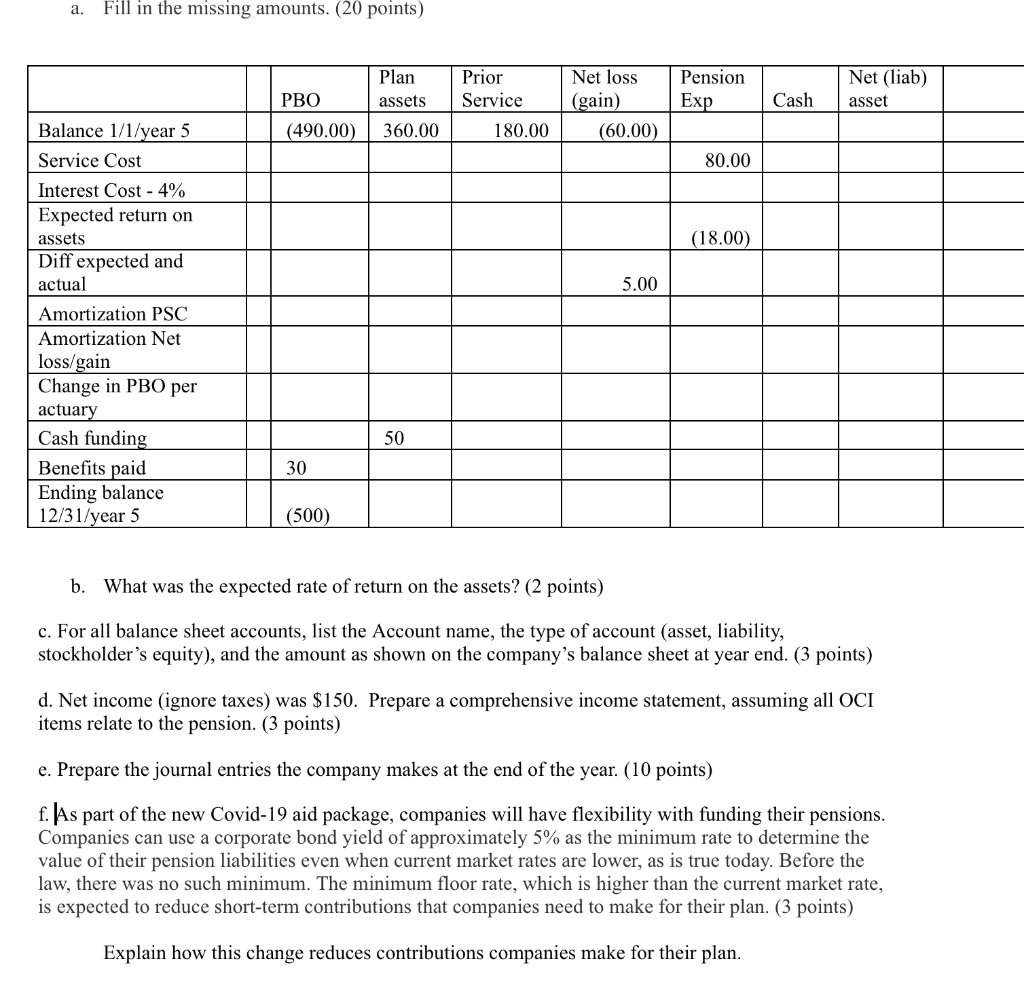

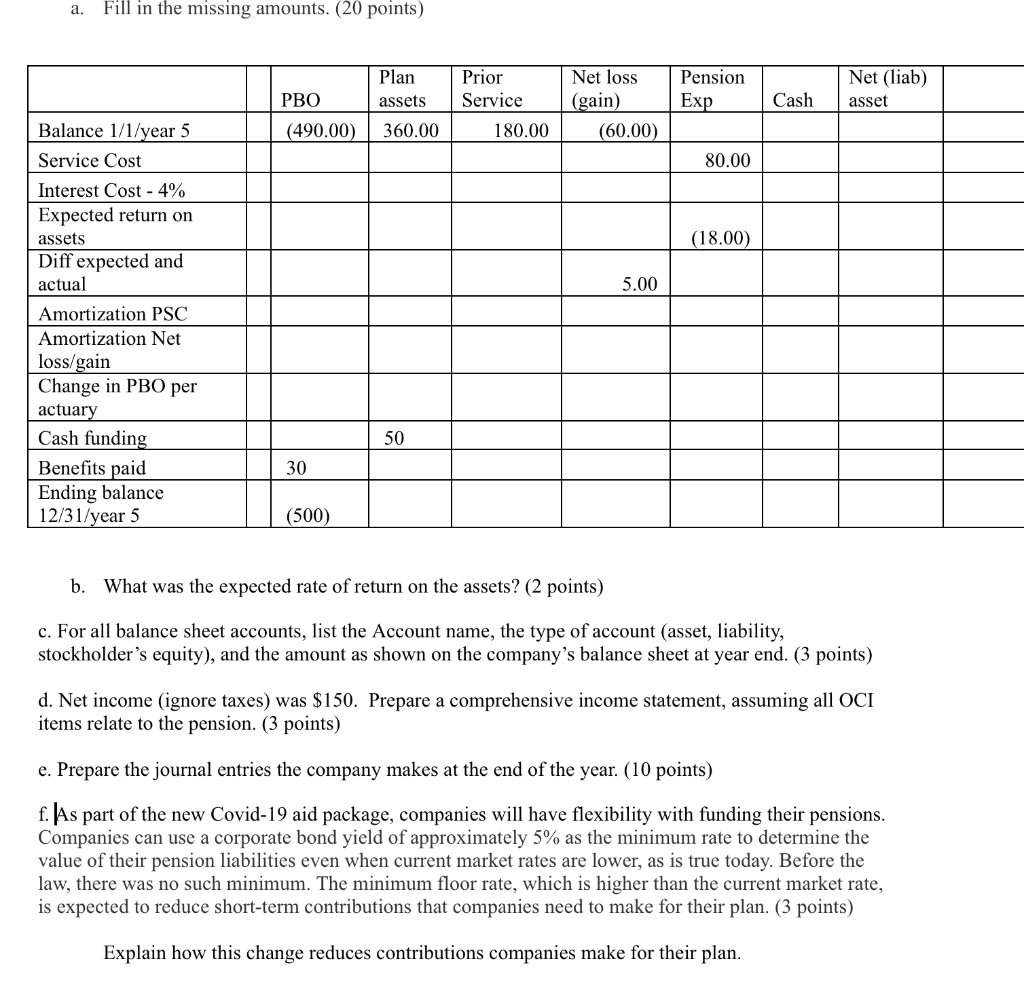

a. Fill in the missing amounts. (20 points) Plan assets Prior Service Net loss (gain) (60.00) Pension Exp Net (liab) asset PBO Cash (490.00 360.00 180.00 80.00 (18.00) 5.00 Balance 1/1/year 5 Service Cost Interest Cost - 4% Expected return on assets Diff expected and actual Amortization PSC Amortization Net loss/gain Change in PBO per actuary Cash funding Benefits paid Ending balance 12/31/year 5 50 30 (500) b. What was the expected rate of return on the assets? (2 points) c. For all balance sheet accounts, list the Account name, the type of account (asset, liability, stockholder's equity), and the amount as shown on the company's balance sheet at year end. (3 points) d. Net income (ignore taxes) was $150. Prepare a comprehensive income statement, assuming all OCI items relate to the pension. (3 points) e. Prepare the journal entries the company makes at the end of the year. (10 points) f. [As part of the new Covid-19 aid package, companies will have flexibility with funding their pensions. Companies can use a corporate bond yield of approximately 5% as the minimum rate to determine the value of their pension liabilities even when current market rates are lower, as is true today. Before the law, there was no such minimum. The minimum floor rate, which is higher than the current market rate, is expected to reduce short-term contributions that companies need to make for their plan. (3 points) Explain how this change reduces