Question

A dozer cost $300,000 to purchase, and the machine useful life is 10 years and 10,000 operating hours. The salvage value of the equipment at

A dozer cost $300,000 to purchase, and the machine useful life is 10 years and 10,000 operating hours.

The salvage value of the equipment at the end of 10 years is 20% of the purchase price. The maintenance cost for the

equipment is $30 per operating hour. A major engine repair is expected in 5 years for $30,000. if the company cost of

capital rate is 10%, how much should the owner of the machine charge per hour of use if the machine is expected to

operate 1,000 hours per year?

This is about getting all values to a common denominator by resolving all amounts to uniform series

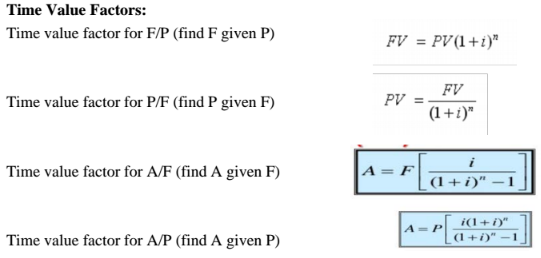

Step 1: Use A/P to resolve the purchase price to uniform series for each year

Step 2:Use A/F to resolve the salvage price (20% of purchase price) to uniform series for each year (n=10)

Step 3: Use the P/F to convert the $30,000 major engine repair cost to present value (n=5)

Step 4: Use A/P to resolve the present value amount that you got in step 3 to uniform series (n=10)

Step 5: Compute the total yearly amount by adding up the values from step 1, 4 and subtract the value from step 2

Step 6: Divide one of the yearly value from steps 5 by 1000 and that should give you the hourly rate

Steps 7: Add the hourly rate from step 6 to the $30 per operating hour (maintenance), and that is your final number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started