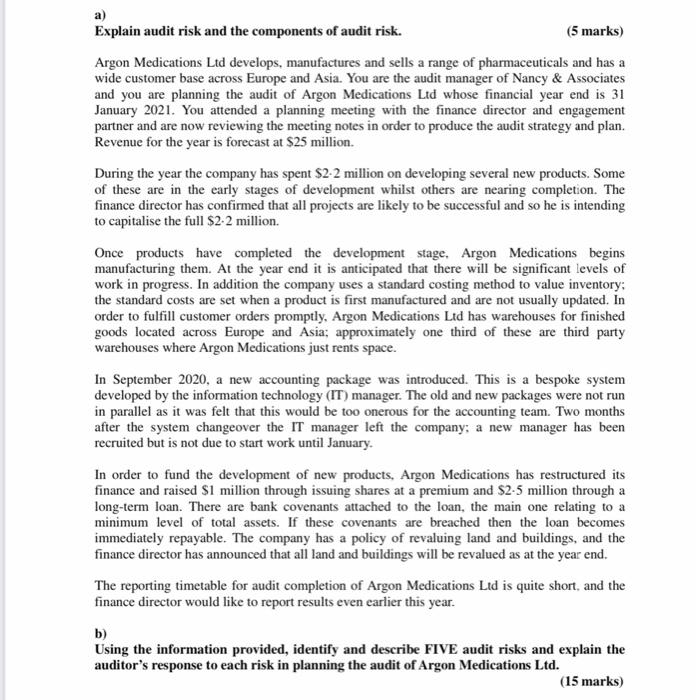

a) Explain audit risk and the components of audit risk. (5 marks) Argon Medications Ltd develops, manufactures and sells a range of pharmaceuticals and has a wide customer base across Europe and Asia. You are the audit manager of Nancy & Associates and you are planning the audit of Argon Medications Ltd whose financial year end is 31 January 2021. You attended a planning meeting with the finance director and engagement partner and are now reviewing the meeting notes in order to produce the audit strategy and plan. Revenue for the year is forecast at $25 million. During the year the company has spent $2.2 million on developing several new products. Some of these are in the early stages of development whilst others are nearing completion. The finance director has confirmed that all projects are likely to be successful and so he is intending to capitalise the full $2.2 million. Once products have completed the development stage, Argon Medications begins manufacturing them. At the year end it is anticipated that there will be significant levels of work in progress. In addition the company uses a standard costing method to value inventory: the standard costs are set when a product is first manufactured and are not usually updated. In order to fulfill customer orders promptly, Argon Medications Ltd has warehouses for finished goods located across Europe and Asia: approximately one third of these are third party warehouses where Argon Medications just rents space. In September 2020, a new accounting package was introduced. This is a bespoke system developed by the information technology (IT) manager. The old and new packages were not run in parallel as it was felt that this would be too onerous for the accounting team. Two months after the system changeover the IT manager left the company, a new manager has been recruited but is not due to start work until January. In order to fund the development of new products, Argon Medications has restructured its finance and raised $1 million through issuing shares at a premium and $2.5 million through a long-term loan. There are bank covenants attached to the loan, the main one relating to a minimum level of total assets. If these covenants are breached then the loan becomes immediately repayable. The company has a policy of revaluing land and buildings, and the finance director has announced that all land and buildings will be revalued as at the year end. The reporting timetable for audit completion of Argon Medications Lid is quite short, and the finance director would like to report results even earlier this year. b) Using the information provided, identify and describe FIVE audit risks and explain the auditor's response to each risk in planning the audit of Argon Medications Ltd. (15 marks) a) Explain audit risk and the components of audit risk. (5 marks) Argon Medications Ltd develops, manufactures and sells a range of pharmaceuticals and has a wide customer base across Europe and Asia. You are the audit manager of Nancy & Associates and you are planning the audit of Argon Medications Ltd whose financial year end is 31 January 2021. You attended a planning meeting with the finance director and engagement partner and are now reviewing the meeting notes in order to produce the audit strategy and plan. Revenue for the year is forecast at $25 million. During the year the company has spent $2.2 million on developing several new products. Some of these are in the early stages of development whilst others are nearing completion. The finance director has confirmed that all projects are likely to be successful and so he is intending to capitalise the full $2.2 million. Once products have completed the development stage, Argon Medications begins manufacturing them. At the year end it is anticipated that there will be significant levels of work in progress. In addition the company uses a standard costing method to value inventory: the standard costs are set when a product is first manufactured and are not usually updated. In order to fulfill customer orders promptly, Argon Medications Ltd has warehouses for finished goods located across Europe and Asia: approximately one third of these are third party warehouses where Argon Medications just rents space. In September 2020, a new accounting package was introduced. This is a bespoke system developed by the information technology (IT) manager. The old and new packages were not run in parallel as it was felt that this would be too onerous for the accounting team. Two months after the system changeover the IT manager left the company, a new manager has been recruited but is not due to start work until January. In order to fund the development of new products, Argon Medications has restructured its finance and raised $1 million through issuing shares at a premium and $2.5 million through a long-term loan. There are bank covenants attached to the loan, the main one relating to a minimum level of total assets. If these covenants are breached then the loan becomes immediately repayable. The company has a policy of revaluing land and buildings, and the finance director has announced that all land and buildings will be revalued as at the year end. The reporting timetable for audit completion of Argon Medications Lid is quite short, and the finance director would like to report results even earlier this year. b) Using the information provided, identify and describe FIVE audit risks and explain the auditor's response to each risk in planning the audit of Argon Medications Ltd. (15 marks)