Answered step by step

Verified Expert Solution

Question

1 Approved Answer

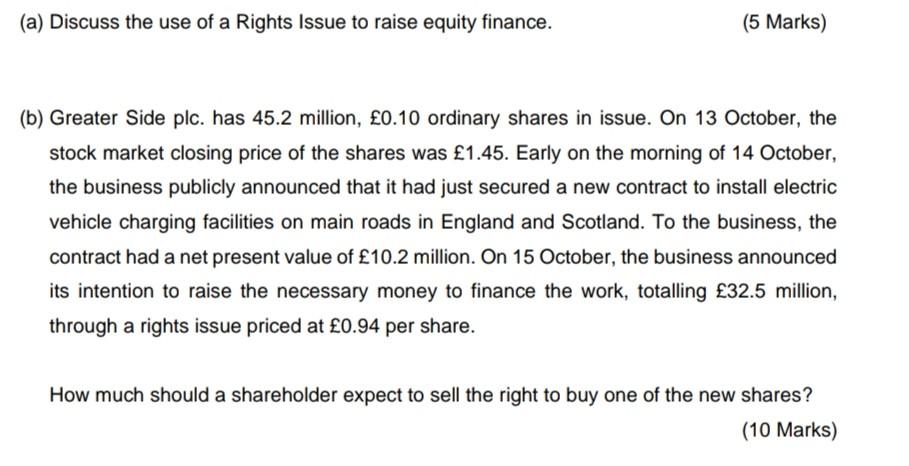

(a) Discuss the use of a Rights Issue to raise equity finance. (5 Marks) (b) Greater Side plc. has 45.2 million, 0.10 ordinary shares in

(a) Discuss the use of a Rights Issue to raise equity finance. (5 Marks) (b) Greater Side plc. has 45.2 million, 0.10 ordinary shares in issue. On 13 October, the stock market closing price of the shares was 1.45. Early on the morning of 14 October, the business publicly announced that it had just secured a new contract to install electric vehicle charging facilities on main roads in England and Scotland. To the business, the contract had a net present value of 10.2 million. On 15 October, the business announced its intention to raise the necessary money to finance the work, totalling 32.5 million, through a rights issue priced at 0.94 per share. How much should a shareholder expect to sell the right to buy one of the new shares? (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started