Answered step by step

Verified Expert Solution

Question

1 Approved Answer

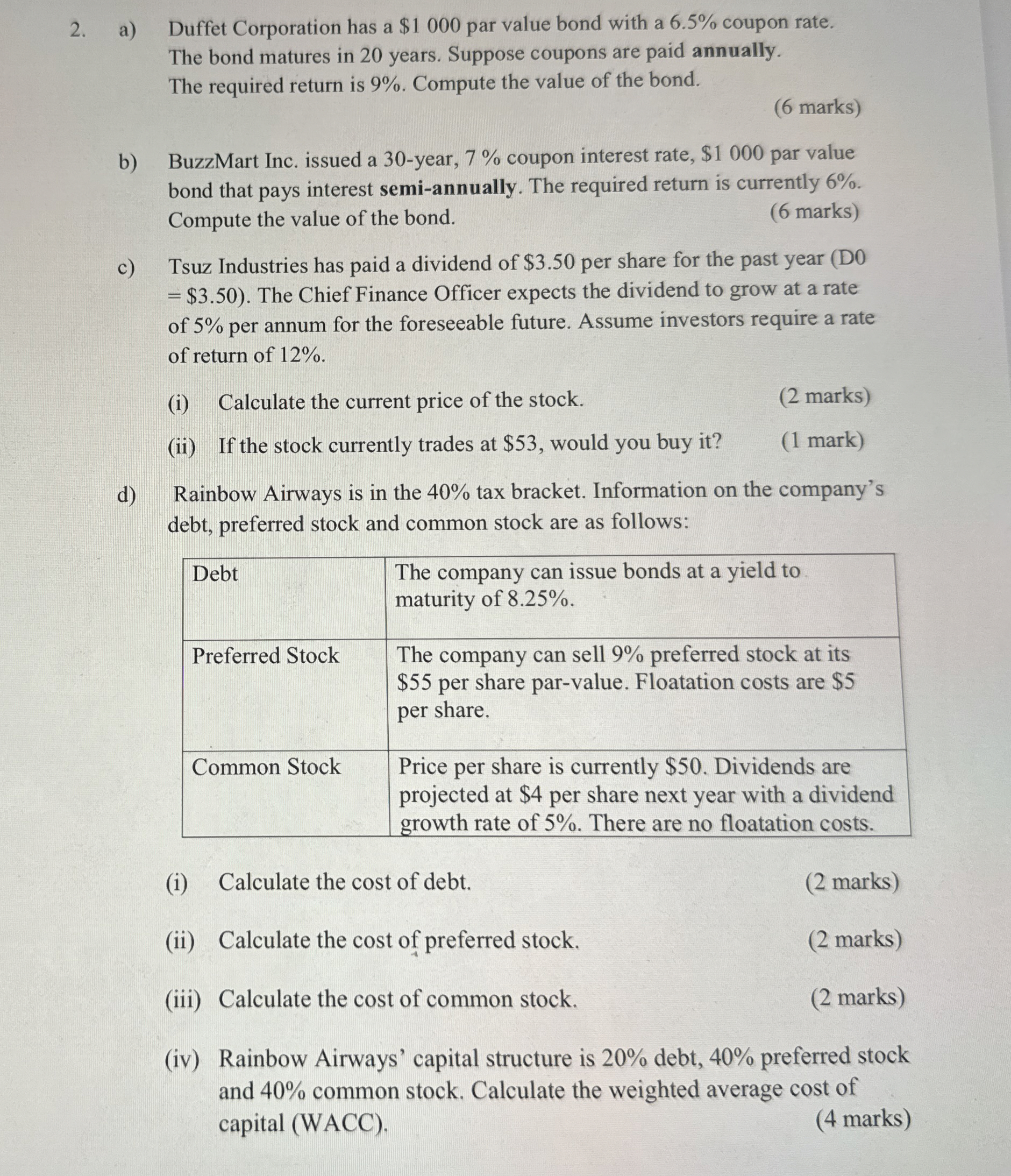

a ) Duffet Corporation has a $ 1 0 0 0 par value bond with a 6 . 5 % coupon rate. The bond matures

a Duffet Corporation has a $ par value bond with a coupon rate.

The bond matures in years. Suppose coupons are paid annually.

The required return is Compute the value of the bond.

marks

b BuzzMart Inc. issued a year, coupon interest rate, $ par value bond that pays interest semiannually. The required return is currently Compute the value of the bond.

marks

c Tsuz Industries has paid a dividend of $ per share for the past year D$ The Chief Finance Officer expects the dividend to grow at a rate of per annum for the foreseeable future. Assume investors require a rate of return of

i Calculate the current price of the stock.

marks

ii If the stock currently trades at $ would you buy it

mark

d Rainbow Airways is in the tax bracket. Information on the company's debt, preferred stock and common stock are as follows:

tableDebttableThe company can issue bonds at a yield tomaturity of Preferred Stock,tableThe company can sell preferred stock at its$ per share parvalue. Floatation costs are $per share.Common Stock,tablePrice per share is currently $ Dividends areprojected at $ per share next year with a dividendgrowth rate of There are no floatation costs.

i Calculate the cost of debt.

marks

ii Calculate the cost of preferred stock.

marks

iii Calculate the cost of common stock.

marks

iv Rainbow Airways' capital structure is debt, preferred stock and common stock. Calculate the weighted average cost of capital WACC

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started