Question

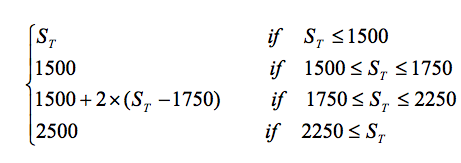

A European-style derivative security on the S&P 500 has the following payoff structure at the maturity date in 3 years: where S T is the

A European-style derivative security on the S&P 500 has the following payoff

structure at the maturity date in 3 years:

where ST is the index level at the maturity date. The index spot level is 2,078 and its volatility is 20%. The risk-free interest rate is 4% and the index dividend yield is 2%. We consider a 6-step binomial tree.

(a) Use Excel to draw this payoff pattern for the following range [1000 , 3000] with a step of 50.

(b) Price this security using a 6-step binomial tree. Show all details.

(c) Compute the delta of this derivative at each node of the tree. What do you notice for the nodes at time 2.5 years?

S. 1500 1500 + 2x (ST-1750) 2500 f S, s1500 f 1500 ST S1750 1750 if 2250 s S STS2250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started