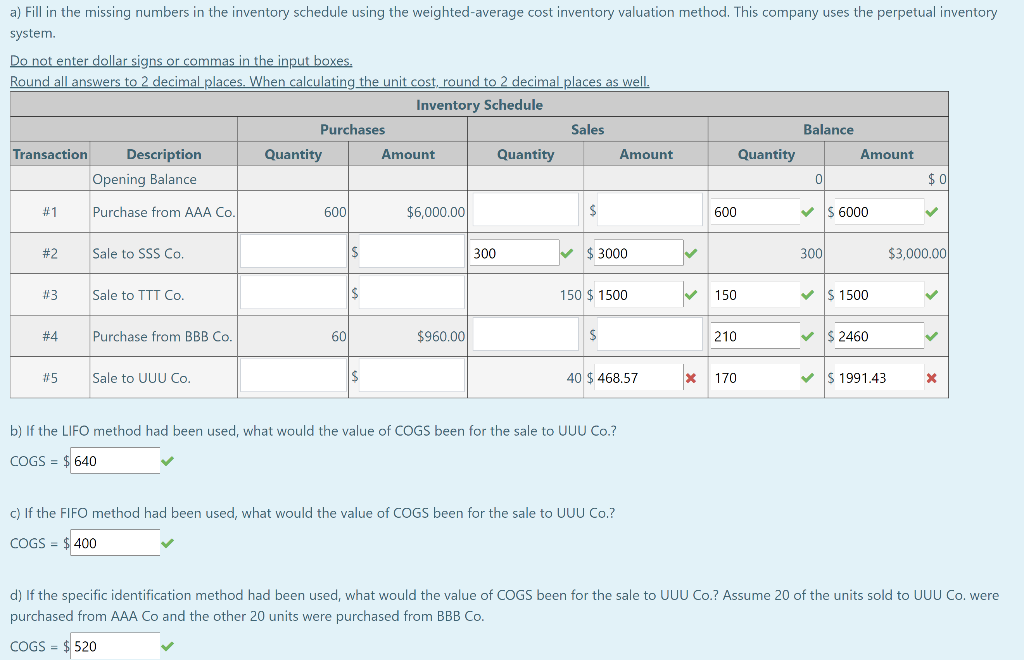

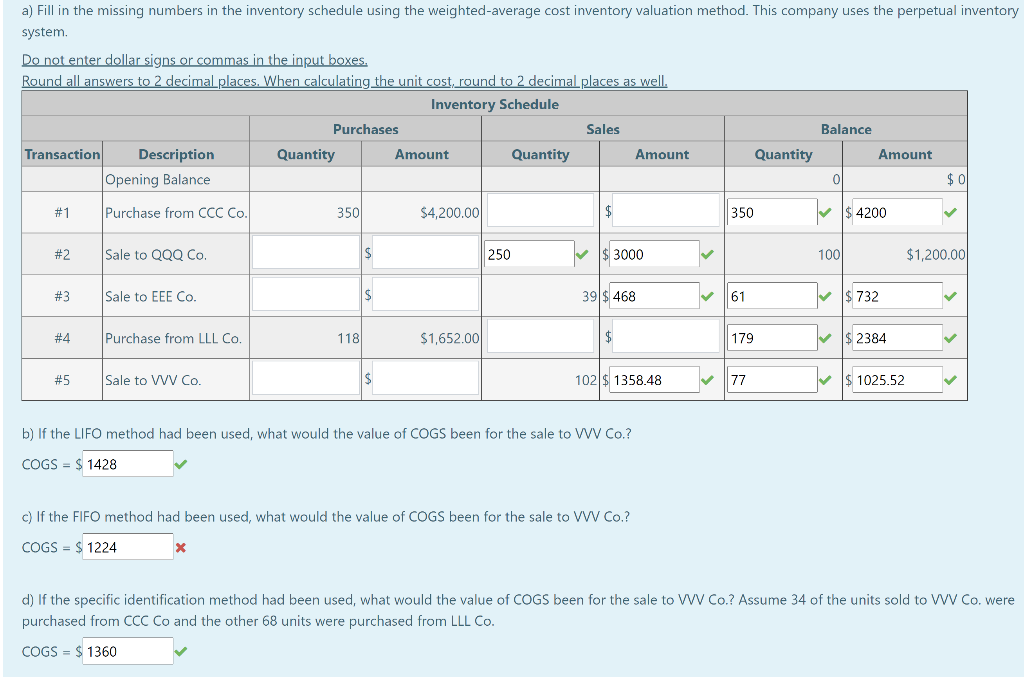

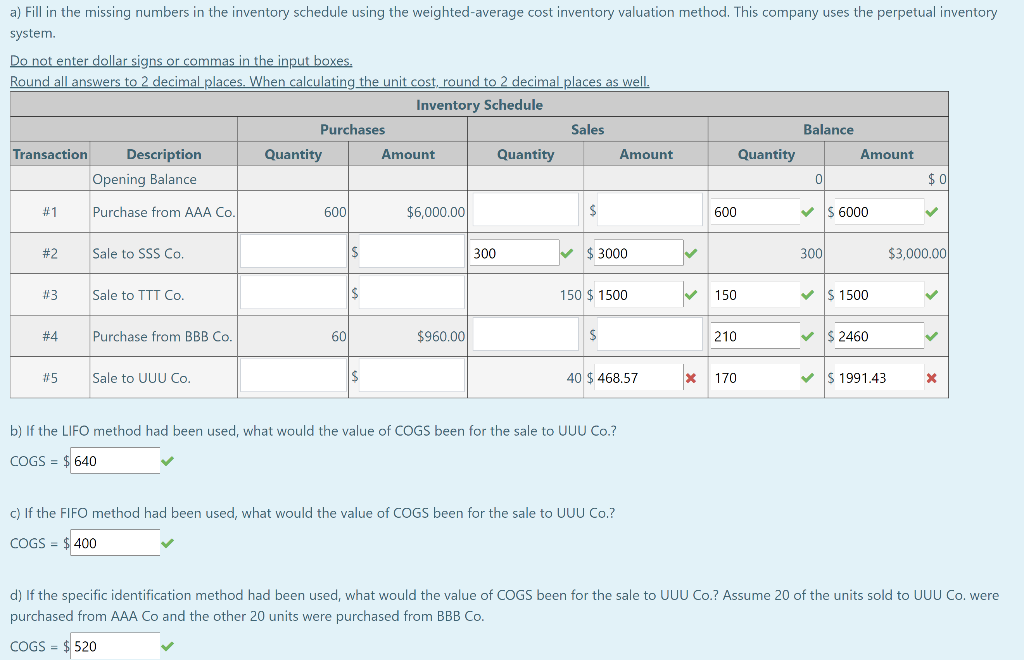

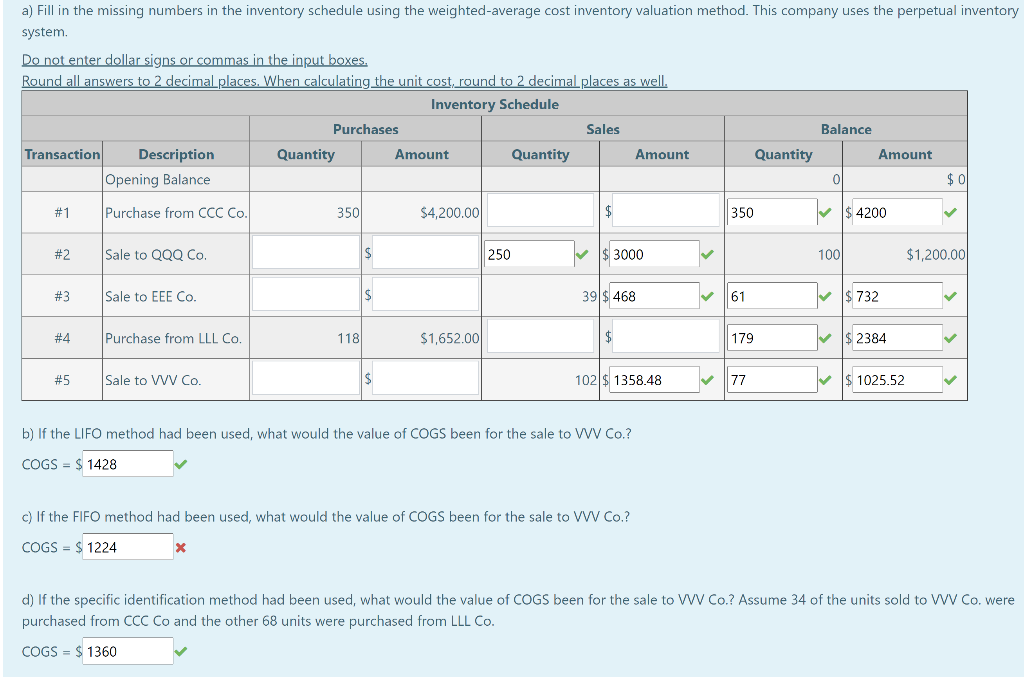

a) Fill in the missing numbers in the inventory schedule using the weighted average cost inventory valuation method. This company uses the perpetual inventory system. Do not enter dollar signs or commas in the input boxes. Round all answers to 2 decimal places. When calculating the unit cost, round to 2 decimal places as well. Inventory Schedule Purchases Balance Transaction Description Quantity Amount Quantity Amount Quantity Amount Opening Balance 0 $ 0 #1 Purchase from AAA CO. 600 $6,000.00 $ 600 S 6000 Sales #2 Sale to SSS Co. S 300 $ 3000 300 $3,000.00 #3 Sale to TTT CO. $ 150 $ 1500 150 S 1500 #4 Purchase from BBB Co. 60 $960.00 s 210 S 2460 #5 Sale