Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Discuss TWO (2) characteristics of a private debt. (4 marks) (b) Consider two 20 years bond with annual coupon payments. Bond A has 8

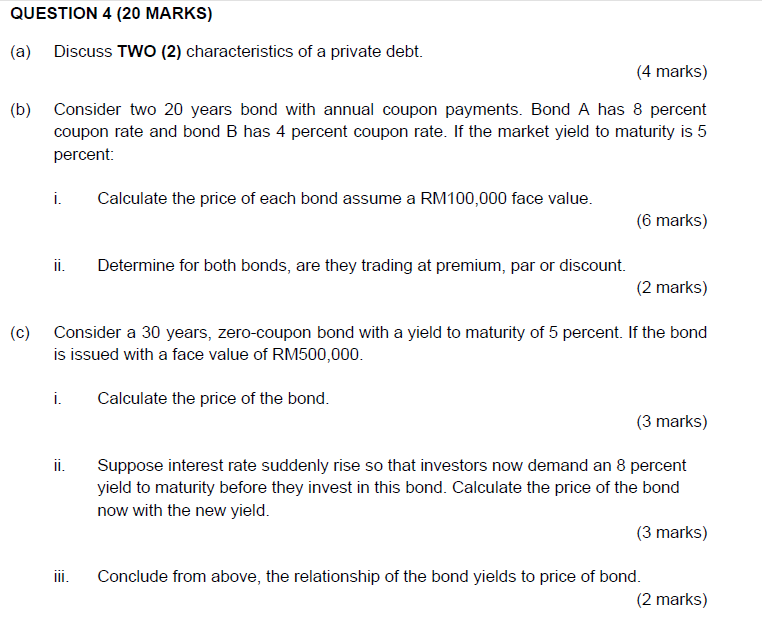

(a) Discuss TWO (2) characteristics of a private debt. (4 marks) (b) Consider two 20 years bond with annual coupon payments. Bond A has 8 percent coupon rate and bond B has 4 percent coupon rate. If the market yield to maturity is 5 percent: i. Calculate the price of each bond assume a RM100,000 face value. (6 marks) ii. Determine for both bonds, are they trading at premium, par or discount. (2 marks) (c) Consider a 30 years, zero-coupon bond with a yield to maturity of 5 percent. If the bond is issued with a face value of RM500,000. i. Calculate the price of the bond. (3 marks) ii. Suppose interest rate suddenly rise so that investors now demand an 8 percent yield to maturity before they invest in this bond. Calculate the price of the bond now with the new yield. (3 marks) Conclude from above, the relationship of the bond yields to price of bond. (2 marks)

(a) Discuss TWO (2) characteristics of a private debt. (4 marks) (b) Consider two 20 years bond with annual coupon payments. Bond A has 8 percent coupon rate and bond B has 4 percent coupon rate. If the market yield to maturity is 5 percent: i. Calculate the price of each bond assume a RM100,000 face value. (6 marks) ii. Determine for both bonds, are they trading at premium, par or discount. (2 marks) (c) Consider a 30 years, zero-coupon bond with a yield to maturity of 5 percent. If the bond is issued with a face value of RM500,000. i. Calculate the price of the bond. (3 marks) ii. Suppose interest rate suddenly rise so that investors now demand an 8 percent yield to maturity before they invest in this bond. Calculate the price of the bond now with the new yield. (3 marks) Conclude from above, the relationship of the bond yields to price of bond. (2 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started