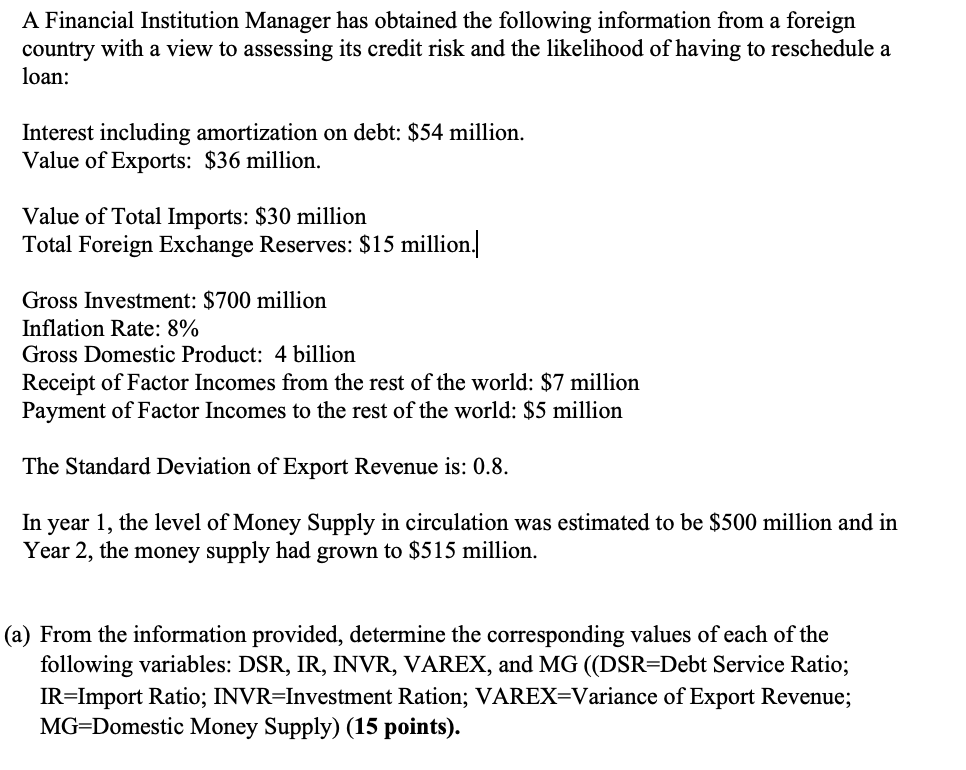

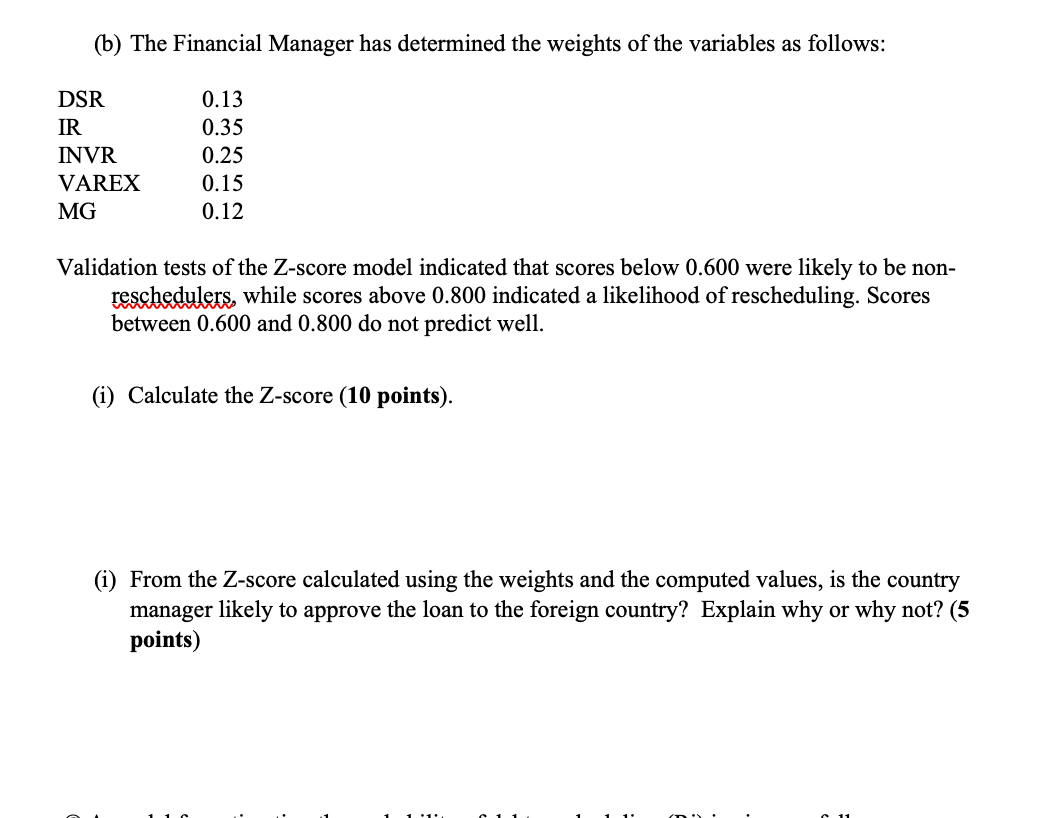

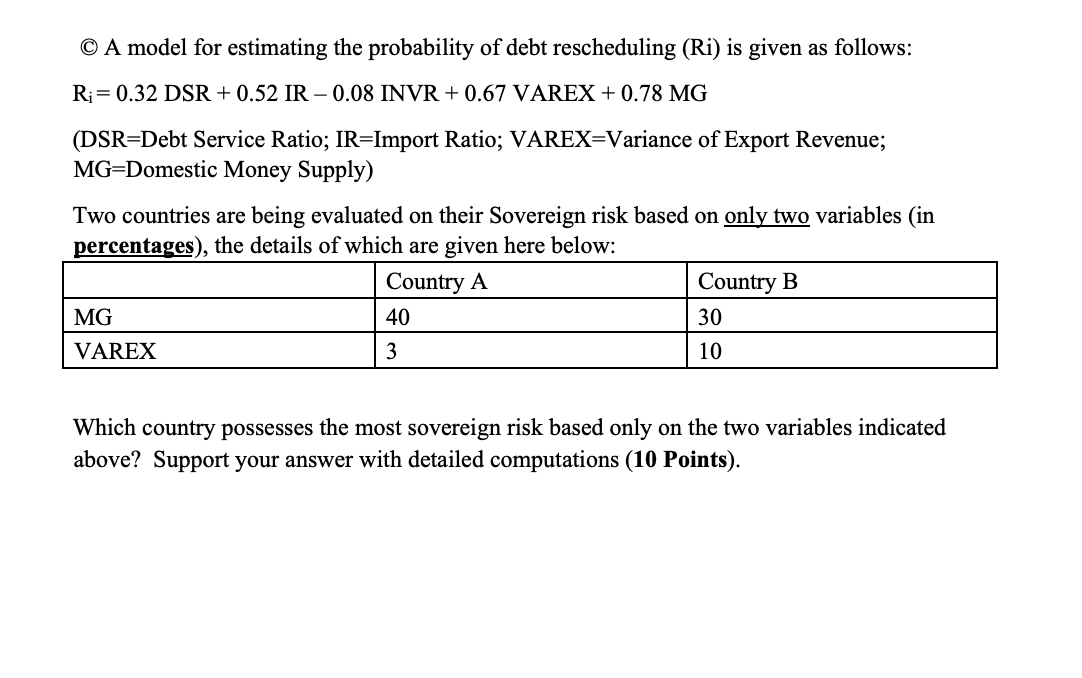

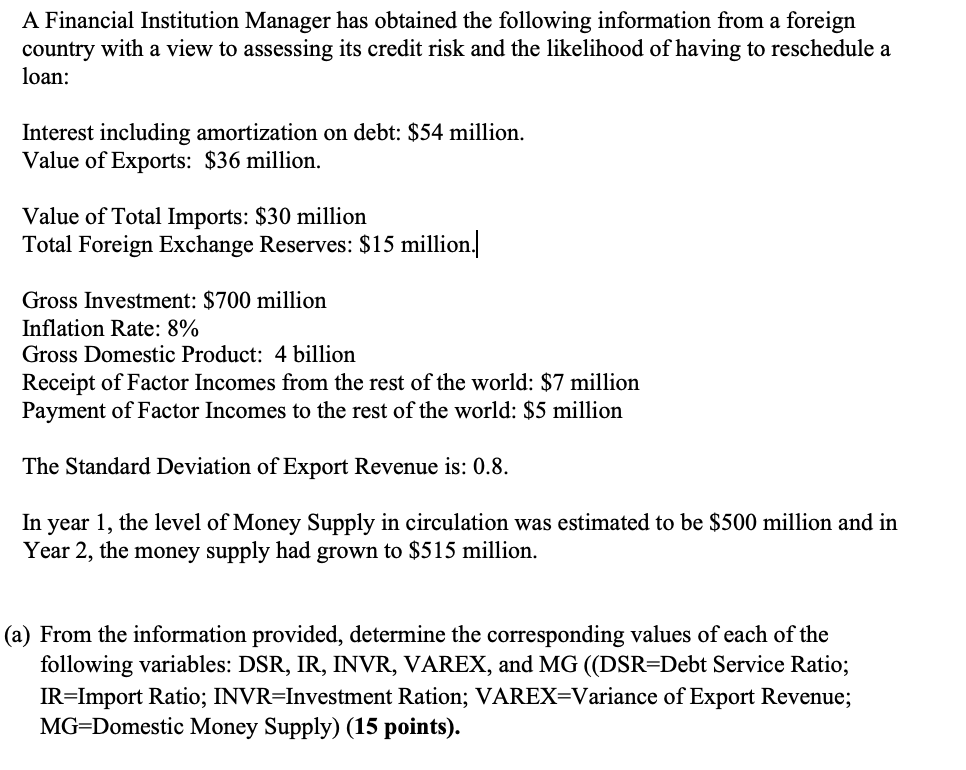

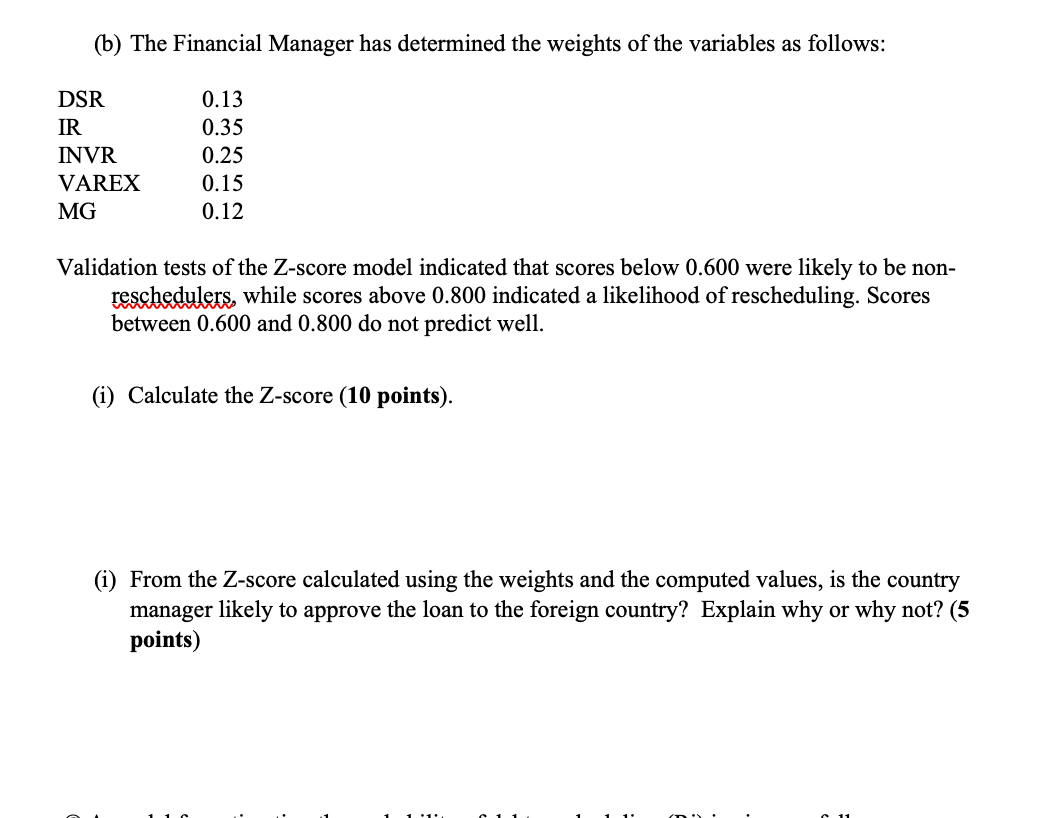

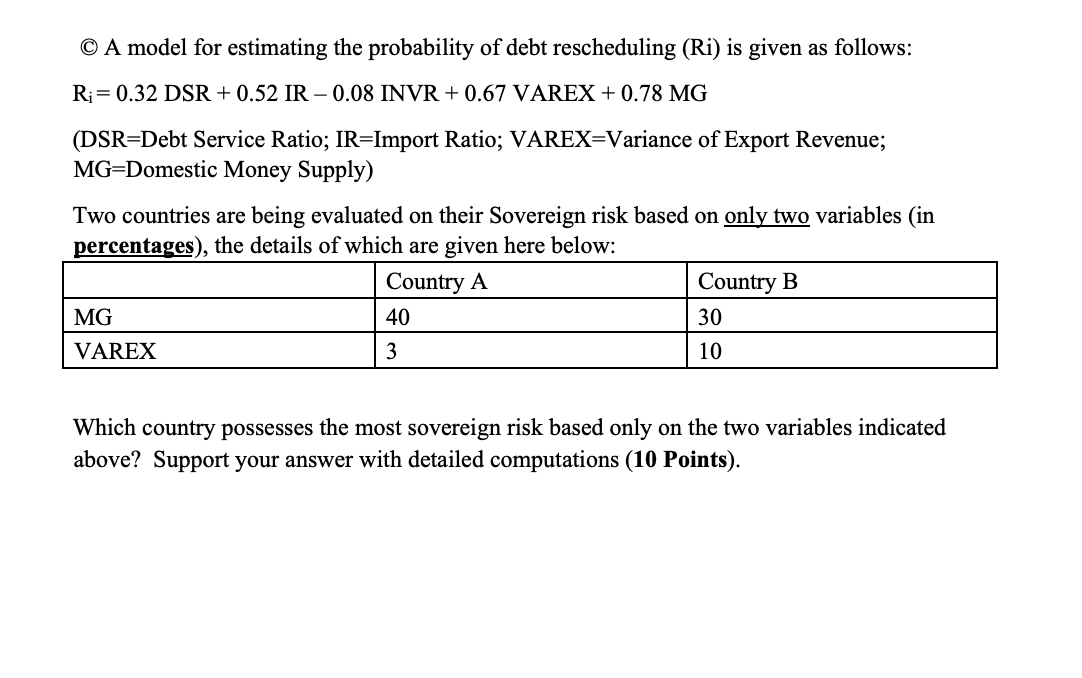

A Financial Institution Manager has obtained the following information from a foreign country with a view to assessing its credit risk and the likelihood of having to reschedule a loan: Interest including amortization on debt: $54 million. Value of Exports: $36 million. Value of Total Imports: $30 million Total Foreign Exchange Reserves: $15 million. Gross Investment: $700 million Inflation Rate: 8% Gross Domestic Product: 4 billion Receipt of Factor Incomes from the rest of the world: $7 million Payment of Factor Incomes to the rest of the world: $5 million The Standard Deviation of Export Revenue is: 0.8. In year 1, the level of Money Supply in circulation was estimated