to UUU CO. $ 40 $ 468.57 X 170 S 1991.43 X b) If the LIFO method had been used, what would the value of COGS been for the sale to UUU Co.? COGS = $ 640 c) If the FIFO method had been used, what would the value of COGS been for the sale to UUU Co.? COGS = $ 400 d) If the specific identification method had been used, what would the value of COGS been for the sale to UUU Co.? Assume 20 of the units sold to UUU Co. were purchased from AAA Co and the other 20 units were purchased from BBB Co. COGS = $ 520 a) Fill in the missing numbers in the inventory schedule using the weighted average cost inventory valuation method. This company uses the perpetual inventory system. Do not enter dollar signs or commas in the input boxes. Round all answers to 2 decimal places. When calculating the unit cost, round to 2 decimal places as well. Inventory Schedule Purchases Sales Transaction Description Quantity Amount Quantity Amount Opening Balance Balance Quantity Amount 0 #1 Purchase from CCC Co. 350 $4,200.00 $ 350 $ 4200 #2 Sale to QQQ Co. IS 250 s 3000 100 $1,200.00 #3 Sale to EEE Co. S 39 $ 468 61 $ 732 #4 Purchase from LLL CO. 118) $1,652.00 $ 179 $ 2384 #5 Sale to VV Co. 102 $ 1358.48 77 $ 1025.52 b) If the LIFO method had been used, what would the value of COGS been for the sale to WWV Co.? COGS = $ 1428 c) If the FIFO method had been used, what would the value of COGS been for the sale to VW Co.? COGS = $ 1224 X d) If the specific identification method had been used, what would the value of COGS been for the sale to WV Co.? Assume 34 of the units sold to WV Co. were purchased from CCC Co and the other 68 units were purchased from LLL Co. COGS = $ 1360