Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A direct marketing company acquired a customer list for 230,000 on July 1, 2014 and expects that it will be able to derive benefits from

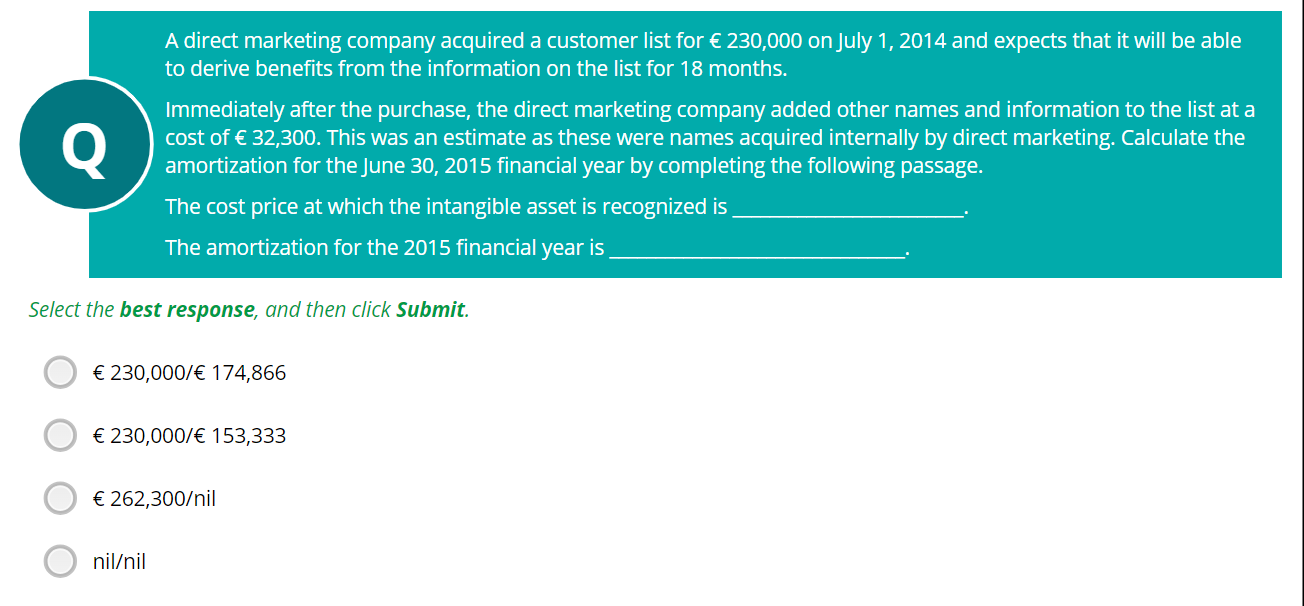

A direct marketing company acquired a customer list for 230,000 on July 1, 2014 and expects that it will be able to derive benefits from the information on the list for 18 months. Immediately after the purchase, the direct marketing company added other names and information to the list at a cost of 32,300. This was an estimate as these were names acquired internally by direct marketing. Calculate the amortization for the June 30, 2015 financial year by completing the following passage. The cost price at which the intangible asset is recognized is The amortization for the 2015 financial year is Select the best response, and then click Submit. 230,000/174,866 230,000/153,333 262,300/ nil nilil

A direct marketing company acquired a customer list for 230,000 on July 1, 2014 and expects that it will be able to derive benefits from the information on the list for 18 months. Immediately after the purchase, the direct marketing company added other names and information to the list at a cost of 32,300. This was an estimate as these were names acquired internally by direct marketing. Calculate the amortization for the June 30, 2015 financial year by completing the following passage. The cost price at which the intangible asset is recognized is The amortization for the 2015 financial year is Select the best response, and then click Submit. 230,000/174,866 230,000/153,333 262,300/ nil nilil Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started