Answered step by step

Verified Expert Solution

Question

1 Approved Answer

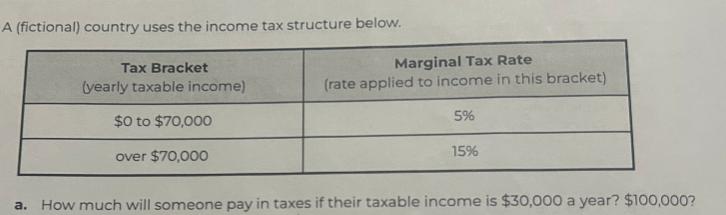

A (fictional) country uses the income tax structure below. Tax Bracket (yearly taxable income) $0 to $70,000 over $70,000 Marginal Tax Rate (rate applied

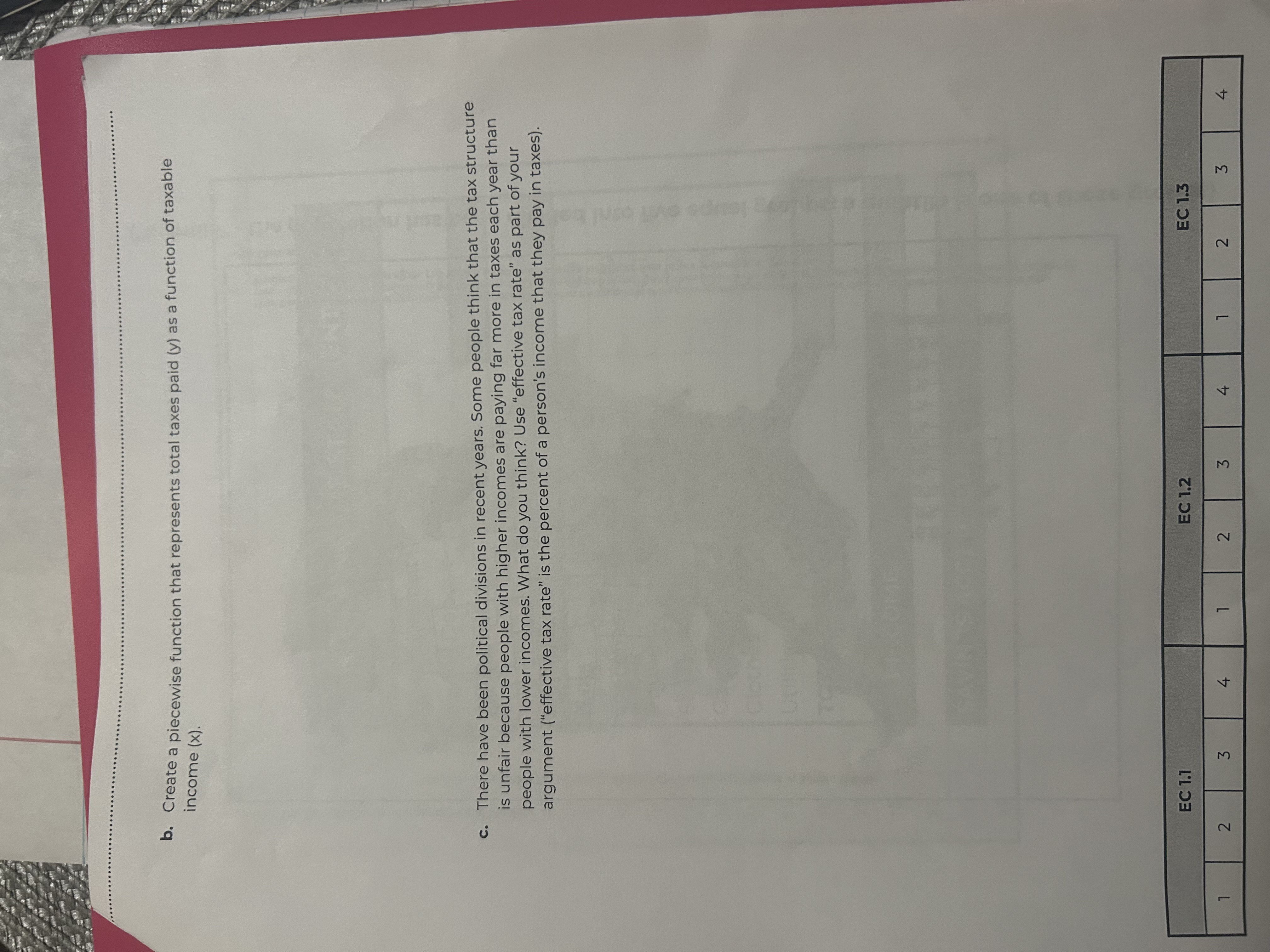

A (fictional) country uses the income tax structure below. Tax Bracket (yearly taxable income) $0 to $70,000 over $70,000 Marginal Tax Rate (rate applied to income in this bracket) 5% 15% a. How much will someone pay in taxes if their taxable income is $30,000 a year? $100,000? b. Create a piecewise function that represents total taxes paid (y) as a function of taxable income (x). c. There have been political divisions in recent years. Some people think that the tax structure is unfair because people with higher incomes are paying far more in taxes each year than people with lower incomes. What do you think? Use "effective tax rate" as part of your argument ("effective tax rate" is the percent of a person's income that they pay in taxes). EC 1.1 EC 1.2 EC 1.3 1 2 3 4 1 2 3 4 1 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the taxes someone will pay based on the given tax st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started