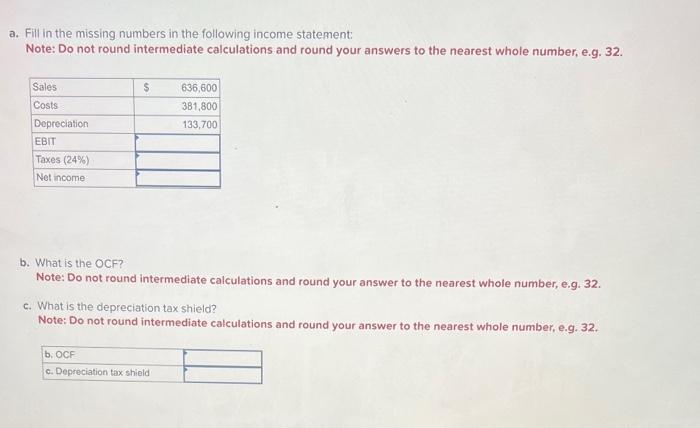

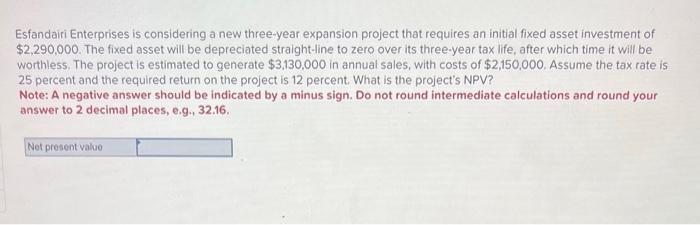

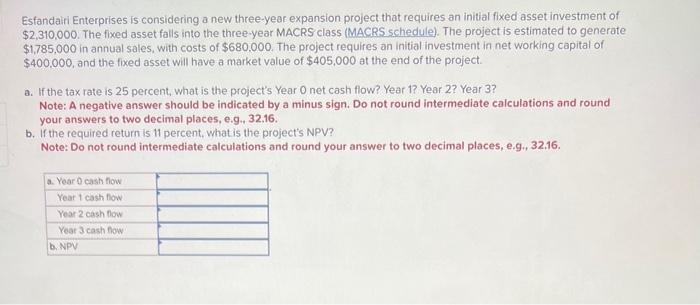

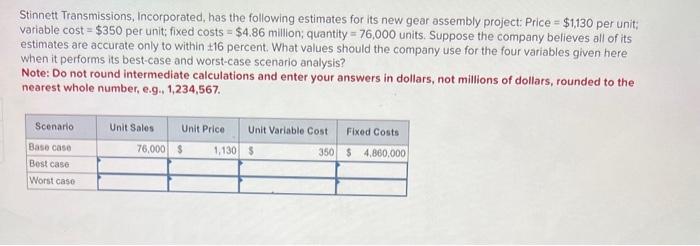

a. Fill in the missing numbers in the following income statement: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g. 32 . b. What is the OCF? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32 . c. What is the depreciation tax shield? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32 . Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,290,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $3,130.000 in annual sales, with costs of $2,150,000. Assume the tax rate is 25 percent and the required return on the project is 12 percent. What is the project's NPV? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 32.16. Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,310,000. The fixed asset falls into the three-year MACRS class (MACRS schedule). The project is estimated to generate $1,785,000 in annual sales, with costs of $680,000. The project requires an initial investment in net working capital of $400,000, and the fixed asset will have a market value of $405,000 at the end of the project. a. If the tax rate is 25 percent, what is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to two decimal places, e.g. 32.16. b. If the required return is 11 percent, what is the project's NPV? Note: Do not round intermediate calculations and round your answer to two decimal places, e.g., 32.16. Stinnett Transmissions, Incorporated, has the following estimates for its new gear assembly project: Price =$1,130 per unit; variable cost =$350 per unit; fixed costs =$4.86 million; quantity =76,000 units. Suppose the company believes all of its estimates are accurate only to within \pm 16 percent. What values should the company use for the four variables given here when it performs its best-case and worst-case scenario analysis? Note: Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567