Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Discuss four benefits that would accrue to a foreign investor investing in the international bonds and (b) Highlight four conditions that must be

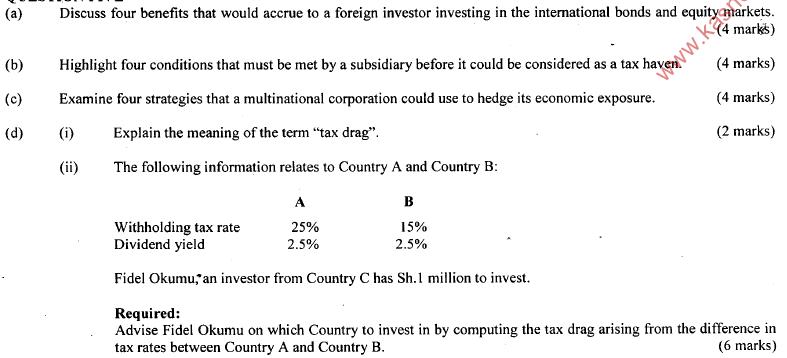

(a) Discuss four benefits that would accrue to a foreign investor investing in the international bonds and (b) Highlight four conditions that must be met by a subsidiary before it could be considered as a (c) www.ka kets. have marks) (d) Examine four strategies that a multinational corporation could use to hedge its economic exposure. (4 marks) (i) Explain the meaning of the term "tax drag". (ii) (4 marks) (2 marks) The following information relates to Country A and Country B: A B Withholding tax rate 25% 15% Dividend yield 2.5% 2.5% Fidel Okumu, an investor from Country C has Sh.1 million to invest. Required: Advise Fidel Okumu on which Country to invest in by computing the tax drag arising from the difference in tax rates between Country A and Country B. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Benefits of Investing in International Bonds and Equity Markets 1 Diversification Investing in international bonds and equity markets allows foreign investors to diversify their investment portfolio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started