable to shareholders of the parent company; and (4) Profit after tax attributable to non-controlling interest.

Note: The consolidation journal entries and the consolidated statement of changes in equity are not required. Also, you may choose to use whichever consolidation method you deem appropriate for the consolidation of the Algo group.

(c) As Raynald would like your advice on the consolidation methods to use for the consolidation of the Algo group, write an e-mail to Raynald to appraise the appropriateness of the consolidation of consolidation method versus the indirect interest method for performing consolidation for the Algo group.

In your answer, explain which method is more appropriate and why, or if both methods are appropriate, explain why. In addition, if there is insufficient information to make your appraisal of the appropriateness of the two methods, list down the additional information you would need in order to make your appraisal of the appropriateness of the two methods.

(1) (11) (111) Statements of financial position as at 31 December 20x9. Algo S$'000 Non-current assets Investment in Bossa, at cost Investment in Caro, at cost Amount due from Caro Current assets Share capital Retained profit Non-current liabilities Amount due to Algo Current liabilities Sales Less cost of sales Gross profit Add dividend income Less expenses Profit before tax Less tax 500 560 Retained profit: 100 360 1,520 Beginning balance Add profit for the year Less dividend Ending balance 700 620 200 1,520 Algo S$'000 500 200 300 160 200 260 60 200 Statements of profit or loss and other comprehensive income for the year ended 31 December 20x9. 200 Bossa S$ 000 600 420 200 - 620 410 340 1,350 300 700 200 - 150 1,350 Bossa S$'000 1,200 400 800 70 320 550 150 400 Caro S$'000 700 Profit after tax Other comprehensive income Total comprehensive income Statements of changes in equity (partial) for the year ended 31 December 20x9. Algo Bossa Caro S$'000 S$'000 S$'000 400 300 1,000 500 400 200 700 200 500 100 100 100 1,000 Caro S$'000 590 200 390 200 190 40 150 150 450 150 100 500

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Dear Raynald Thank you for submitting the draft consolidated financial statements for the Algo group for the year ended 31 December 20x9 I have reviewed the financial statements and have identified th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started