Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A family obtains a 30-year mortgage to purchase a home, requiring monthly payments to pay back the loan. With an APR of 6.25%, they can

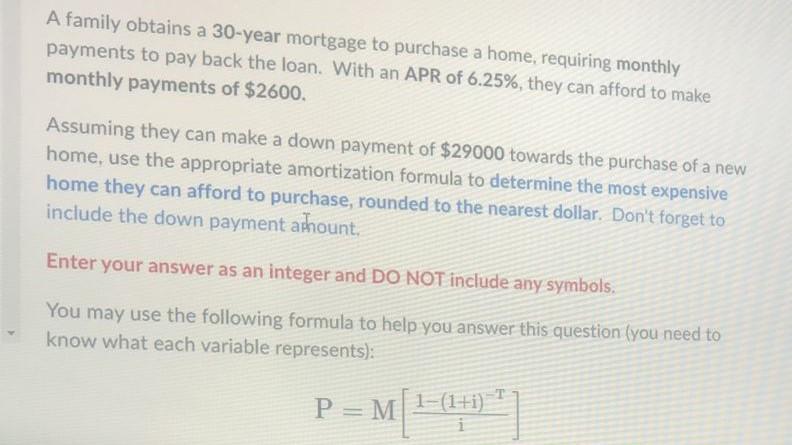

A family obtains a 30-year mortgage to purchase a home, requiring monthly payments to pay back the loan. With an APR of 6.25%, they can afford to make monthly payments of $2600. Assuming they can make a down payment of $29000 towards the purchase of a new home, use the appropriate amortization formula to determine the most expensive home they can afford to purchase, rounded to the nearest dollar. Don't forget to include the down payment arhount. Enter your answer as an integer and DO NOT include any symbols, You may use the following formula to help you answer this question (you need to know what each variable represents); P=M[i1(1+i)T]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started