Answered step by step

Verified Expert Solution

Question

1 Approved Answer

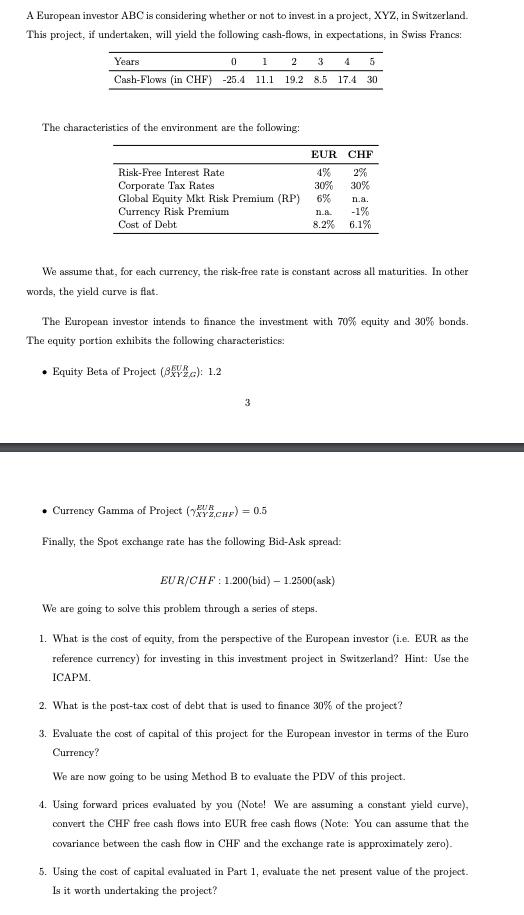

A European investor ABC is considering whether or not to invest in a project, XYZ, in Switzerland. This project, if undertaken, will yield the

A European investor ABC is considering whether or not to invest in a project, XYZ, in Switzerland. This project, if undertaken, will yield the following cash-flows, in expectations, in Swiss Francs: Years 0 1 2 3 5 Cash-Flows (in CHF) -25.4 11.1 19.2 8.5 17.4 30 The characteristics of the environment are the following: Risk-Free Interest Rate Corporate Tax Rates. Global Equity Mkt Risk Premium (RP) Currency Risk Premium Cost of Debt EUR CHF 4% 2% 30% 30% 6% n.a. 8.2% 3 We assume that, for each currency, the risk-free rate is constant across all maturities. In other words, the yield curve is flat. n.a. -1% 6.1% The European investor intends to finance the investment with 70% equity and 30% bonds. The equity portion exhibits the following characteristics: Equity Beta of Project (3V): 1.2 EUR Currency Gamma of Project (CHF) = 0.5 Finally, the Spot exchange rate has the following Bid-Ask spread: EUR/CHF: 1.200(bid) - 1.2500(ask) We are going to solve this problem through a series of steps. 1. What is the cost of equity, from the perspective of the European investor (i.e. EUR as the reference currency) for investing in this investment project in Switzerland? Hint: Use the ICAPM. 2. What is the post-tax cost of debt that is used to finance 30% of the project? 3. Evaluate the cost of capital of this project for the European investor in terms of the Euro Currency? We are now going to be using Method B to evaluate the PDV of this project. 4. Using forward prices evaluated by you (Note! We are assuming a constant yield curve), convert the CHF free cash flows into EUR free cash flows (Note: You can assume that the covariance between the cash flow in CHF and the exchange rate is approximately zero). 5. Using the cost of capital evaluated in Part 1, evaluate the net present value of the project. Is it worth undertaking the project?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The European investor intends to finance the investment with 70 equity and 30 bonds The equity portion exhibits the following characteristics Equity Beta of Project 32 12 3 Currency Gamma of Project C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started