Answered step by step

Verified Expert Solution

Question

1 Approved Answer

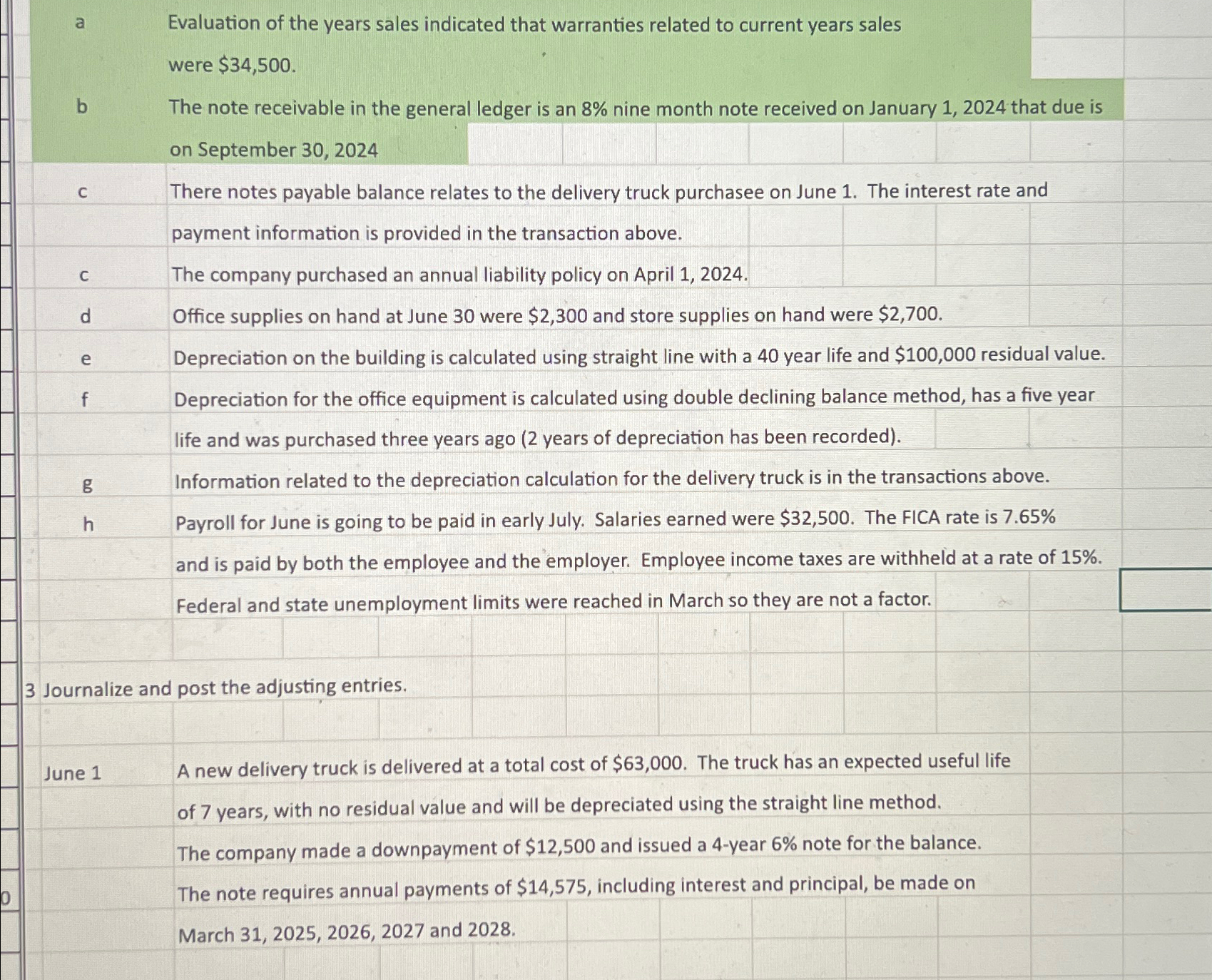

a Evaluation of the years sales indicated that warranties related to current years sales were $ 3 4 , 5 0 0 . b The

a Evaluation of the years sales indicated that warranties related to current years sales were $

b The note receivable in the general ledger is an nine month note received on January that due is on September

c There notes payable balance relates to the delivery truck purcent information is provided in the transaction above.

c The company purchased an annual liability policy on April

d Office supplies on hand at June were $ and store supplies on hand were $

e Depreciation on the building is calculated using straight line with a year life and $ residual value.

f

Depreciation for the office equipment is calculated using double declining balance method, has a five year life and was purchased three years ago years of depreciation has been recorded

g Information related to the depreciation calculation for the delivery truck is in the transactions above.

h Payroll for June is going to be paid in early July. Salaries earned were $ The FICA rate is and is paid by both the employee and the employer. Employee income taxes are withheld at a rate of Federal and state unemployment limits were reached in March so they are not a factor.

Journalize and post the adjusting entries.

June

A new delivery truck is delivered at a total cost of $ The truck has an expected useful life of years, with no residual value and will be depreciated using the straight line method.

The company made a downpayment of $ and issued a year note for the balance.

The note requires annual payments of $ including interest and principal, be made on

March and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started