Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A donor contributes cash unconditionally for the purpose of carrying out the business of a not - for - profit organization. The recipient organization fully

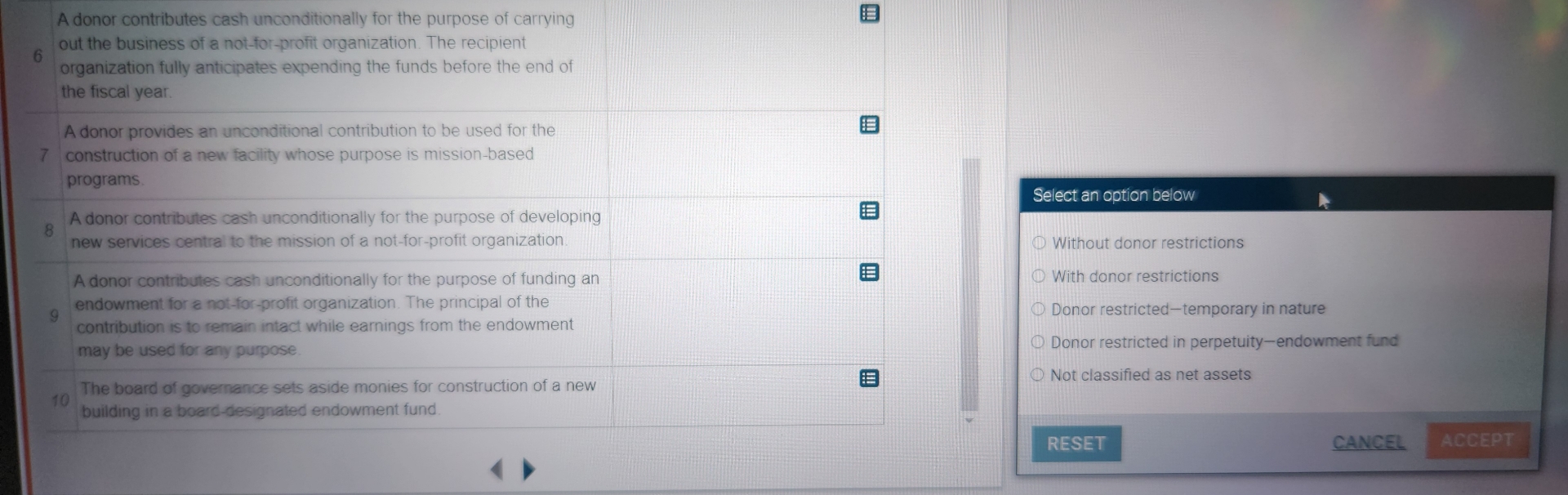

A donor contributes cash unconditionally for the purpose of carrying out the business of a notforprofit organization. The recipient organization fully anticipates expending the funds before the end of the fiscal year.

A donor provides an unconditional contribution to be used for the

construction of a new facility whose purpose is missionbased programs.

A donor contributes cash unconditionally for the purpose of developing new services central to the mission of a notforprofit organization.

A donor contributes cash unconditionally for the purpose of funding an endowment for a notforprofit organization. The principal of the contribution is to remain intact while earnings from the endowment may be used for any purpose.

The board of governance sets aside monies for construction of a new building in a boarddesignated endowment fund

Select an option below

Without donor restrictions

With donor restrictions

Donor restrictedtemporary in nature

Donor restricted in perpetuityendowment fund

Not classified as net assets

CANCEL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started