contributions companies make for their plan. a. Fill in the missing amounts. (20 points) Plan assets Prior Service Net loss (gain) (60.00) Pension Exp Net (liab) asset PBO Cash (490.00 360.00 180.00 80.00 (18.00) 5.00 Balance 1/1/year 5 Service Cost Interest Cost - 4% Expected return on assets Diff expected and actual Amortization PSC Amortization Net loss/gain Change in PBO per actuary Cash funding Benefits paid Ending balance 12/31/year 5 50 30 (500) b. What was the expected rate of return on the assets? (2 points) c. For all balance sheet accounts, list the Account name, the type of account (asset, liability, stockholder's equity), and the amount as shown on the company's balance sheet at year end. (3 points) d. Net income (ignore taxes) was $150. Prepare a comprehensive income statement, assuming all OCI items relate to the pension. (3 points) e. Prepare the journal entries the company makes at the end of the year. (10 points) f. [As part of the new Covid-19 aid package, companies will have flexibility with funding their pensions. Companies can use a corporate bond yield of approximately 5% as the minimum rate to determine the value of their pension liabilities even when current market rates are lower, as is true today. Before the law, there was no such minimum. The minimum floor rate, which is higher than the current market rate, is expected to reduce short-term contributions that companies need to make for their plan. (3 points) Explain how this change reduces contributions companies make for their plan