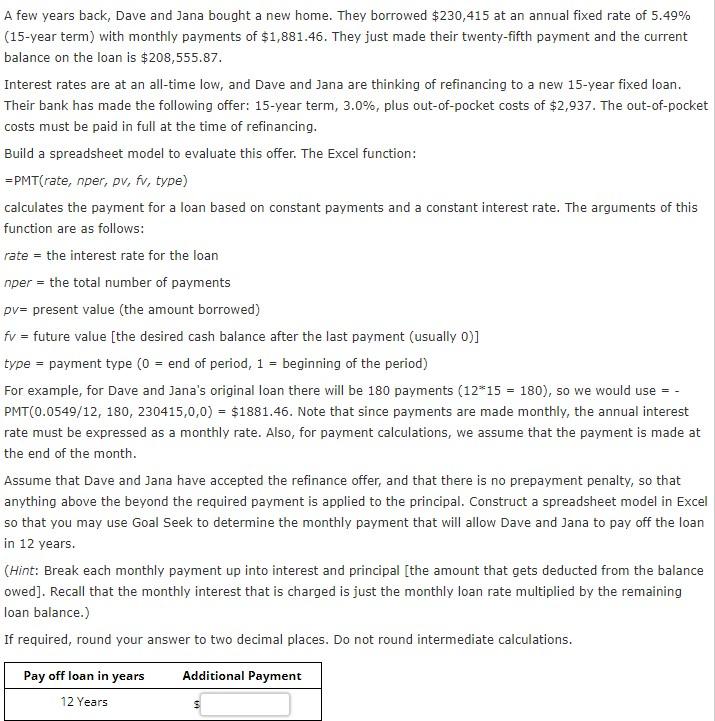

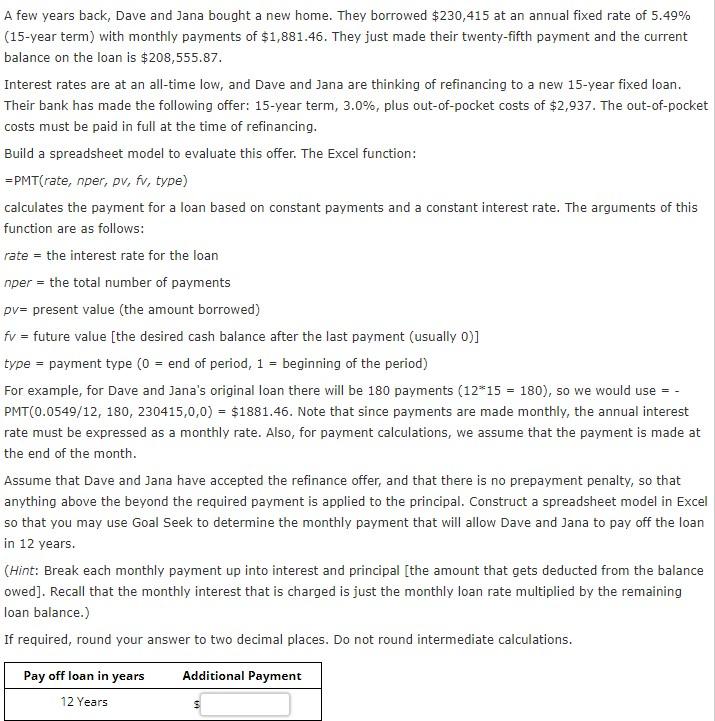

A few years back, Dave and Jana bought a new home. They borrowed $230,415 at an annual fixed rate of 5.49% (15-year term) with monthly payments of $1,881.46. They just made their twenty-fifth payment and the current balance on the loan is $208,555.87. Interest rates are at an all-time low, and Dave and Jana are thinking of refinancing to a new 15-year fixed loan. Their bank has made the following offer: 15 -year term, 3.0%, plus out-of-pocket costs of $2,937. The out-of-pocket costs must be paid in full at the time of refinancing. Build a spreadsheet model to evaluate this offer. The Excel function: = PMT ( rate, nper, pv, fv, type) calculates the payment for a loan based on constant payments and a constant interest rate. The arguments of this function are as follows: rate = the interest rate for the loan nper = the total number of payments pV= present value (the amount borrowed) fV= future value [the desired cash balance after the last payment (usually 0)] type = payment type (0= end of period, 1= beginning of the period ) For example, for Dave and Jana's original loan there will be 180 payments (1215=180), so we would use = PMT(0.0549/12,180,230415,0,0)=$1881.46. Note that since payments are made monthly, the annual interest rate must be expressed as a monthly rate. Also, for payment calculations, we assume that the payment is made at the end of the month. Assume that Dave and Jana have accepted the refinance offer, and that there is no prepayment penalty, so that anything above the beyond the required payment is applied to the principal. Construct a spreadsheet model in Excel so that you may use Goal Seek to determine the monthly payment that will allow Dave and Jana to pay off the loan in 12 years. (Hint: Break each monthly payment up into interest and principal [the amount that gets deducted from the balance owed]. Recall that the monthly interest that is charged is just the monthly loan rate multiplied by the remaining loan balance.) If required, round your answer to two decimal places. Do not round intermediate calculations. A few years back, Dave and Jana bought a new home. They borrowed $230,415 at an annual fixed rate of 5.49% (15-year term) with monthly payments of $1,881.46. They just made their twenty-fifth payment and the current balance on the loan is $208,555.87. Interest rates are at an all-time low, and Dave and Jana are thinking of refinancing to a new 15-year fixed loan. Their bank has made the following offer: 15 -year term, 3.0%, plus out-of-pocket costs of $2,937. The out-of-pocket costs must be paid in full at the time of refinancing. Build a spreadsheet model to evaluate this offer. The Excel function: = PMT ( rate, nper, pv, fv, type) calculates the payment for a loan based on constant payments and a constant interest rate. The arguments of this function are as follows: rate = the interest rate for the loan nper = the total number of payments pV= present value (the amount borrowed) fV= future value [the desired cash balance after the last payment (usually 0)] type = payment type (0= end of period, 1= beginning of the period ) For example, for Dave and Jana's original loan there will be 180 payments (1215=180), so we would use = PMT(0.0549/12,180,230415,0,0)=$1881.46. Note that since payments are made monthly, the annual interest rate must be expressed as a monthly rate. Also, for payment calculations, we assume that the payment is made at the end of the month. Assume that Dave and Jana have accepted the refinance offer, and that there is no prepayment penalty, so that anything above the beyond the required payment is applied to the principal. Construct a spreadsheet model in Excel so that you may use Goal Seek to determine the monthly payment that will allow Dave and Jana to pay off the loan in 12 years. (Hint: Break each monthly payment up into interest and principal [the amount that gets deducted from the balance owed]. Recall that the monthly interest that is charged is just the monthly loan rate multiplied by the remaining loan balance.) If required, round your answer to two decimal places. Do not round intermediate calculations