Question

a. Equipment with a book value of $80,500 and an original cost of $160,000 was sold at a loss of $31,000. b. Paid $118,000

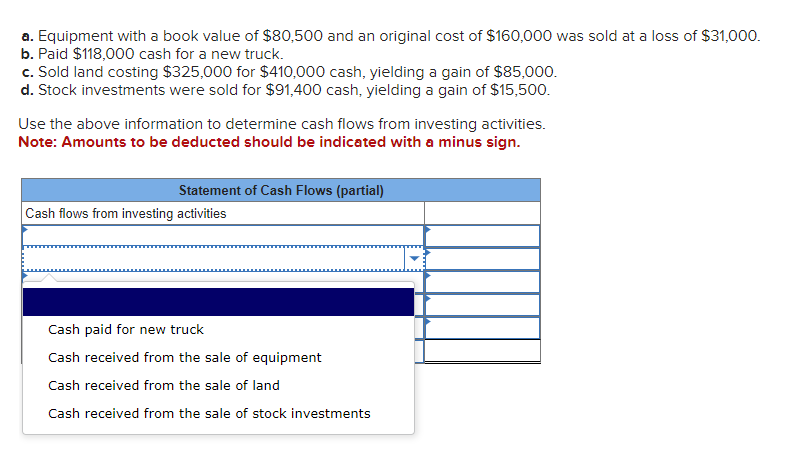

a. Equipment with a book value of $80,500 and an original cost of $160,000 was sold at a loss of $31,000. b. Paid $118,000 cash for a new truck. c. Sold land costing $325,000 for $410,000 cash, yielding a gain of $85,000. d. Stock investments were sold for $91,400 cash, yielding a gain of $15,500. Use the above information to determine cash flows from investing activities. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Cash flows from investing activities Cash paid for new truck Cash received from the sale of equipment Cash received from the sale of land Cash received from the sale of stock investments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer calculate the cash flows from investing activities based on the given information a Cash rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John Wild, Ken Shaw, Barbara Chiappetta

22nd edition

9781259566905, 978-0-07-76328, 77862279, 1259566900, 0-07-763289-3, 978-0077862275

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App