Question

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2010. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions. (a) The firm estimates sales of $1,000,000. (b) The firm maintains a cash balance of $25,000. (c) Accounts receivable represents 15 percent of sales. (d) Inventory represents 35 percent of sales. (e) A new piece of mining equipment costing $150,000 will be purchased in 2010. Total depreciation for 2010 will be $75,000. (f) Accounts payable represents 10 percent of sales. (g) There will be no change in notes payable, accruals, and common stock. (h) The firm plans to retire a long term note of $100,000. (i) Dividends of $45,000 will be paid in 2010. (j) The firm predicts a 4 percent net profit margin.

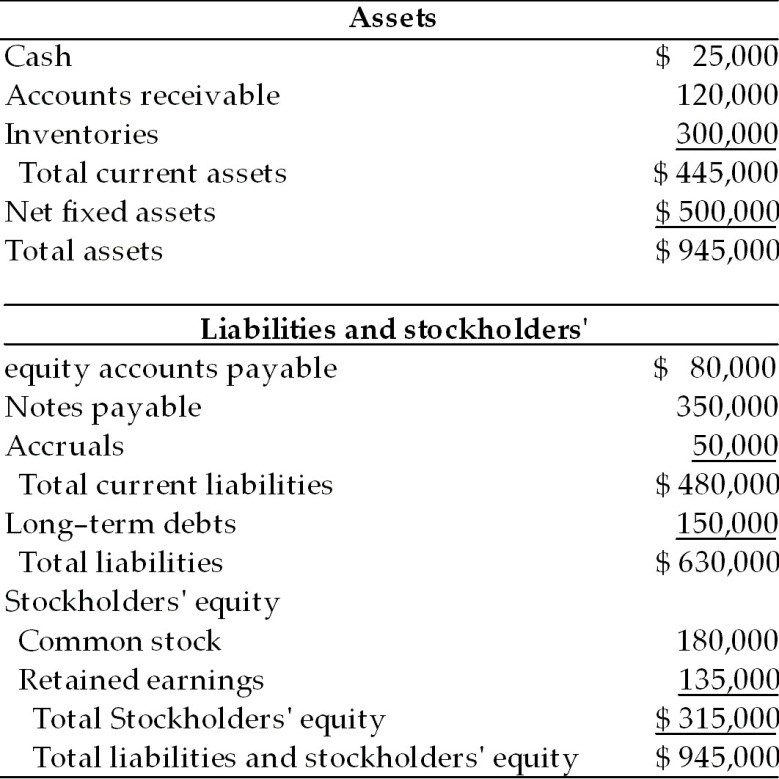

Balance Sheet General Talc Mines December 31, 2009

30) The pro forma total current assets amount is ________. (See Table 4.5) A) $470,900 B) $500,000 C) $525,000 D) $575,000

31) The pro forma net fixed assets amount is ________. (See Table 4.5) A) $500,000 B) $575,000 C) $600,000 D) $650,000

32) The pro forma current liabilities amount is ________.(See Table 4.5) A) $400,000 B) $450,000 C) $475,000 D) $500,000

33) The pro forma total liabilities amount is ________. (See Table 4.5) A) $500,000 B) $550,000 C) $700,000 D) $650,000

34) The pro forma accumulated retained earnings amount is ________. (See Table 4.5) A) $90,000 B) $175,000 C) $140,000 D) $130,000

35) The external financing required in 2010 will be ________. (See Table 4.5) A) $230,000 B) $240,000 C) $0 D) $195,000

36) General Talc Mines may prepare to ________. (See Table 4.5) A) arrange for a loan equal to the external funds requirement B) eliminate the dividend to cover the needed financing C) cancel the retirement of the long term note to cover the needed financing D) repurchase common stock equal to the external funds requirement

37) The external funds requirement results primarily from ________. (See Table 4.5) A) the payment of dividends B) the retirement of debt and purchase of new fixed assets C) low profit margin D) high cost of sales

38) If General Talc Mines cannot raise the external financing required through traditional credit channels, the firm may ________. (See Table 4.5) A) increase sales B) purchase additional fixed assets to raise productivity C) sell common stock D) factor accounts receivable

Assets Cash Accounts receivable Inventories $ 25,000 120,000 300,000 $445,000 500,000 945,000 Total current assets Net fixed assets Total assets Liabilities and stockholders' $ 80,000 350,000 50,000 $480,000 150,000 $630,000 equity accounts payable otes payable Accruals Long-term debts Stockholders' equity Total current liabilities Total liabilities 180,000 135,000 % 315.000 945,000 Common stock Retained earnings Total Stockholders' equity Total liabilities and stockholders' equitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started