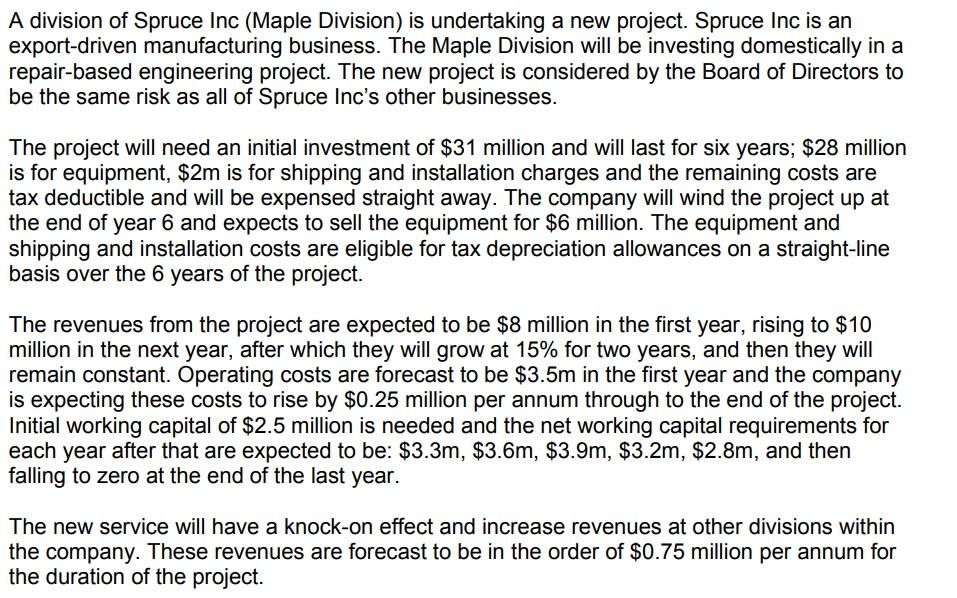

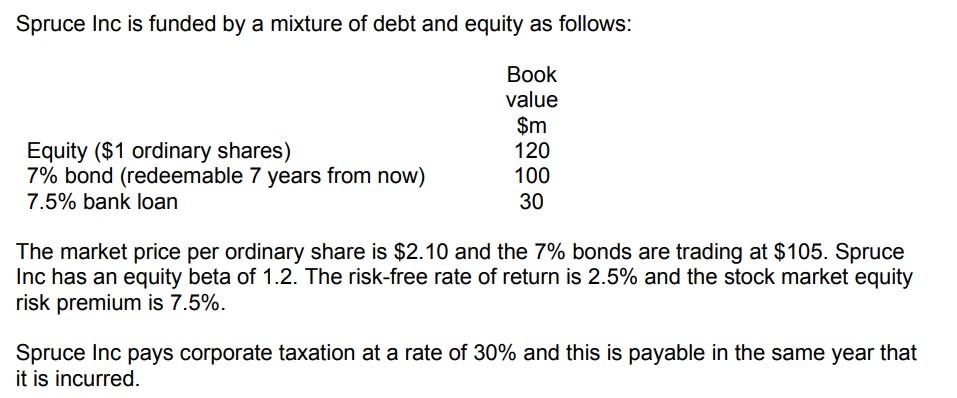

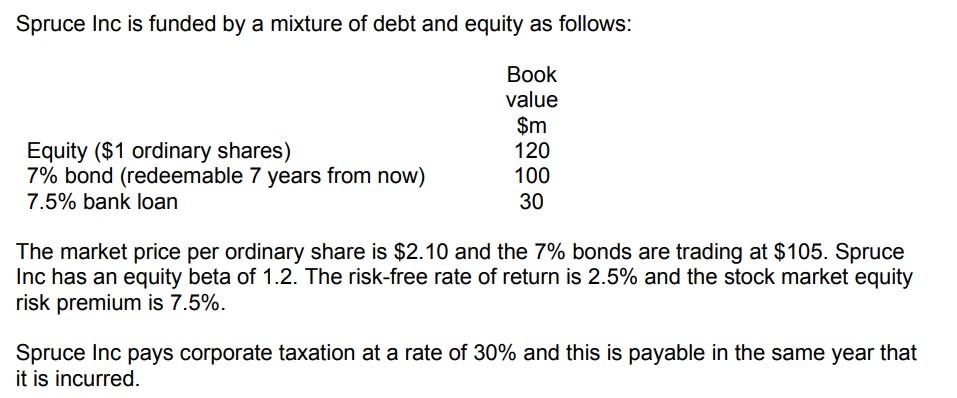

A division of Spruce Inc (Maple Division) is undertaking a new project. Spruce Inc is an export-driven manufacturing business. The Maple Division will be investing domestically in a repair-based engineering project. The new project is considered by the Board of Directors to be the same risk as all of Spruce Inc's other businesses. The project will need an initial investment of $31 million and will last for six years; $28 million is for equipment, $2m is for shipping and installation charges and the remaining costs are tax deductible and will be expensed straight away. The company will wind the project up at the end of year 6 and expects to sell the equipment for $6 million. The equipment and shipping and installation costs are eligible for tax depreciation allowances on a straight-line basis over the 6 years of the project. The revenues from the project are expected to be $8 million in the first year, rising to $10 million in the next year, after which they will grow at 15% for two years, and then they will remain constant. Operating costs are forecast to be $3.5m in the first year and the company is expecting these costs to rise by $0.25 million per annum through to the end of the project. Initial working capital of $2.5 million is needed and the net working capital requirements for each year after that are expected to be: $3.3m, $3.6m, $3.9m, $3.2m, $2.8m, and then falling to zero at the end of the last year. The new service will have a knock-on effect and increase revenues at other divisions within the company. These revenues are forecast to be in the order of $0.75 million per annum for the duration of the project. Spruce Inc is funded by a mixture of debt and equity as follows: Equity ($1 ordinary shares) 7% bond (redeemable 7 years from now) 7.5% bank loan Book value $m 120 100 30 The market price per ordinary share is $2.10 and the 7% bonds are trading at $105. Spruce Inc has an equity beta of 1.2. The risk-free rate of return is 2.5% and the stock market equity risk premium is 7.5%. Spruce Inc pays corporate taxation at a rate of 30% and this is payable in the same year that it is incurred. 1. Calculate the net present value of the Maple Division project and recommend whether Spruce Inc should invest in it. Show all workings. (15 marks)