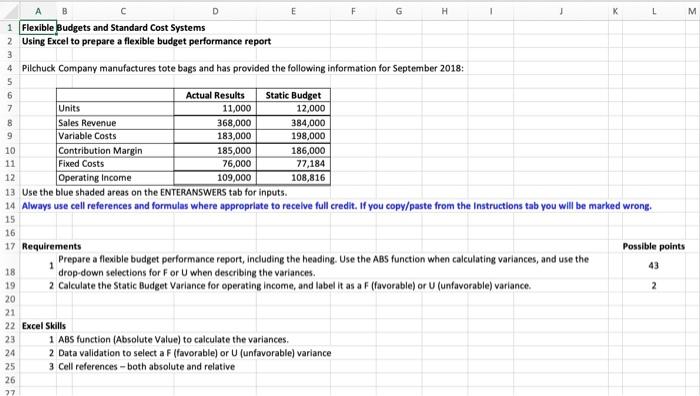

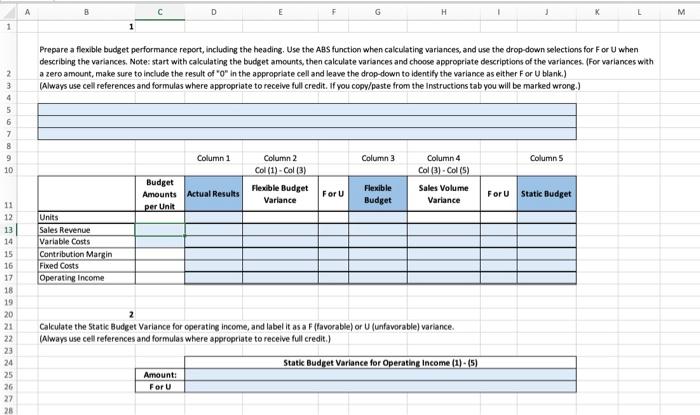

A E F G H K - M B 1 Flexible Budgets and Standard Cost Systems 2 Using Excel to prepare a flexible budget performance report 4 Pilchuck Company manufactures tote bags and has provided the following information for September 2018: 3 5 6 7 8 9 10 11 12 Actual Results Static Budget Units 11,000 12,000 Sales Revenue 368,000 384,000 Variable Costs 183,000 198,000 Contribution Margin 185,000 186,000 Fixed Costs 76,000 77,184 Operating Income 109,000 108,816 13 Use the blue shaded areas on the ENTERANSWERS tab for inputs. 14. Always use cell references and formulas where appropriate to recelve full credit. If you copy/paste from the Instructions tab you will be marked wrong. 15 16 17 Requirements Possible points Prepare a flexible budget performance report, including the heading. Use the ABS function when calculating variances, and use the 1 43 18 drop-down selections for For U when describing the variances. 19 2 Calculate the Static Budget Variance for operating Income, and label it as a F (favorable) or U (unfavorable) variance. 2 20 21 22 Excel Skills 1 ABS function (Absolute Value) to calculate the variances 2 Data validation to select a F (favorable) or U(unfavorable) variance 25 3 Cell references - both absolute and relative 23 24 26 27 A D E G H K M 1 1 2 3 Prepare a flexible budget performance report, including the heading, Use the ABS function when calculating variances, and use the drop-down selections for ForU when describing the variances. Note: start with calculating the budget amounts, then calculate variances and choose appropriate descriptions of the variances. (For variances with a zero amount, make sure to include the result of "o" in the appropriate cell and leave the drop-down to identify the variance as either For U blank.) (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong.) 4 5 6 7 8 9 10 Column 1 Column 3 Columns Column 4 Col (3). Col (5) Budget Amounts Actual Results Per Unit Column 2 Col(1)-Col (3) Flexible Budget Variance For U Flexible Budget Sales Volume Variance For U Static Budget Units Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Calculate the State Budget Variance for operating income, and label it as a F(favorable) or U (unfavorable) variance. (Always use cell references and formulas where appropriate to receive full credit.) Statk Budget Variance for Operating Income (1) - (5) Amount: For U