to be $500 million and in Year 2, the money supply had grown to $515 million. (a) From the information provided, determine the corresponding values of each of the following variables: DSR, IR, INVR, VAREX, and MG (DSR=Debt Service Ratio; IR=Import Ratio; INVR=Investment Ration; VAREX=Variance of Export Revenue; MG=Domestic Money Supply) (15 points). (b) The Financial Manager has determined the weights of the variables as follows: DSR IR INVR VAREX MG 0.13 0.35 0.25 0.15 0.12 Validation tests of the Z-score model indicated that scores below 0.600 were likely to be non- reschedulers, while scores above 0.800 indicated a likelihood of rescheduling. Scores between 0.600 and 0.800 do not predict well. (i) Calculate the Z-score (10 points). (i) From the Z-score calculated using the weights and the computed values, is the country manager likely to approve the loan to the foreign country? Explain why or why not? (5 points) A model for estimating the probability of debt rescheduling (Ri) is given as follows: Ri= 0.32 DSR + 0.52 IR -0.08 INVR + 0.67 VAREX + 0.78 MG (DSR=Debt Service Ratio; IR=Import Ratio; VAREX=Variance of Export Revenue; MG=Domestic Money Supply) Two countries are being evaluated on their Sovereign risk based on only two variables (in percentages), the details of which are given here below: Country A Country B MG 40 30 VAREX 3 10 Which country possesses the most sovereign risk based only on the two variables indicated above? Support your answer with detailed computations (10 Points). A Financial Institution Manager has obtained the following information from a foreign country with a view to assessing its credit risk and the likelihood of having to reschedule a loan: Interest including amortization on debt: $54 million. Value of Exports: $36 million. Value of Total Imports: $30 million Total Foreign Exchange Reserves: $15 million. Gross Investment: $700 million Inflation Rate: 8% Gross Domestic Product: 4 billion Receipt of Factor Incomes from the rest of the world: $7 million Payment of Factor Incomes to the rest of the world: $5 million The Standard Deviation of Export Revenue is: 0.8. In year 1, the level of Money Supply in circulation was estimated to be $500 million and in Year 2, the money supply had grown to $515 million. (a) From the information provided, determine the corresponding values of each of the following variables: DSR, IR, INVR, VAREX, and MG (DSR=Debt Service Ratio; IR=Import Ratio; INVR=Investment Ration; VAREX=Variance of Export Revenue; MG=Domestic Money Supply) (15 points). (b) The Financial Manager has determined the weights of the variables as follows: DSR IR INVR VAREX MG 0.13 0.35 0.25 0.15 0.12 Validation tests of the Z-score model indicated that scores below 0.600 were likely to be non- reschedulers, while scores above 0.800 indicated a likelihood of rescheduling. Scores between 0.600 and 0.800 do not predict well. (i) Calculate the Z-score (10 points). (i) From the Z-score calculated using the weights and the computed values, is the country manager likely to approve the loan to the foreign country? Explain why or why not? (5 points) A model for estimating the probability of debt rescheduling (Ri) is given as follows: Ri= 0.32 DSR + 0.52 IR -0.08 INVR + 0.67 VAREX + 0.78 MG (DSR=Debt Service Ratio; IR=Import Ratio; VAREX=Variance of Export Revenue; MG=Domestic Money Supply) Two countries are being evaluated on their Sovereign risk based on only two variables (in percentages), the details of which are given here below: Country A Country B MG 40 30 VAREX 3 10 Which country possesses the most sovereign risk based only on the two variables indicated above? Support your answer with detailed computations (10 Points)