Answered step by step

Verified Expert Solution

Question

1 Approved Answer

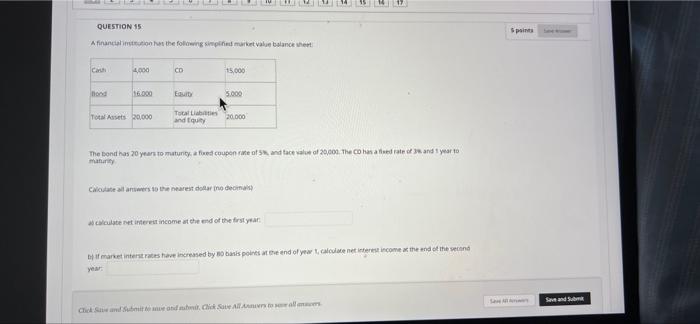

A financial institution has the following simplified market value balance sheet: Cash 4,000 CD 15,000 Bond 16,000 Equity 5,000 Total Assets 20,000 Total Liabilities and

A financial institution has the following simplified market value balance sheet:

| Cash | 4,000 | CD | 15,000 |

| Bond | 16,000 | Equity | 5,000 |

| Total Assets | 20,000 | Total Liabilities and Equity | 20,000 |

The bond has 20 years to maturity, a fixed coupon rate of 5%, and face value of 20,000. The CD has a fixed rate of 3% and 1 year to maturity.

Calculate all answers to the nearest dollar (no decimals)

a) calculate net interest income at the end of the first year:

b) If market interst rates have increased by 80 basis points at the end of year 1, calculate net interest income at the end of the second year:

QUESTION 15 Sprint A financial in the following simplified market value blanche ca 4.000 CD 15.000 tond 16.000 ED 5.000 Total Assets 20.000 and Eury 20.000 The band has 20 years to maturity, a fedcoupon to and tace value of 2000. The chart of sand year to may Calculate alla vers to the nearest do model) calculate interest income at the end of the first year marte interstates have increased by sis points the end of yewlienterest income the end of the second Save and Chand. Click Se All InStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started