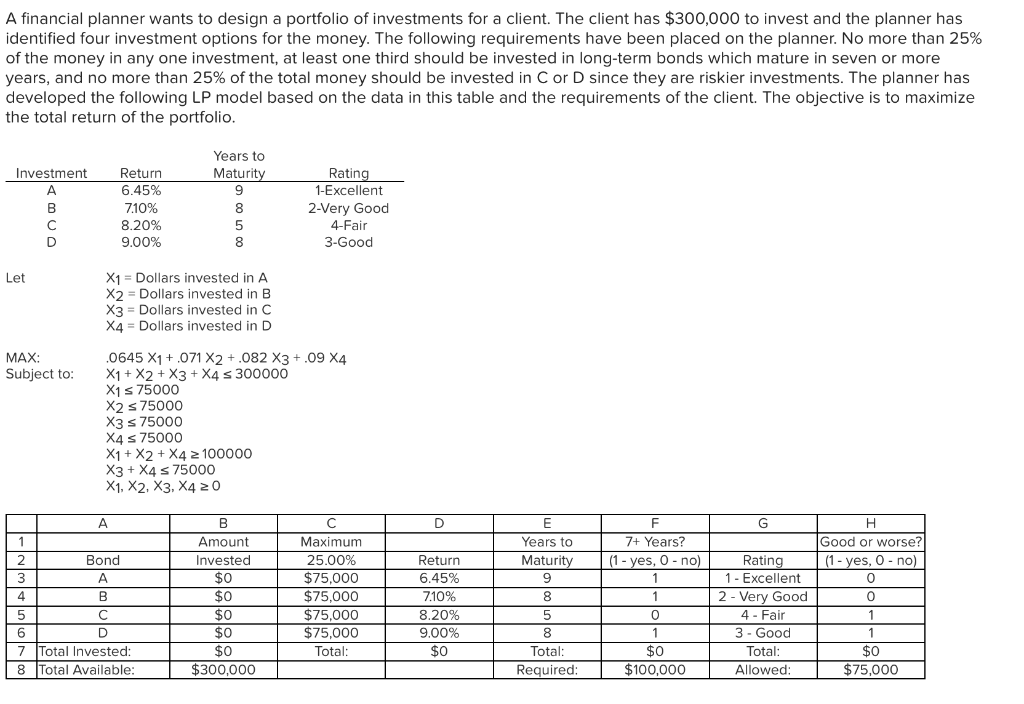

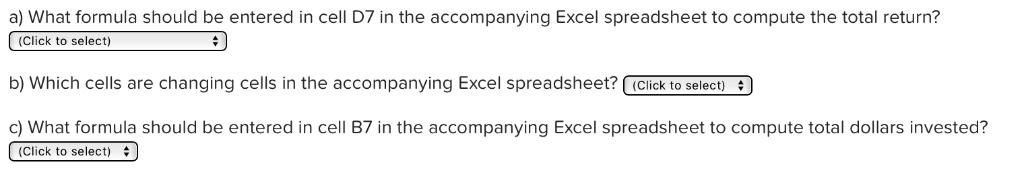

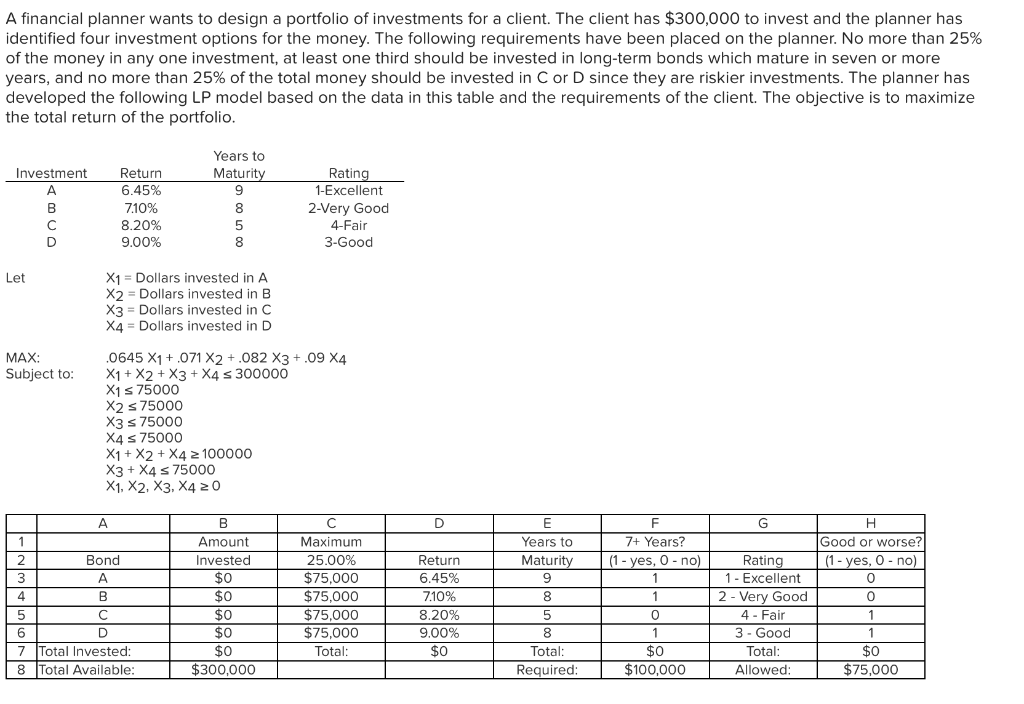

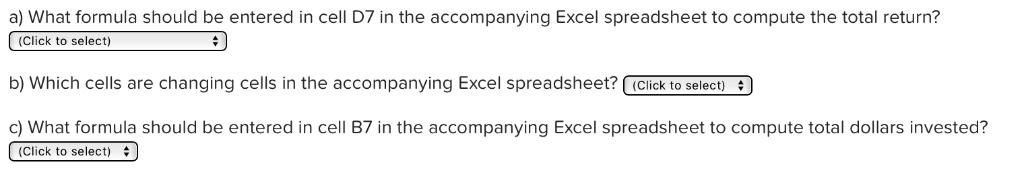

A financial planner wants to design a portfolio of investments for a client. The client has $300,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 25% of the money in any one investment, at least one third should be invested in long-term bonds which mature in seven or more years, and no more than 25% of the total money should be invested in C or D since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio. Years to Investment Return Maturity Rating 6,45% A 1-Excellent 710% 2-Very Good 8 8.20% 4-Fair D 9.00% 3-Good X1 Dollars invested in A X2 Dollars invested in B Dollars invested in C Let Dollars invested in D X4 MAX: Subject to: 0645 X1071 X2 + .082 X3 + .09 X4 X1X2X3 + X4 s 300000 X1s 75000 X2 s75000 X3s 75000 X4 s 75000 X1+ X2+X4 2100000 X3X475000 X1, X2, , 4 20 A C E G. ximum 7+ Years? Good or worse? 1 Amount Years to (1 - yes, 0- no) 2 Bond Invested 25.00% Return Maturity (1- yes, 0-no) Rating $0 $75,000 $75,000 1 A 6.45% 1 Excellent C $0 2 - Very Good 4 Fair 4 710% $0 $75,000 $75,000 1 5 8.20% 5 $0 9.00% 3-Good 1 $0 $0 $0 $0 Total Invested: Total: Total: Total: Required $100,000 Total Available: $300,000 $75,000 Allowed: a) What formula should be entered in cell D7 in the accompanying Excel spreadsheet to compute the total return? (Click to select) b) Which cells are changing cells in the accompanying Excel spreadsheet? (Click to select) c) What formula should be entered in cell B7 in the