Question

a) Discuss the impact of interest rate risk on banks. (8 marks) b) Consider the following balance sheet of Robobank: Assets () Duration Liabilities ()

a) Discuss the impact of interest rate risk on banks. (8 marks)

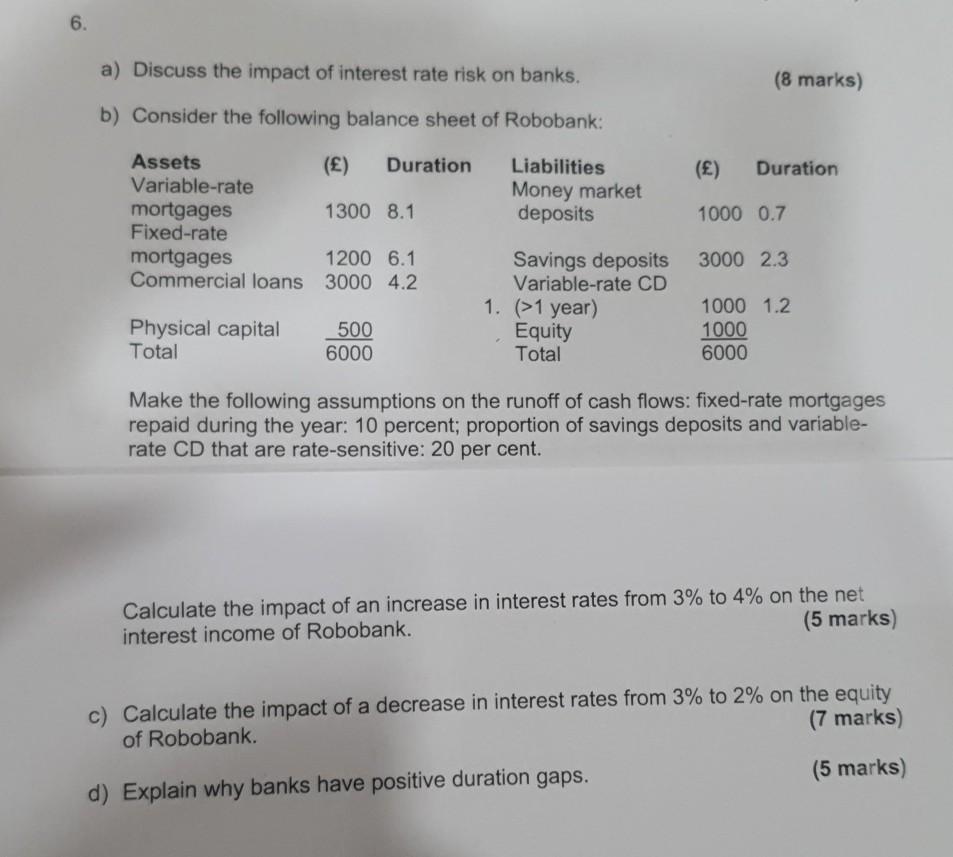

b) Consider the following balance sheet of Robobank:

Assets () Duration Liabilities () Duration Variable-rate Money market mortgages 1300 8.1 deposits 1000 0.7 Fixed-rate mortgages 1200 6.1 Savings deposits 3000 2.3 Commercial loans 3000 4.2 Variable-rate CD 1. (>1 year) 1000 1.2 Physical capital 500 Equity 1000 Total 6000 Total 6000

Make the following assumptions on the runoff of cash flows: fixed-rate mortgages repaid during the year: 10 percent; proportion of savings deposits and variable-rate CD that are rate-sensitive: 20 per cent. Calculate the impact of an increase in interest rates from 3% to 4% on the net interest income of Robobank. (5 marks)

c) Calculate the impact of a decrease in interest rates from 3% to 2% on the equity of Robobank. (7 marks)

d) Explain why banks have positive duration gaps. (5 marks)

6. a) Discuss the impact of interest rate risk on banks. (8 marks) b) Consider the following balance sheet of Robobank: () Duration Assets () Duration Variable-rate mortgages 1300 8.1 Fixed-rate mortgages 1200 6.1 Commercial loans 3000 4.2 Liabilities Money market deposits 1000 0.7 3000 2.3 Savings deposits Variable-rate CD 1. (>1 year) Equity Total Physical capital Total 500 6000 1000 1.2 1000 6000 Make the following assumptions on the runoff of cash flows: fixed-rate mortgages repaid during the year: 10 percent; proportion of savings deposits and variable- rate CD that are rate-sensitive: 20 per cent. Calculate the impact of an increase in interest rates from 3% to 4% on the net interest income of Robobank. (5 marks) c) Calculate the impact of a decrease in interest rates from 3% to 2% on the equity of Robobank. (7 marks) (5 marks) d) Explain why banks have positive duration gaps

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started