Question

A European growth mutual fund specializes in stocks from the British Isles continental Europe and Scandinavia The fund has over 121 stocks Let x be

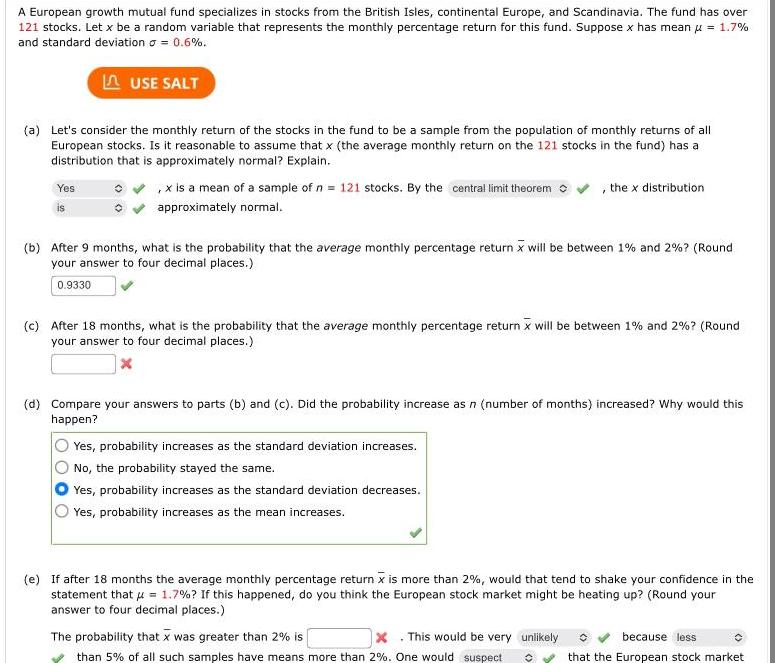

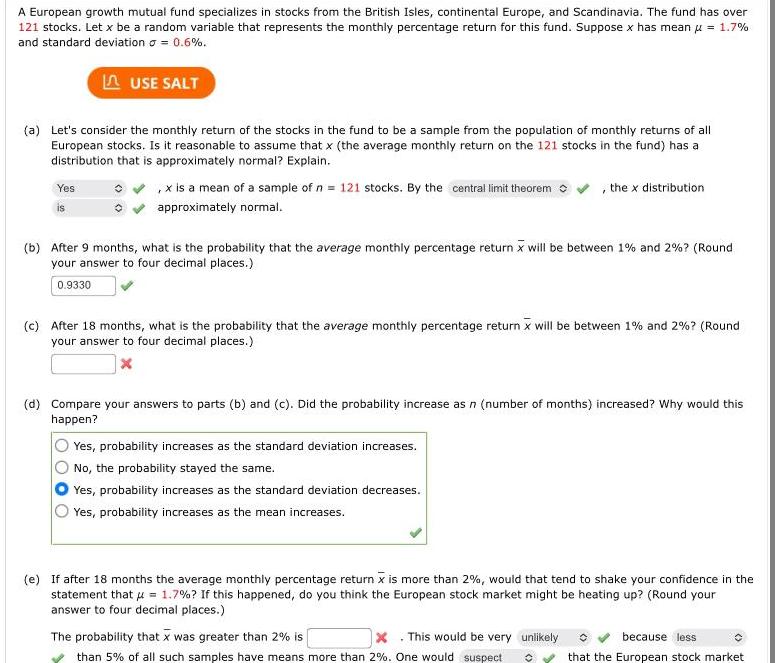

A European growth mutual fund specializes in stocks from the British Isles continental Europe and Scandinavia The fund has over 121 stocks Let x be a random variable that represents the monthly percentage return for this fund Suppose x has mean 1 7 and standard deviation 0 6 LAUSE SALT a Let s consider the monthly return of the stocks in the fund to be a sample from the population of monthly returns of all European stocks Is it reasonable to assume that x the average monthly return on the 121 stocks in the fund has a distribution that is approximately normal Explain Yes is x is a mean of a sample of n 121 stocks By the central limit theorem approximately normal b After 9 months what is the probability that the average monthly percentage return x will be between 1 and 2 Round your answer to four decimal places 0 9330 c After 18 months what is the probability that the average monthly percentage return x will be between 1 and 2 Round your answer to four decimal places X the x distribution d Compare your answers to parts b and c Did the probability increase as n number of months increased Why would this happen Yes probability increases as the standard deviation increases No the probability stayed the same Yes probability increases as the standard deviation decreases Yes probability increases as the mean increases e If after 18 months the average monthly percentage return x is more than 2 would that tend to shake your confidence in the statement that 1 7 If this happened do you think the European stock market might be heating up Round your answer to four decimal places x This would be very unlikely The probability that x was greater than 2 is than 5 of all such samples have means more than 2 One would suspect because less that the European stock market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started