Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Explain briefly how an impairment loss for non-revaluated asset and revalued asset (in accordance with MFRS 116) would be recognised in the financial statement.

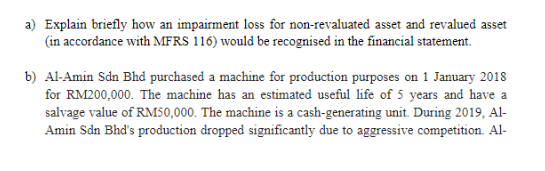

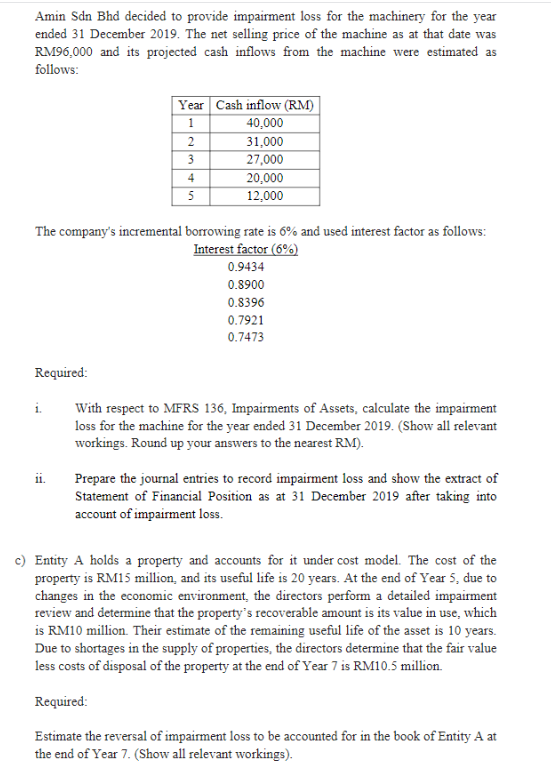

a) Explain briefly how an impairment loss for non-revaluated asset and revalued asset (in accordance with MFRS 116) would be recognised in the financial statement. b) Al-Amin Sdn Bhd purchased a machine for production purposes on 1 January 2018 for RM200,000. The machine has an estimated useful life of 5 years and have a salvage value of RM50,000. The machine is a cash-generating unit. During 2019, A1Amin Sdn Bhd's production dropped significantly due to aggressive competition. Al- Amin Sdn Bhd decided to provide impairment loss for the machinery for the year ended 31 December 2019. The net selling price of the machine as at that date was RM96,000 and its projected cash inflows from the machine were estimated as follows: The company's incremental borrowing rate is 6% and used interest factor as follows: Required: i. With respect to MFRS 136, Impairments of Assets, calculate the impairment loss for the machine for the year ended 31 December 2019. (Show all relevant workings. Round up your answers to the nearest RM). ii. Prepare the journal entries to record impairment loss and show the extract of Statement of Financial Position as at 31 December 2019 after taking into account of impairment loss. c) Entity A holds a property and accounts for it under cost model. The cost of the property is RM15 million, and its useful life is 20 years. At the end of Year 5, due to changes in the economic environment, the directors perform a detailed impairment review and determine that the property's recoverable amount is its value in use, which is RM10 million. Their estimate of the remaining useful life of the asset is 10 years. Due to shortages in the supply of properties, the directors determine that the fair value less costs of disposal of the property at the end of Year 7 is RM10.5 million. Required: Estimate the reversal of impairment loss to be accounted for in the book of Entity A at the end of Year 7. (Show all relevant workings)

a) Explain briefly how an impairment loss for non-revaluated asset and revalued asset (in accordance with MFRS 116) would be recognised in the financial statement. b) Al-Amin Sdn Bhd purchased a machine for production purposes on 1 January 2018 for RM200,000. The machine has an estimated useful life of 5 years and have a salvage value of RM50,000. The machine is a cash-generating unit. During 2019, A1Amin Sdn Bhd's production dropped significantly due to aggressive competition. Al- Amin Sdn Bhd decided to provide impairment loss for the machinery for the year ended 31 December 2019. The net selling price of the machine as at that date was RM96,000 and its projected cash inflows from the machine were estimated as follows: The company's incremental borrowing rate is 6% and used interest factor as follows: Required: i. With respect to MFRS 136, Impairments of Assets, calculate the impairment loss for the machine for the year ended 31 December 2019. (Show all relevant workings. Round up your answers to the nearest RM). ii. Prepare the journal entries to record impairment loss and show the extract of Statement of Financial Position as at 31 December 2019 after taking into account of impairment loss. c) Entity A holds a property and accounts for it under cost model. The cost of the property is RM15 million, and its useful life is 20 years. At the end of Year 5, due to changes in the economic environment, the directors perform a detailed impairment review and determine that the property's recoverable amount is its value in use, which is RM10 million. Their estimate of the remaining useful life of the asset is 10 years. Due to shortages in the supply of properties, the directors determine that the fair value less costs of disposal of the property at the end of Year 7 is RM10.5 million. Required: Estimate the reversal of impairment loss to be accounted for in the book of Entity A at the end of Year 7. (Show all relevant workings) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started