A bank extends a traditional 30-year fixed-rate residential mortgage with level monthly payments to a borrower with the following details: House value / purchase

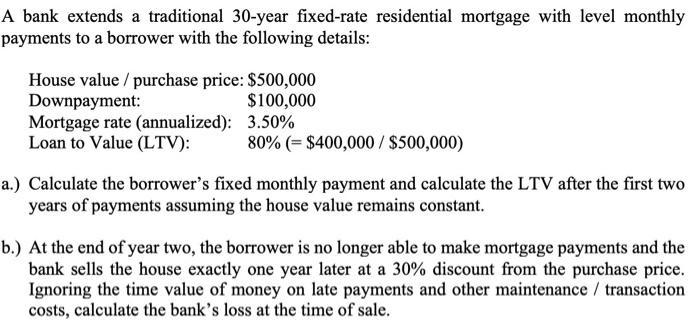

A bank extends a traditional 30-year fixed-rate residential mortgage with level monthly payments to a borrower with the following details: House value / purchase price: $500,000 Downpayment: $100,000 Mortgage rate (annualized): Loan to Value (LTV): 3.50% 80% (= $400,000/ $500,000) a.) Calculate the borrower's fixed monthly payment and calculate the LTV after the first two years of payments assuming the house value remains constant. b.) At the end of year two, the borrower is no longer able to make mortgage payments and the bank sells the house exactly one year later at a 30% discount from the purchase price. Ignoring the time value of money on late payments and other maintenance / transaction costs, calculate the bank's loss at the time of sale.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A B Carroll co...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started