Answered step by step

Verified Expert Solution

Question

1 Approved Answer

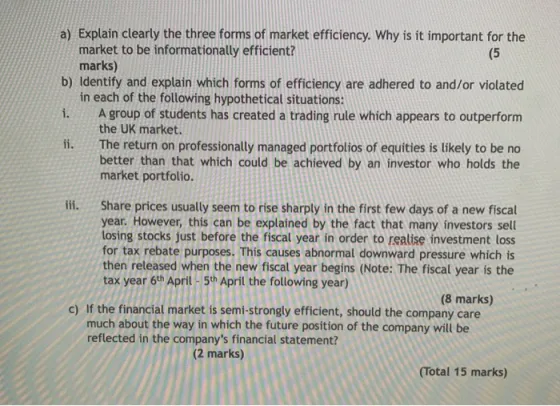

a) Explain clearly the three forms of market efficiency. Why is it important for the market to be informationally efficient? (5 marks) b) Identify

a) Explain clearly the three forms of market efficiency. Why is it important for the market to be informationally efficient? (5 marks) b) Identify and explain which forms of efficiency are adhered to and/or violated in each of the following hypothetical situations: 1. A group of students has created a trading rule which appears to outperform the UK market. 11. iii. The return on professionally managed portfolios of equities is likely to be no better than that which could be achieved by an investor who holds the market portfolio. Share prices usually seem to rise sharply in the first few days of a new fiscal year. However, this can be explained by the fact that many investors sell losing stocks just before the fiscal year in order to realise investment loss for tax rebate purposes. This causes abnormal downward pressure which is then released when the new fiscal year begins (Note: The fiscal year is the tax year 6th April - 5th April the following year) (8 marks) c) If the financial market is semi-strongly efficient, should the company care much about the way in which the future position of the company will be reflected in the company's financial statement? (2 marks) (Total 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Market Efficiency and RealWorld Scenarios a Three Forms of Market Efficiency Weak Form This form states that all past price information is already ref...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started