Question

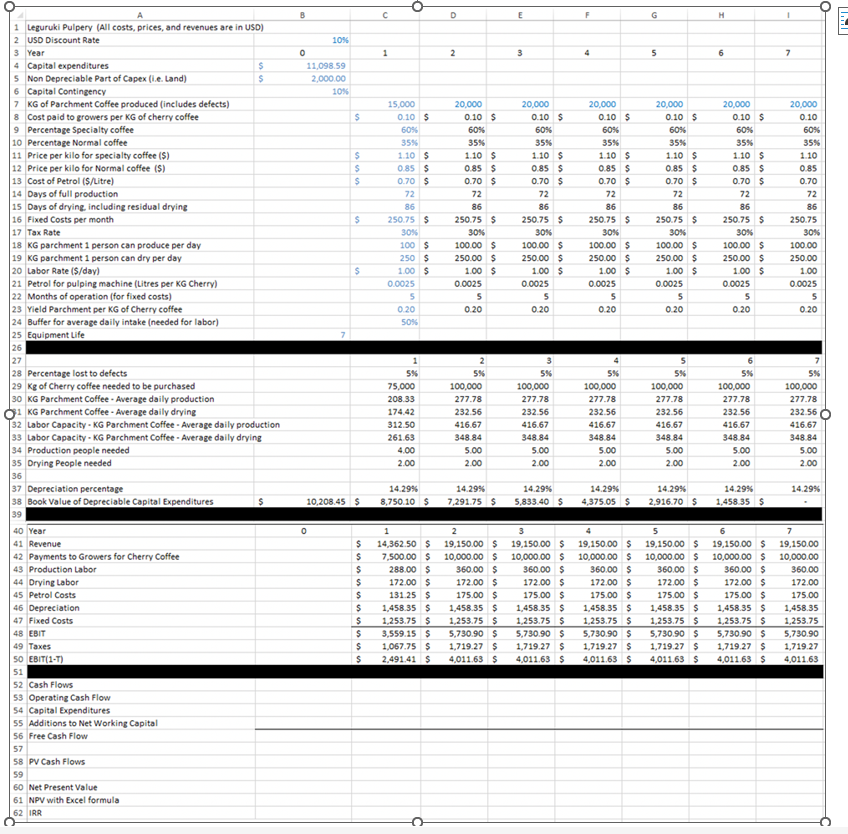

A few assumptions that you should use in your calculations: Assume that all analysis is to be done in US dollars and everything is fully

A few assumptions that you should use in your calculations:

Assume that all analysis is to be done in US dollars and everything is fully hedged so exchange rates will remain at US$1 to 1,000 Tanzanian Shillings for the life of the project.

Assume that all revenues, expenses, and cash flows occur at the end of the year.

Assume that the tax rate is 30%, which is the tax rate on resident corporations in Tanzania according to the 2010/2011 PWC Worldwide Tax Summary. Assume that any negative EBIT earns a tax credit in that year. Thus, operating cash flow equals EBIT(1-) + Depreciation even if EBIT is negative.

Assume that all of the capital expenditures shown in Exhibit 4 occur at time 0 (i.e. today) and that there are no additional capital expenditures needed for the life of the project. For simplicity, you can assume ALL of the capital expenditures are depreciated on a straight-line basis over the 7-year life of the pulpery.

Assume that working capital is zero at the end of each year (i.e. there is no working capital for the project). This is because in each year, they will not carry over any inventory, nor will they extend credit to customers or use credit to suppliers (the farmers).

For labor needed, assume that staffing is done on the basis of average daily production (or average daily drying).

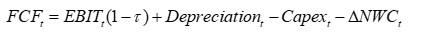

Cash Flows for the Project This is where your model will calculate the cash flows for years 0-7. Remember that free cash flow in each year t is given by: Operating cash flow Capital Expenditures Additions to Net working capital. Operating cash flow is EBIT*(1-). The total formula is shown below:

These numbers can be pulled directly from the income statement and from the initial capital expenditures. Per the prep sheet, assume no additions to net working capital are needed. Since we now have the cash flows, we can compute NPV and IRR from them. Note that this will be the NPV and IRR to all investors (loan and equity investors). Since the case also talks about a back-end payment to the growers, we can figure out how much we can pay per KG of cherry coffee based on the free cash flow in each year. This is based on the assumption of no loan.

These numbers can be pulled directly from the income statement and from the initial capital expenditures. Per the prep sheet, assume no additions to net working capital are needed. Since we now have the cash flows, we can compute NPV and IRR from them. Note that this will be the NPV and IRR to all investors (loan and equity investors). Since the case also talks about a back-end payment to the growers, we can figure out how much we can pay per KG of cherry coffee based on the free cash flow in each year. This is based on the assumption of no loan.

What is the NPV and IRR of the pulpery project? Should Technoserve proceed with the pulpery project?

FCFt=EBITt(1)+ Depreciation t Capex tNWCt FCFt=EBITt(1)+ Depreciation t Capex tNWCtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started