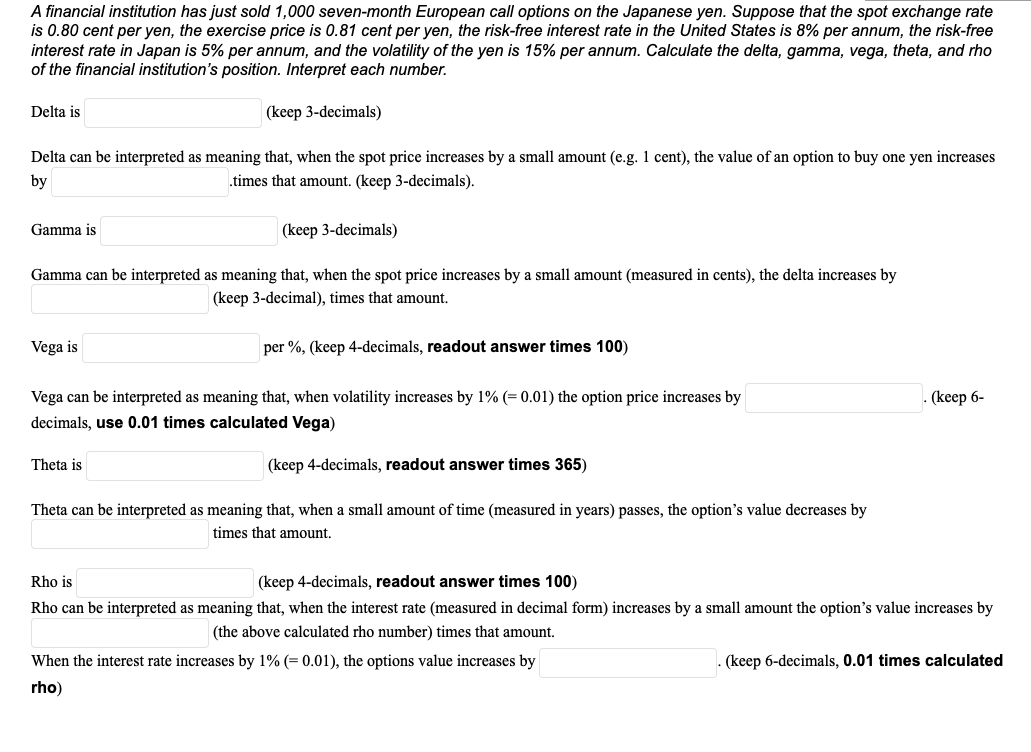

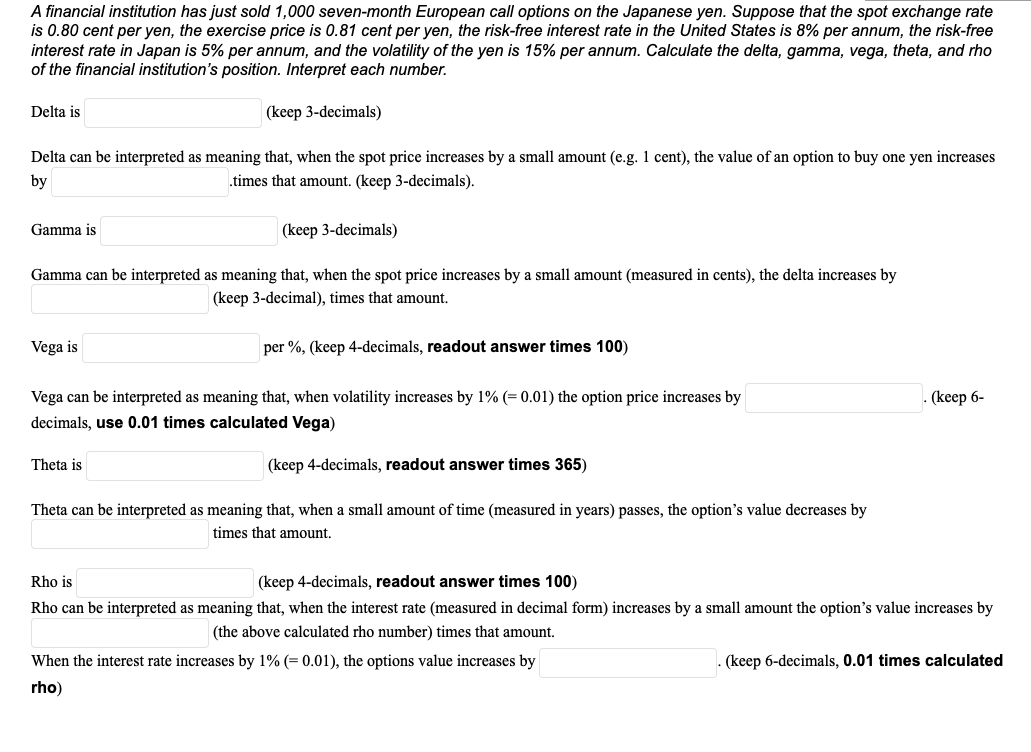

A financial institution has just sold 1,000 seven-month European call options on the Japanese yen. Suppose that the spot exchange rate is 0.80 cent per yen, the exercise price is 0.81 cent per yen, the risk-free interest rate in the United States is 8% per annum, the risk-free interest rate in Japan is 5% per annum, and the volatility of the yen is 15% per annum. Calculate the delta, gamma, vega, theta, and rho of the financial institution's position. Interpret each number. Delta is (keep 3-decimals) Delta can be interpreted as meaning that, when the spot price increases by a small amount (e.g. 1 cent), the value of an option to buy one yen increases by .times that amount. (keep 3-decimals). Gamma is (keep 3-decimals) Gamma can be interpreted as meaning that, when the spot price increases by a small amount (measured in cents), the delta increases by (keep 3-decimal), times that amount. Vega is per %, (keep 4-decimals, readout answer times 100) (keep 6- Vega can be interpreted as meaning that, when volatility increases by 1% (=0.01) the option price increases by decimals, use 0.01 times calculated Vega) Theta is (keep 4-decimals, readout answer times 365) Theta can be interpreted as meaning that, when a small amount of time (measured in years) passes, the option's value decreases by times that amount. Rho is (keep 4-decimals, readout answer times 100) Rho can be interpreted as meaning that, when the interest rate (measured in decimal form) increases by a small amount the option's value increases by (the above calculated rho number) times that amount. When the interest rate increases by 1% = 0.01), the options value increases by . (keep 