accompanying Excel spreadsheet to compute total dollars invested? (Click to select) A financial planner wants to design a portfolio of investments for a client. The client has $300,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 25% of the money in any one investment, at least one third should be invested in long-term bonds which mature in seven or more years, and no more than 25% of the total money should be invested in C or D since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio. Years to Investment Return Maturity Rating 6,45% A 1-Excellent 710% 2-Very Good 8 8.20% 4-Fair D 9.00% 3-Good X1 Dollars invested in A X2 Dollars invested in B Dollars invested in C Let Dollars invested in D X4 MAX: Subject to: 0645 X1071 X2 + .082 X3 + .09 X4 X1X2X3 + X4 s 300000 X1s 75000 X2 s75000 X3s 75000 X4 s 75000 X1+ X2+X4 2100000 X3X475000 X1, X2, , 4 20 A C E G. ximum 7+ Years? Good or worse? 1 Amount Years to (1 - yes, 0- no) 2 Bond Invested 25.00% Return Maturity (1- yes, 0-no) Rating $0 $75,000 $75,000 1 A 6.45% 1 Excellent C $0 2 - Very Good 4 Fair 4 710% $0 $75,000 $75,000 1 5 8.20% 5 $0 9.00% 3-Good 1 $0 $0 $0 $0 Total Invested: Total: Total: Total: Required $100,000 Total Available: $300,000 $75,000 Allowed: a) What formula should be entered in cell D7 in the accompanying Excel spreadsheet to compute the total return? (Click to select) b) Which cells are changing cells in the accompanying Excel spreadsheet? (Click to select) c) What formula should be entered in cell B7 in the accompanying Excel spreadsheet to compute total dollars invested? (Click to select)