Answered step by step

Verified Expert Solution

Question

1 Approved Answer

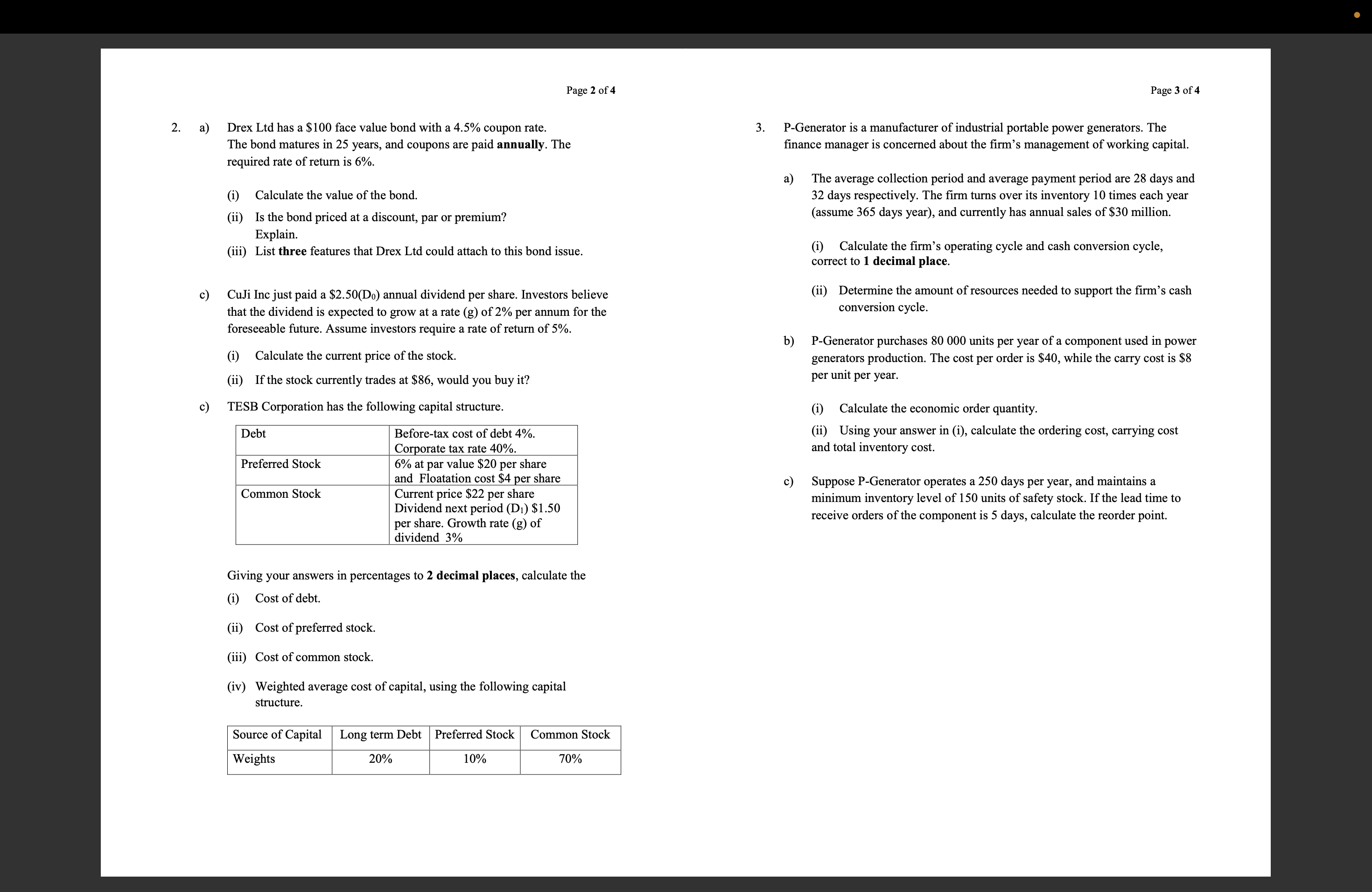

a ) Drex Ltd has a $ 1 0 0 face value bond with a 4 . 5 % coupon rate. The bond matures in

a Drex Ltd has a $ face value bond with a coupon rate.

The bond matures in years, and coupons are paid annually. The

required rate of return is

i Calculate the value of the bond.

ii Is the bond priced at a discount, par or premium?

Explain.

iii List three features that Drex Ltd could attach to this bond issue.

c CuJi Inc just paid a $ annual dividend per share. Investors believe

that the dividend is expected to grow at a rate g of per annum for the

foreseeable future. Assume investors require a rate of return of

i Calculate the current price of the stock.

ii If the stock currently trades at $ would you buy it

c TESB Corporation has the following capital structure.

Giving your answers in percentages to decimal places, calculate the

i Cost of debt.

ii Cost of preferred stock.

iii Cost of common stock.

iv Weighted average cost of capital, using the following capital

structure.

PGenerator is a manufacturer of industrial portable power generators. The

finance manager is concerned about the firm's management of working capital.

a The average collection period and average payment period are days and

days respectively. The firm turns over its inventory times each year

assume days year and currently has annual sales of $ million.

i Calculate the firm's operating cycle and cash conversion cycle,

correct to decimal place.

ii Determine the amount of resources needed to support the firm's cash

conversion cycle.

b PGenerator purchases units per year of a component used in power

generators production. The cost per order is $ while the carry cost is $

per unit per year.

i Calculate the economic order quantity.

ii Using your answer in i calculate the ordering cost, carrying cost

and total inventory cost.

c Suppose PGenerator operates a days per year, and maintains a

minimum inventory level of units of safety stock. If the lead time to

receive orders of the component is days, calculate the reorder point.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started