Answered step by step

Verified Expert Solution

Question

1 Approved Answer

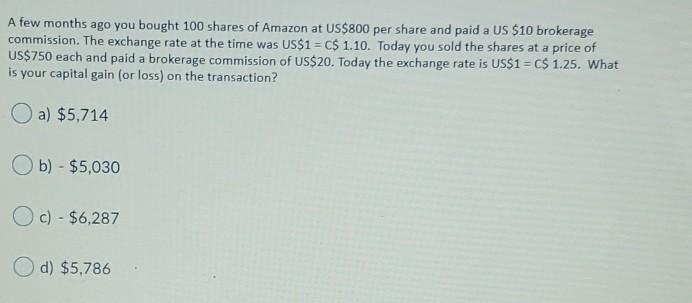

A few months ago you bought 100 shares of Amazon at US$800 per share and paid a US $10 brokerage commission. The exchange rate at

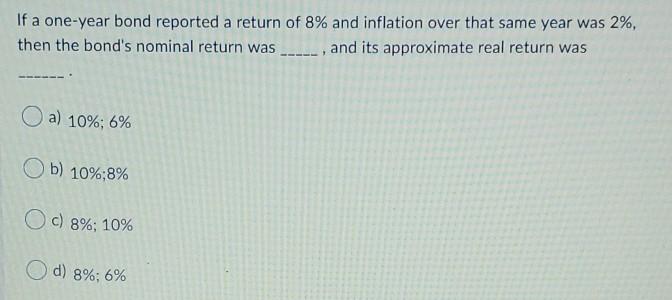

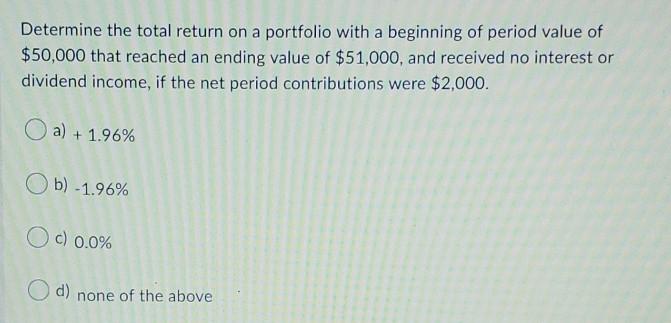

A few months ago you bought 100 shares of Amazon at US$800 per share and paid a US $10 brokerage commission. The exchange rate at the time was US$1 = C$ 1.10. Today you sold the shares at a price of US$750 each and paid a brokerage commission of US$20. Today the exchange rate is US$1 = C$ 1.25. What is your capital gain (or loss) on the transaction? a) $5,714 Ob) - $5,030 Oc) - $6,287 Od) $5,786 If a one-year bond reported a return of 8% and inflation over that same year was 2%, then the bond's nominal return was and its approximate real return was a) 10%; 6% b) 10%;8% c) 8%; 10% d) 8%; 6% Determine the total return on a portfolio with a beginning of period value of $50,000 that reached an ending value of $51,000, and received no interest or dividend income, if the net period contributions were $2,000. a) +1.96% b) - 1.96% OC) 0.0% d) none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started