6-decimals, 0.01 times calculated rho) A financial institution has just sold 1,000 seven-month European call options on the Japanese yen. Suppose that the spot exchange rate is 0.80 cent per yen, the exercise price is 0.81 cent per yen, the risk-free interest rate in the United States is 8% per annum, the risk-free interest rate in Japan is 5% per annum, and the volatility of the yen is 15% per annum. Calculate the delta, gamma, vega, theta, and rho of the financial institution's position. Interpret each number. Delta is (keep 3-decimals) Delta can be interpreted as meaning that, when the spot price increases by a small amount (e.g. 1 cent), the value of an option to buy one yen increases by .times that amount. (keep 3-decimals). Gamma is (keep 3-decimals) Gamma can be interpreted as meaning that, when the spot price increases by a small amount (measured in cents), the delta increases by (keep 3-decimal), times that amount. Vega is per %, (keep 4-decimals, readout answer times 100) (keep 6- Vega can be interpreted as meaning that, when volatility increases by 1% (=0.01) the option price increases by decimals, use 0.01 times calculated Vega) Theta is (keep 4-decimals, readout answer times 365) Theta can be interpreted as meaning that, when a small amount of time (measured in years) passes, the option's value decreases by times that amount. Rho is (keep 4-decimals, readout answer times 100) Rho can be interpreted as meaning that, when the interest rate (measured in decimal form) increases by a small amount the option's value increases by (the above calculated rho number) times that amount. When the interest rate increases by 1% = 0.01), the options value increases by . (keep 6-decimals, 0.01 times calculated rho)