Question

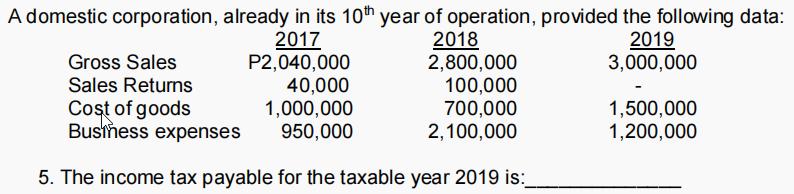

A domestic corporation, already in its 10th year of operation, provided the following data: 2017 P2,040,000 40,000 1,000,000 950,000 2018 2,800,000 100,000 700,000 2,100,000

A domestic corporation, already in its 10th year of operation, provided the following data: 2017 P2,040,000 40,000 1,000,000 950,000 2018 2,800,000 100,000 700,000 2,100,000 2019 Gross Sales 3,000,000 Sales Retums Cost of goods Busiess expenses 1,500,000 1,200,000 5. The income tax payable for the taxable year 2019 is:

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A BI 2018 2800000 100000 2700000 Particulars 2017 2019 3000000 2 Gross Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Walter Harrison, Charles Horngren, William Thomas

10th edition

133796833, 133427536, 9780133796834, 978-0133427530

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App