------------

a)

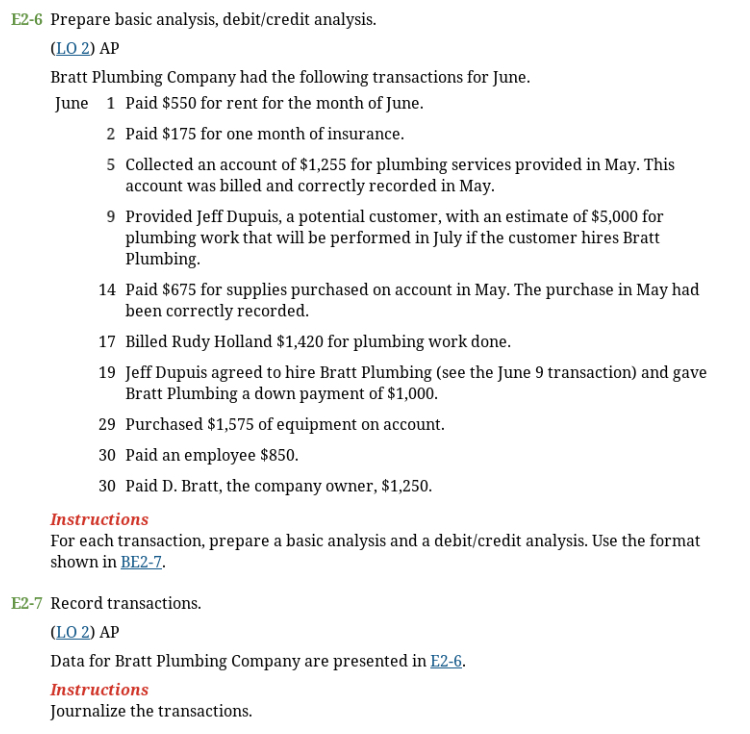

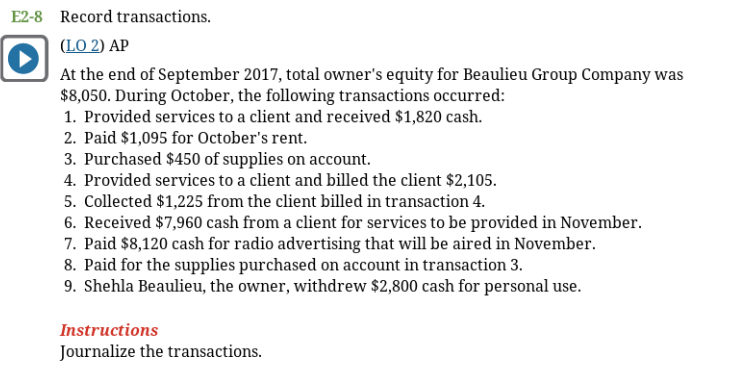

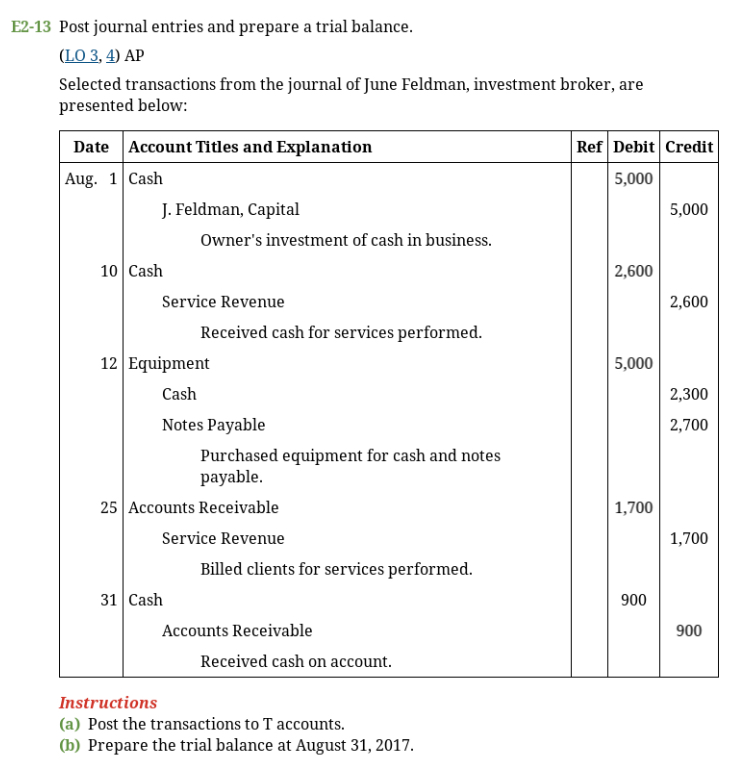

E2-6 Prepare basic analysis, debit/credit analysis. (LO 2) AP Bratt Plumbing Company had the following transactions for June. June 1 Paid $550 for rent for the month of June. 2 Paid $175 for one month of insurance. 5 Collected an account of $1,255 for plumbing services provided in May. This account was billed and correctly recorded in May. 9 Provided Jeff Dupuis, a potential customer, with an estimate of $5,000 for plumbing work that will be performed in July if the customer hires Bratt Plumbing. 14 Paid $675 for supplies purchased on account in May. The purchase in May had been correctly recorded 17 Billed Rudy Holland $1,420 for plumbing work done. 19 Jeff Dupuis agreed to hire Bratt Plumbing (see the June 9 transaction) and gave Bratt Plumbing a down payment of $1,000. 29 Purchased $1,575 of equipment on account. 30 Paid an employee $850. 30 Paid D. Bratt, the company owner, $1,250. Instructions For each transaction, prepare a basic analysis and a debit/credit analysis. Use the format shown in BE2-7. E2-7 Record transactions. (LO 2) AP Data for Bratt Plumbing Company are presented in E2-6. Instructions Journalize the transactions.E13 Record transactions. [E] m \"P At the end of September 2&11, total owner's equity for Beaulieu Group [fornplanjtt was $3,031. During October, the following transactions occurred: 1. Provided services to a client and received $1,320 cash. 2. Paid 51,1195 for October's rent. 3. Purchased $451] of supplies on account. 4. Provided services to a client and billed the client $2.15. 5. Collected $1,225 from the client billed in transaction 4. E. Received $1,950 cash from a client for services to be provided in November. '.-'. Paid $3,120 cash for radio advertising that will be aired in November. 8. Paid for the supplies purchased on account in transaction 3. 9. Shelda Beaulieu. the owner. withdrew $2,300 cash for personal use. Instructions Iournalize the transactions. E2-13 Post journal entries and prepare a trial balance. (LO 3, 4) AP Selected transactions from the journal of June Feldman, investment broker, are presented below: Date Account Titles and Explanation Ref Debit Credit Aug. 1 Cash 5,000 J. Feldman, Capital 5,000 Owner's investment of cash in business. 10 Cash 2,600 Service Revenue 2,600 Received cash for services performed. 12 Equipment 5,000 Cash 2,300 Notes Payable 2,700 Purchased equipment for cash and notes payable. 25 Accounts Receivable 1,700 Service Revenue 1,700 Billed clients for services performed. 31 Cash 900 Accounts Receivable 900 Received cash on account. Instructions (a) Post the transactions to T accounts. (b) Prepare the trial balance at August 31, 2017