Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Explain what efficient-market hypothesis (EMH) say about (a) securities prices, (b) their reaction to new information, and (c) investor opportunities to profit? What is

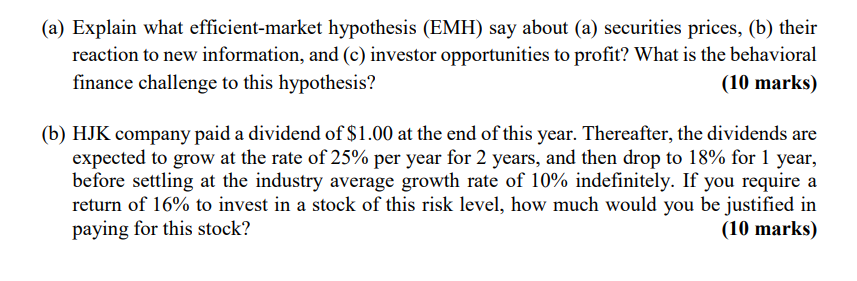

(a) Explain what efficient-market hypothesis (EMH) say about (a) securities prices, (b) their reaction to new information, and (c) investor opportunities to profit? What is the behavioral finance challenge to this hypothesis? (10 marks) (b) HJK company paid a dividend of $1.00 at the end of this year. Thereafter, the dividends are expected to grow at the rate of 25% per year for 2 years, and then drop to 18% for 1 year, before settling at the industry average growth rate of 10% indefinitely. If you require a return of 16% to invest in a stock of this risk level, how much would you be justified in paying for this stock? (10 marks)

(a) Explain what efficient-market hypothesis (EMH) say about (a) securities prices, (b) their reaction to new information, and (c) investor opportunities to profit? What is the behavioral finance challenge to this hypothesis? (10 marks) (b) HJK company paid a dividend of $1.00 at the end of this year. Thereafter, the dividends are expected to grow at the rate of 25% per year for 2 years, and then drop to 18% for 1 year, before settling at the industry average growth rate of 10% indefinitely. If you require a return of 16% to invest in a stock of this risk level, how much would you be justified in paying for this stock? (10 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started