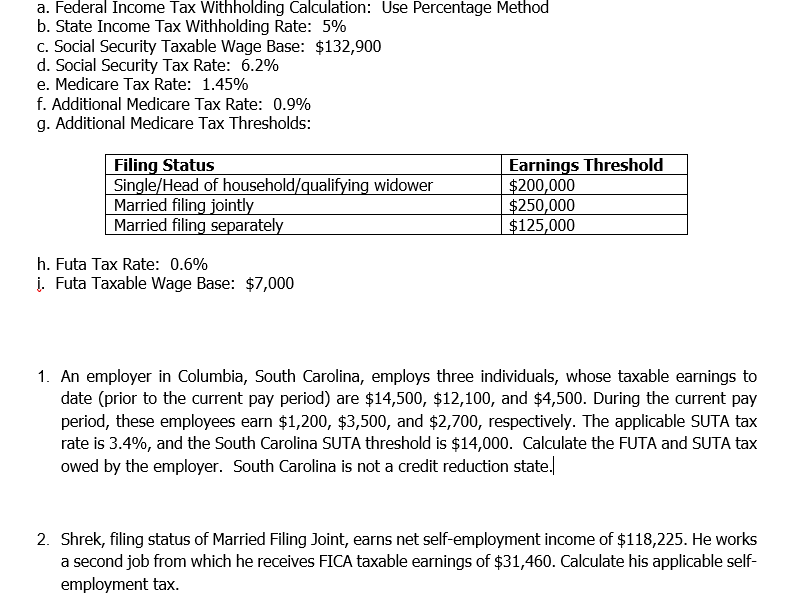

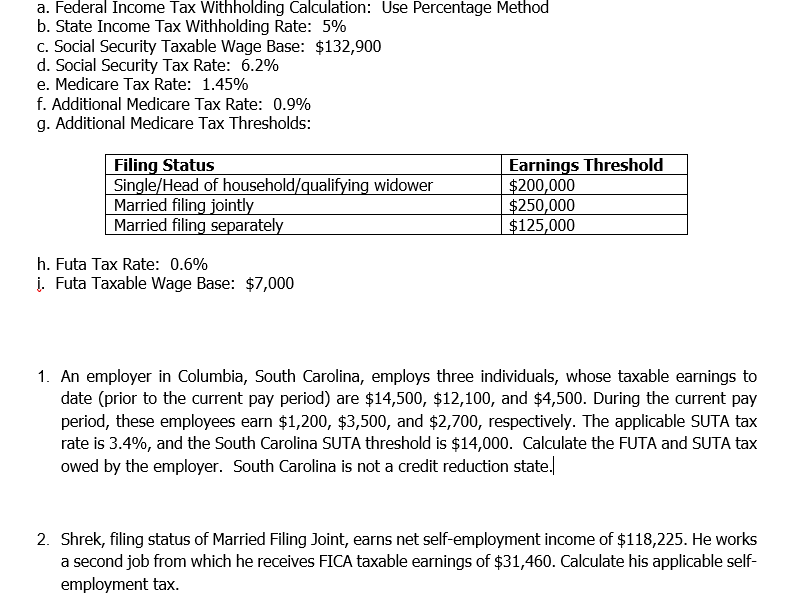

a. Federal Income Tax Withholding Calculation: Use Percentage Method b. State Income Tax Withholding Rate: 5% c. Social Security Taxable Wage Base: $132,900 d. Social Security Tax Rate: 6.2% e. Medicare Tax Rate: 1.45% f. Additional Medicare Tax Rate: 0.9% g. Additional Medicare Tax Thresholds: Filing Status Single/Head of household/qualifying widower Married filing jointly Married filing separately h. Futa Tax Rate: 0.6% . Futa Taxable Wage Base: $7,000 Earnings Threshold $200,000 $250,000 $125,000 1. An employer in Columbia, South Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $14,500, $12,100, and $4,500. During the current pay period, these employees earn $1,200, $3,500, and $2,700, respectively. The applicable SUTA tax rate is 3.4%, and the South Carolina SUTA threshold is $14,000. Calculate the FUTA and SUTA tax owed by the employer. South Carolina is not a credit reduction state. 2. Shrek, filing status of Married Filing Joint, earns net self-employment income of $118,225. He works a second job from which he receives FICA taxable earnings of $31,460. Calculate his applicable self- employment tax. a. Federal Income Tax Withholding Calculation: Use Percentage Method b. State Income Tax Withholding Rate: 5% c. Social Security Taxable Wage Base: $132,900 d. Social Security Tax Rate: 6.2% e. Medicare Tax Rate: 1.45% f. Additional Medicare Tax Rate: 0.9% g. Additional Medicare Tax Thresholds: Filing Status Single/Head of household/qualifying widower Married filing jointly Married filing separately h. Futa Tax Rate: 0.6% . Futa Taxable Wage Base: $7,000 Earnings Threshold $200,000 $250,000 $125,000 1. An employer in Columbia, South Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $14,500, $12,100, and $4,500. During the current pay period, these employees earn $1,200, $3,500, and $2,700, respectively. The applicable SUTA tax rate is 3.4%, and the South Carolina SUTA threshold is $14,000. Calculate the FUTA and SUTA tax owed by the employer. South Carolina is not a credit reduction state. 2. Shrek, filing status of Married Filing Joint, earns net self-employment income of $118,225. He works a second job from which he receives FICA taxable earnings of $31,460. Calculate his applicable self- employment tax