Question

a. During 2022, George (a 24-year-old single taxpayer) has a salary of $52,000, dividend income of $14,000, and interest income of $4,000. In addition, he

a.  During 2022, George (a 24-year-old single taxpayer) has a salary of $52,000, dividend income of $14,000, and interest income of $4,000. In addition, he has rental income of $1,000. George is covered by a qualified retirement plan. Calculate the maximum regular IRA deduction that George is allowed. fill in the blank 1 of 1

During 2022, George (a 24-year-old single taxpayer) has a salary of $52,000, dividend income of $14,000, and interest income of $4,000. In addition, he has rental income of $1,000. George is covered by a qualified retirement plan. Calculate the maximum regular IRA deduction that George is allowed. fill in the blank 1 of 1

b. During 2022, Irene (a single taxpayer, under age 50) has a salary of $121,000 and dividend income of $10,000. Calculate Irene's maximum contribution to a Roth IRA. fill in the blank 1 of 1$ 1,000

c. Wanda, a single taxpayer age 63, takes a $10,000 distribution from her traditional IRA to purchase furniture for her home. Over the years she has contributed $36,000 to the IRA which had a $50,000 balance at the time of the distribution. Determine how much of Wanda's distribution is taxable.

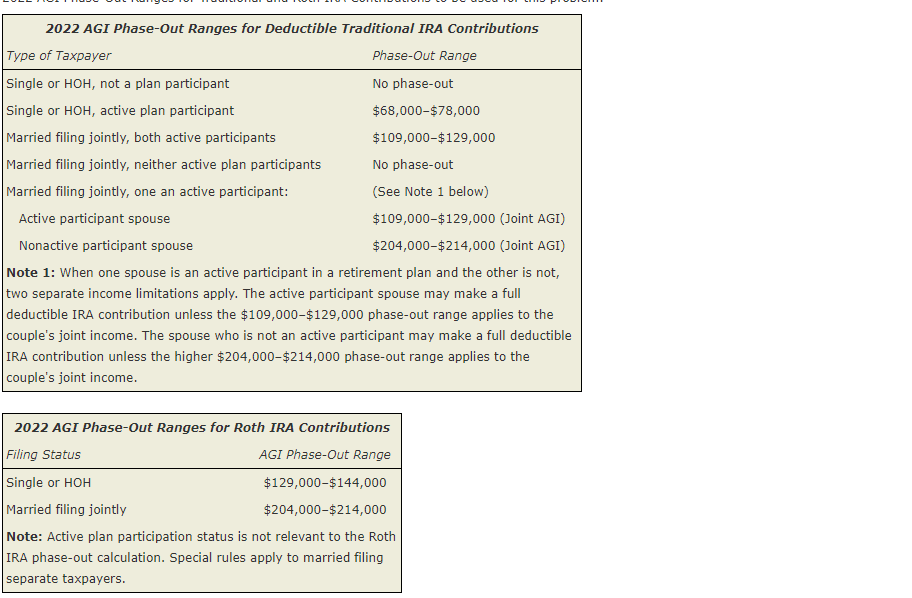

Note 1: When one spouse is an active participant in a retirement plan and the other is not, two separate income limitations apply. The active participant spouse may make a full deductible IRA contribution unless the $109,000$129,000 phase-out range applies to the couple's joint income. The spouse who is not an active participant may make a full deductible IRA contribution unless the higher $204,000 - $214,000 phase-out range applies to the couple's joint incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started