Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A factory is considering the purchase of a new machine for one of its units. The machine costs $100,000. The machine will be depreciated

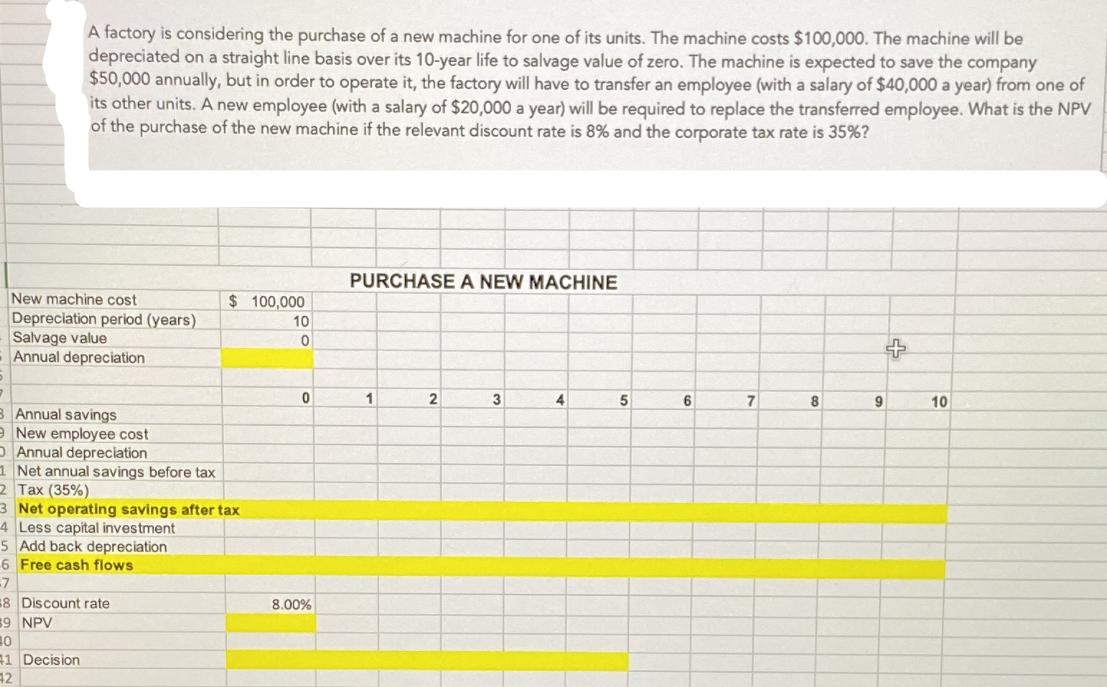

A factory is considering the purchase of a new machine for one of its units. The machine costs $100,000. The machine will be depreciated on a straight line basis over its 10-year life to salvage value of zero. The machine is expected to save the company $50,000 annually, but in order to operate it, the factory will have to transfer an employee (with a salary of $40,000 a year) from one of its other units. A new employee (with a salary of $20,000 a year) will be required to replace the transferred employee. What is the NPV of the purchase of the new machine if the relevant discount rate is 8% and the corporate tax rate is 35%? New machine cost Depreciation period (years) Salvage value Annual depreciation 3 Annual savings e New employee cost O Annual depreciation 1 Net annual savings before tax 2 Tax (35%) 19 NPV 0 41 Decision 42 $100,000 3 Net operating savings after tax 4 Less capital investment 5 Add back depreciation 6 Free cash flows 7 8 Discount rate 10 0 0 8.00% PURCHASE A NEW MACHINE 1 2 3 4 5 6 7 8 9 + 10

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the NPV Net Present Value of the purchase of the new machine we need to calculate the present value of the cash flows associated with the machine over its 10year life and then su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started